South Africa leads clean energy transformation

Res4Africa's 2025 conference in Cape Town will explore SA's energy reforms, the role of the G20, and transmission development milestones.

Published 28 Oct 2025 in nedbank:cib/articles/energy

Nedbank CIB triumphs at the 2025 IFC Awards

Nedbank CIB honoured for sustainable finance leadership

Published 19 Sep 2025 in nedbank:cib/articles/awards

Nedbank celebrates excellence at the API Awards

Celebrating innovation and excellence in African property with Nedbank CIB.

Published 19 Sep 2025 in nedbank:cib/awards

Announcing CIB and Panmure Liberum partnership

Nedbank CIB Markets and Panmure Liberum partnership, providing clients with improved research and trading services.

Published 23 Jul 2025 in nedbank:cib/articles/partnerships

Nedbank CIB honoured for leadership in sustainable finance

Our ESG-backed approach to lending and financing was recognised at the 2022 Global Finance Sustainable Finance Awards, where we ranked in the top 6% of banks globally and received awards for Outstanding Leadership in Green Bonds and Outstanding Leadership in Transition/Sustainability-linked Bonds.

Published 11 Jul 2025 in nedbank:cib/deals/esg

Nedbank CIB honoured for leadership in sustainable finance

Our ESG-backed approach to lending and financing was recognised at the 2022 Global Finance Sustainable Finance Awards, where we ranked in the top 6% of banks globally and received awards for Outstanding Leadership in Green Bonds and Outstanding Leadership in Transition/Sustainability-linked Bonds.

Published 11 Jul 2025 in nedbank:cib/deals/esg

South Africa’s healthcare sector requires more investment for equity

There is a need for additional investment in South Africa’s fast-growing healthcare sector to cater for the increasing needs of the country, including addressing the national hospital bed shortfall, says Anél Bosman, Group Managing Executive of Nedbank Corporate and Investment Banking.

Published 08 Jul 2025 in nedbank:cib/articles/investment

South Africa’s healthcare sector requires more investment for equity

There is a need for additional investment in South Africa’s fast-growing healthcare sector to cater for the increasing needs of the country, including addressing the national hospital bed shortfall, says Anél Bosman, Group Managing Executive of Nedbank Corporate and Investment Banking.

Published 08 Jul 2025 in nedbank:cib/articles/investment

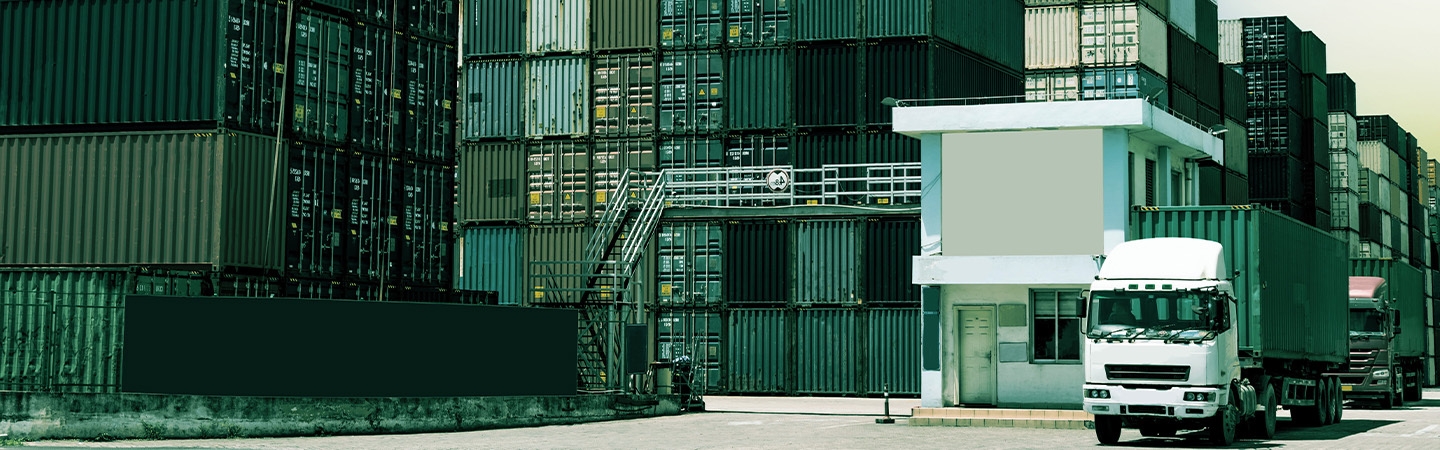

Empowering trade. Enabling growth.

