Select Country

Don’t have your Nedbank ID yet?

Nedbank ID single sign-on gives you full digital access to Nedbank’s banking and lifestyle products and services on the Money app or Online Banking.

Log in

Log in to Online Banking or another one of our secured services.

Awards

Deals

- R4bn Tronox deal funds two 100MW solar plants

- Billions to help Redefine build green properties

- Harmony pursues green goals with R10 billion loan

- Cold solutions finance for cold storage facilities

- International Finance Corporation green bond fund

- Envusa energy deal: The way for renewable energy

- Paladin Energy senior debt funding partnership

- Renewable energy wind farm financing

- Stor-Age’s successful inaugural bond auction

- PlusNet, Peninsula Packaging and Barrier Film Convertors co-investment opportunity | Nedbank CIB

- IFC Green Loan | Nedbank CIB

- AngloGold appoints Nedbank CIB as sole underwriter | Nedbank CIB

- Nedbank CIB Property Finance Team achievement | Nedbank CIB

- PwC Tower, Westlands — Where Kenya's corporate vision meets world-class execution

Women of Corporate Investment Banking

Young Analyst Programme

Articles

- Africa's pathway to a climate-resilient economy

- Commercial property trends 2022

- Green energy in the developing world | Nedbank CIB

- How sustainable finance creates value

- How the property sector recovered in 2023

- FURTHER IMPACT empowerment for entrepreneurs

- There's a new buoyancy around water and sanitation

- What happens when finance meets sustainability?

- Africa’s renewable-energy projects

- Breaking barriers for energy transition in mining

- Nedbank CIB wins big at 2025 IFC Awards

- South Africa leads clean energy transformation

Conferences

Benchmark Reform

Corporate Finance

Financing

Investing

Markets

Transacting

- Login & Register

- Online Banking

- Online Share Trading

- NedFleet

- Register for Nedbank ID

- About us

- Awards

- Deals

- Explore About us

- Awards

- Deals

- R4bn Tronox deal funds two 100MW solar plants

- Billions to help Redefine build green properties

- Harmony pursues green goals with R10 billion loan

- Cold solutions finance for cold storage facilities

- International Finance Corporation green bond fund

- Envusa energy deal: The way for renewable energy

- Paladin Energy senior debt funding partnership

- Renewable energy wind farm financing

- Stor-Age’s successful inaugural bond auction

- PlusNet, Peninsula Packaging and Barrier Film Convertors co-investment opportunity | Nedbank CIB

- IFC Green Loan | Nedbank CIB

- AngloGold appoints Nedbank CIB as sole underwriter | Nedbank CIB

- Nedbank CIB Property Finance Team achievement | Nedbank CIB

- PwC Tower, Westlands — Where Kenya's corporate vision meets world-class execution

- R4bn Tronox deal funds two 100MW solar plants

- Billions to help Redefine build green properties

- Harmony pursues green goals with R10 billion loan

- Cold solutions finance for cold storage facilities

- International Finance Corporation green bond fund

- Envusa energy deal: The way for renewable energy

- Paladin Energy senior debt funding partnership

- Renewable energy wind farm financing

- Stor-Age’s successful inaugural bond auction

- PlusNet, Peninsula Packaging and Barrier Film Convertors co-investment opportunity | Nedbank CIB

- IFC Green Loan | Nedbank CIB

- AngloGold appoints Nedbank CIB as sole underwriter | Nedbank CIB

- Nedbank CIB Property Finance Team achievement | Nedbank CIB

- PwC Tower, Westlands — Where Kenya's corporate vision meets world-class execution

- Women of Corporate Investment Banking

- Young Analyst Programme

- Articles

- Africa's pathway to a climate-resilient economy

- Commercial property trends 2022

- Green energy in the developing world | Nedbank CIB

- How sustainable finance creates value

- How the property sector recovered in 2023

- FURTHER IMPACT empowerment for entrepreneurs

- There's a new buoyancy around water and sanitation

- What happens when finance meets sustainability?

- Africa’s renewable-energy projects

- Breaking barriers for energy transition in mining

- Nedbank CIB wins big at 2025 IFC Awards

- South Africa leads clean energy transformation

- Africa's pathway to a climate-resilient economy

- Commercial property trends 2022

- Green energy in the developing world | Nedbank CIB

- How sustainable finance creates value

- How the property sector recovered in 2023

- FURTHER IMPACT empowerment for entrepreneurs

- There's a new buoyancy around water and sanitation

- What happens when finance meets sustainability?