At Nedbank Corporate and Investment Banking, we see the unexpected connections that power sustainable growth. Our trade and supply chain finance solutions are designed to unlock working capital, streamline trade flows, and empower businesses across Africa to thrive in an increasingly interconnected global economy.

Published 24 Jun 2025 in nedbank:cib/articles/finance

Empowering trade. Enabling growth.

At Nedbank Corporate and Investment Banking, we see the unexpected connections that power sustainable growth. Our trade and supply chain finance solutions are designed to unlock working capital, streamline trade flows, and empower businesses across Africa to thrive in an increasingly interconnected global economy.

Published 24 Jun 2025 in nedbank:cib/articles/finance

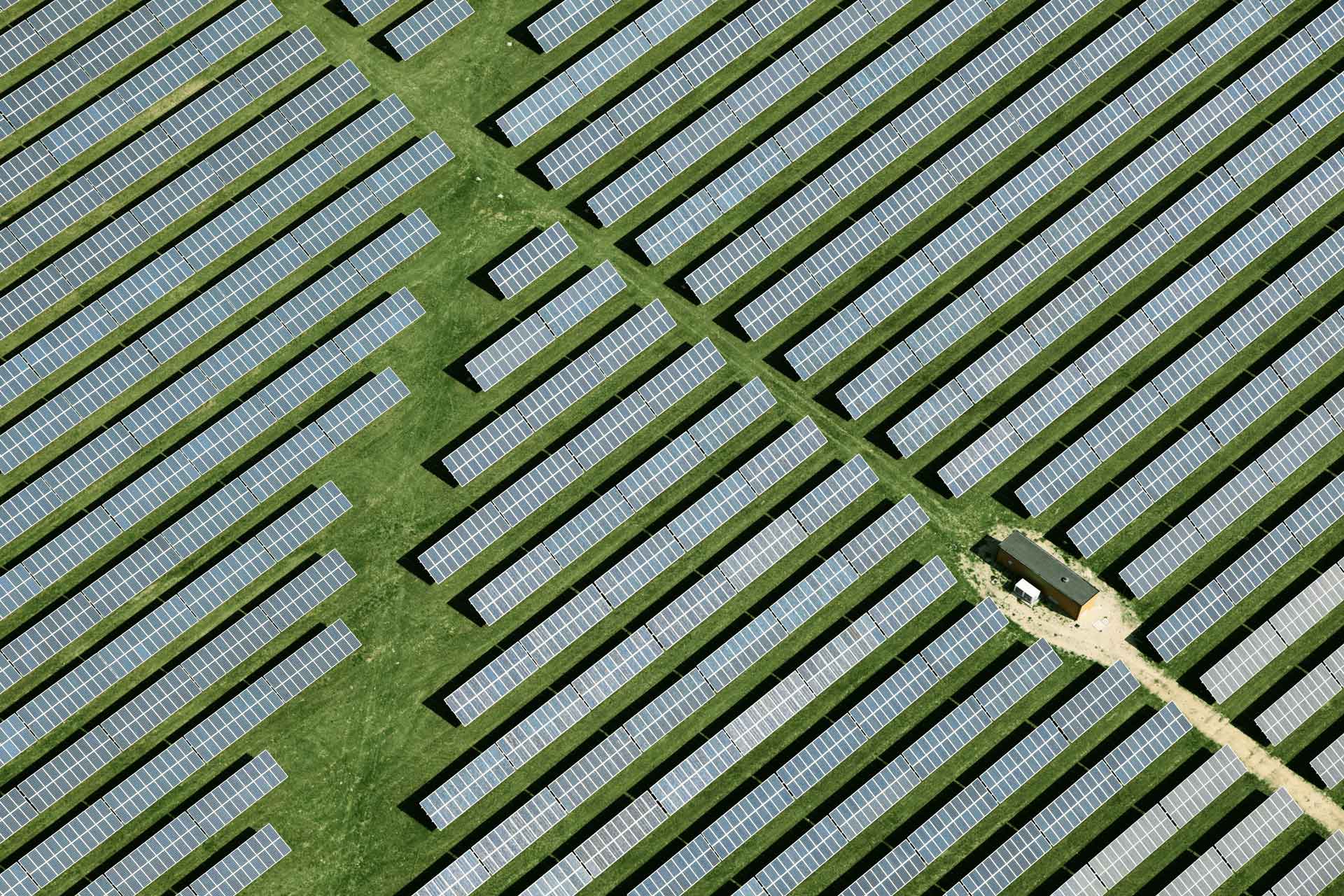

R4 billion solar project powers titanium mine.

To block out the sun’s worst rays, harness its best.

Published 17 Jun 2025 in nedbank:cib/deals/energy

South Africa’s healthcare dilemma

A 200 000-bed shortfall is likely to stall National Health Insurance ambitions.

Published 17 Jun 2025 in nedbank:cib/articles/pharmaceuticals

Sustainability in Africa’s hospitality property sector

Nedbank Corporate and Investment Banking (NCIB) has taken another significant step in advancing sustainable property finance across Africa with the successful conclusion of a €19.4 million sustainability-linked development and term loan for Kasada in Senegal. This unique transaction in hospitality property finance will drive measurable environmental and social impact in the local community.

Published 04 Jun 2025 in nedbank:cib/articles/property

Sustainability in Africa’s hospitality property sector

Nedbank Corporate and Investment Banking (NCIB) has taken another significant step in advancing sustainable property finance across Africa with the successful conclusion of a €19.4 million sustainability-linked development and term loan for Kasada in Senegal. This unique transaction in hospitality property finance will drive measurable environmental and social impact in the local community.

Published 04 Jun 2025 in nedbank:cib/articles/property