- Africa’s renewable-energy projects

- Breaking barriers for energy transition in mining

- Nedbank CIB wins big at 2025 IFC Awards

- South Africa leads clean energy transformation

- Conferences

- Benchmark Reform

- Solutions

- Corporate Finance

- Financing

- Investing

- Markets

- Nedbank Business Hub

- Transacting

- Explore Solutions

- Corporate Finance

- Financing

- Investing

- Markets

- Nedbank Business Hub

- Business hub lead form

- Business hub lead form

- Transacting

- Sustainability

- Explore Sustainability

- Contact us

- Explore Contact us

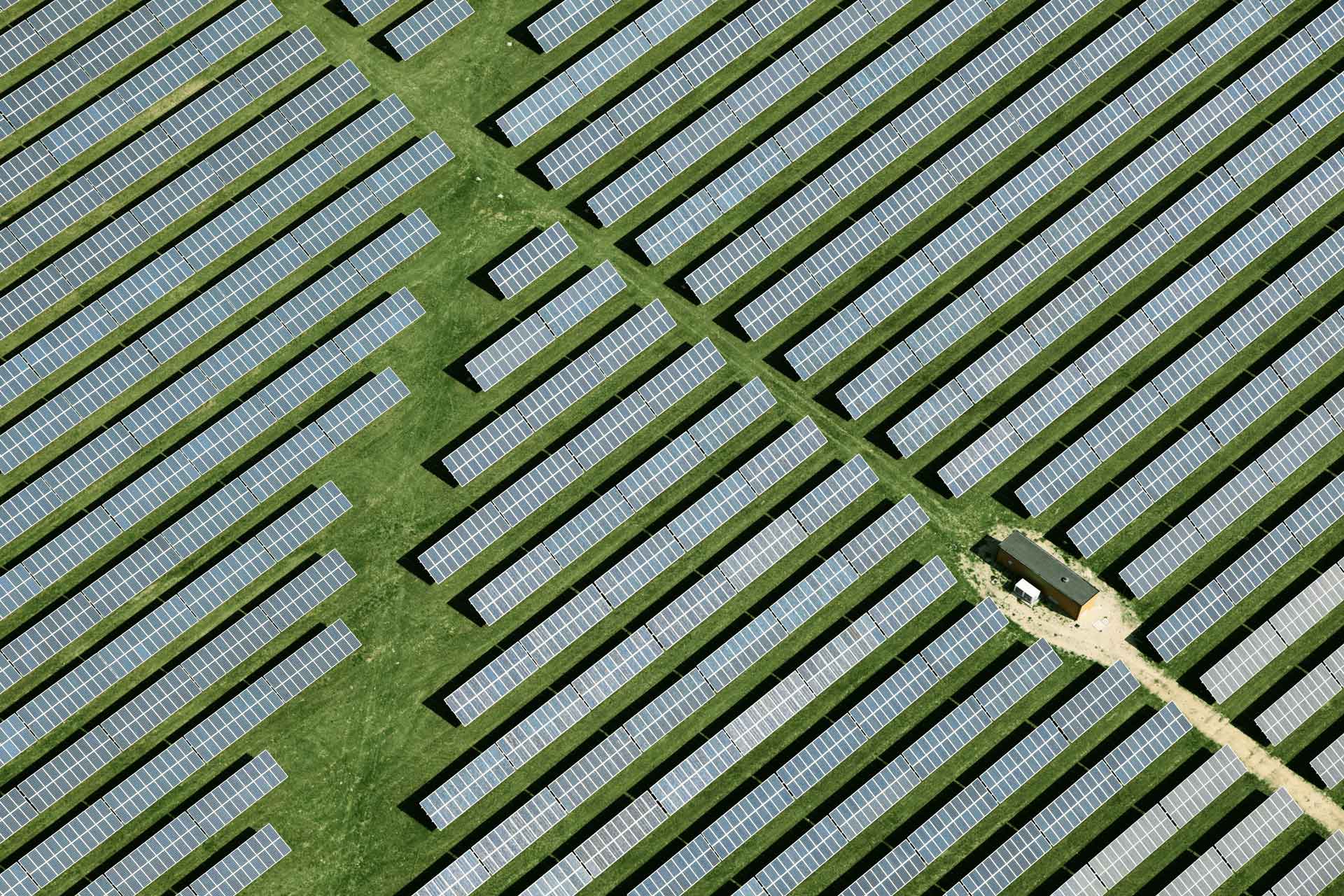

Land Bank and Avo Solar partnership

Land Bank and Avo Solar partnership

Staff writer

2 mins

Learn about the Land Bank and Avo Solar partnership for renewable energy in agriculture.

Land Bank has partnered with Avo Solar from Nedbank to provide access to renewable energy in the agricultural sector. The Agro Energy Fund (AEF), established in partnership with the Department of Agriculture, Land Reform and Rural Development (DALRRD), offers funding support for acquiring alternative energy assets. This initiative aims to alleviate the impact of load-shedding on farming operations and the agricultural sector, focusing on financing energy-intensive agricultural activities like irrigation, intensive agricultural production systems, and on-farm cold chain-related activities.

Understanding the Agro Energy Fund

The AEF is a blended finance scheme offering a combination of grant and debt funding. Its objective is to support the acquisition of alternative energy assets, helping the industry reduce energy costs and mitigate the impact of power interruptions on operations.

Benefits of the blended finance programme

Through the AEF, Land Bank, with the support of DALRRD, provides farmers and agribusinesses an opportunity to invest in their future safely and securely. They receive value for money, post-implementation support, and guidance from qualified professionals, eliminating the hassle of sourcing alternative energy installers.

Supporting energy-intensive agricultural activities

The AEF finances energy-intensive agricultural activities crucial for maintaining productivity and efficiency, especially amid energy challenges.

The role of Land Bank in sustainable agriculture

The Land and Agricultural Development Bank of South Africa offers tailor-made financial solutions for farmers, enabling them to finance land, equipment, asset acquisition, and improvements. As a development finance institution, Land Bank leverages funding from public and private sector partnerships to ensure inclusivity, sustainability, and growth in the agricultural sector.

How Avo Solar from Nedbank enhances the partnership

Avo Solar from Nedbank recently hosted a panel discussion with stakeholders about the Land Bank Agro Energy Fund (AEF). This partnership enables Land Bank to take full advantage of the capabilities Avo Solar from Nedbank have built when it comes to onboarding and vetting service providers. Avo Solar brings the required depth and breadth of technical service providers to implement a programme of this magnitude.

Renewable energy solutions for farming operations

The partnership provides renewable energy solutions for farming operations, helping alleviate the impact of load-shedding and rising energy costs, ensuring the sustainability of the agricultural sector.

Alleviating the impact of load-shedding on agriculture

The AEF, especially with its grant funding component, offers much-needed relief to agribusinesses on energy costs, protecting the financial viability of the sector and the livelihoods it supports.

Financing options for alternative energy assets

Land Bank offers blended financing options for alternative energy assets through the AEF, including a combination of grant and debt funding, providing farmers with the necessary financial support to invest in renewable energy solutions.

Embracing sustainable farming with renewable energy

Clients can have their energy requirements mapped out to understand the estimated costs and savings of their renewable energy system over time, providing invaluable insights for informed decision-making.

The partnership ensures clients are well-supported in their journey towards sustainable farming with renewable energy.

Please contact us to find out more:

Email: AvoRenewables@avo.africa

Telephone: +27 31 820 1021

Land Bank and Avo Solar from Nedbank

Bringing renewable energy to the agricultural sector.

Related posts

See allNedbank CIB honoured for leadership in sustainable finance

Our ESG-backed approach to lending and financing was recognised at the 2022 Global Finance Sustainable Finance Awards, where we ranked in the top 6% of banks globally and received awards for Outstanding Leadership in Green Bonds and Outstanding Leadership in Transition/Sustainability-linked Bonds.

By Staff writer

Published 11 Jul 2025 in nedbank:cib/deals/esg

Nedbank CIB honoured for leadership in sustainable finance

Our ESG-backed approach to lending and financing was recognised at the 2022 Global Finance Sustainable Finance Awards, where we ranked in the top 6% of banks globally and received awards for Outstanding Leadership in Green Bonds and Outstanding Leadership in Transition/Sustainability-linked Bonds.

Staff writer

Published 11 Jul 2025

South Africa’s healthcare sector requires more investment for equity

There is a need for additional investment in South Africa’s fast-growing healthcare sector to cater for the increasing needs of the country, including addressing the national hospital bed shortfall, says Anél Bosman, Group Managing Executive of Nedbank Corporate and Investment Banking.

By Staff writer

Published 08 Jul 2025 in nedbank:cib/articles/investment

South Africa’s healthcare sector requires more investment for equity

There is a need for additional investment in South Africa’s fast-growing healthcare sector to cater for the increasing needs of the country, including addressing the national hospital bed shortfall, says Anél Bosman, Group Managing Executive of Nedbank Corporate and Investment Banking.

Staff writer

Published 08 Jul 2025

Empowering trade. Enabling growth.

At Nedbank Corporate and Investment Banking, we see the unexpected connections that power sustainable growth. Our trade and supply chain finance solutions are designed to unlock working capital, streamline trade flows, and empower businesses across Africa to thrive in an increasingly interconnected global economy.

By Staff writer

Published 24 Jun 2025 in nedbank:cib/articles/finance

Empowering trade. Enabling growth.

At Nedbank Corporate and Investment Banking, we see the unexpected connections that power sustainable growth. Our trade and supply chain finance solutions are designed to unlock working capital, streamline trade flows, and empower businesses across Africa to thrive in an increasingly interconnected global economy.

Staff writer

Published 24 Jun 2025