Land Bank and Avo Solar partnership

Learn about the Land Bank and Avo Solar partnership for renewable energy in agriculture.

Published 24 Apr 2025 in nedbank:cib/articles/energy

Earth Day: Investing in the green transition

Nedbank Corporate and Investment Banking (CIB) is leading the transition to a resilient future through its commitment to sustainable finance. By developing transformative solutions, we empower businesses to not only thrive in a shifting economic landscape but also lead in the effort to make it greener. Through bold innovation and strategic expertise, we are shaping a world where financial success and environmental responsibility are interconnected, creating lasting value for generations to come.

Published 21 Apr 2025 in nedbank:cib/articles/sustainability

Earth Day: Investing in the green transition

Nedbank Corporate and Investment Banking (CIB) is leading the transition to a resilient future through its commitment to sustainable finance. By developing transformative solutions, we empower businesses to not only thrive in a shifting economic landscape but also lead in the effort to make it greener. Through bold innovation and strategic expertise, we are shaping a world where financial success and environmental responsibility are interconnected, creating lasting value for generations to come.

Published 21 Apr 2025 in nedbank:cib/articles/sustainability

Experts discuss trade at GTR Africa 2025

3 of Nedbank CIB's experts will discuss topics affecting trade and commodities at this year's GTR Africa event in Cape Town.

Published 25 Mar 2025 in nedbank:cib/conferences

Nedbank CIB supports Prescient to power renewable growth

Discover how Nedbank CIB’s partnership with Prescient is advancing renewable energy in South Africa.

Published 13 Mar 2025 in nedbank:cib/articles/energy

Nedbank CIB triumphs at the Global Finance Sustainable Finance Awards

Discover how Nedbank CIB’s sustainable finance initiatives earned us the 2025 Global Finance Award.

Published 13 Mar 2025 in nedbank:cib/awards

Nedbank CIB’s awarded Loan of the Year

Nedbank CIB has been honoured for its innovative financing solutions

Published 13 Mar 2025 in nedbank:cib/awards

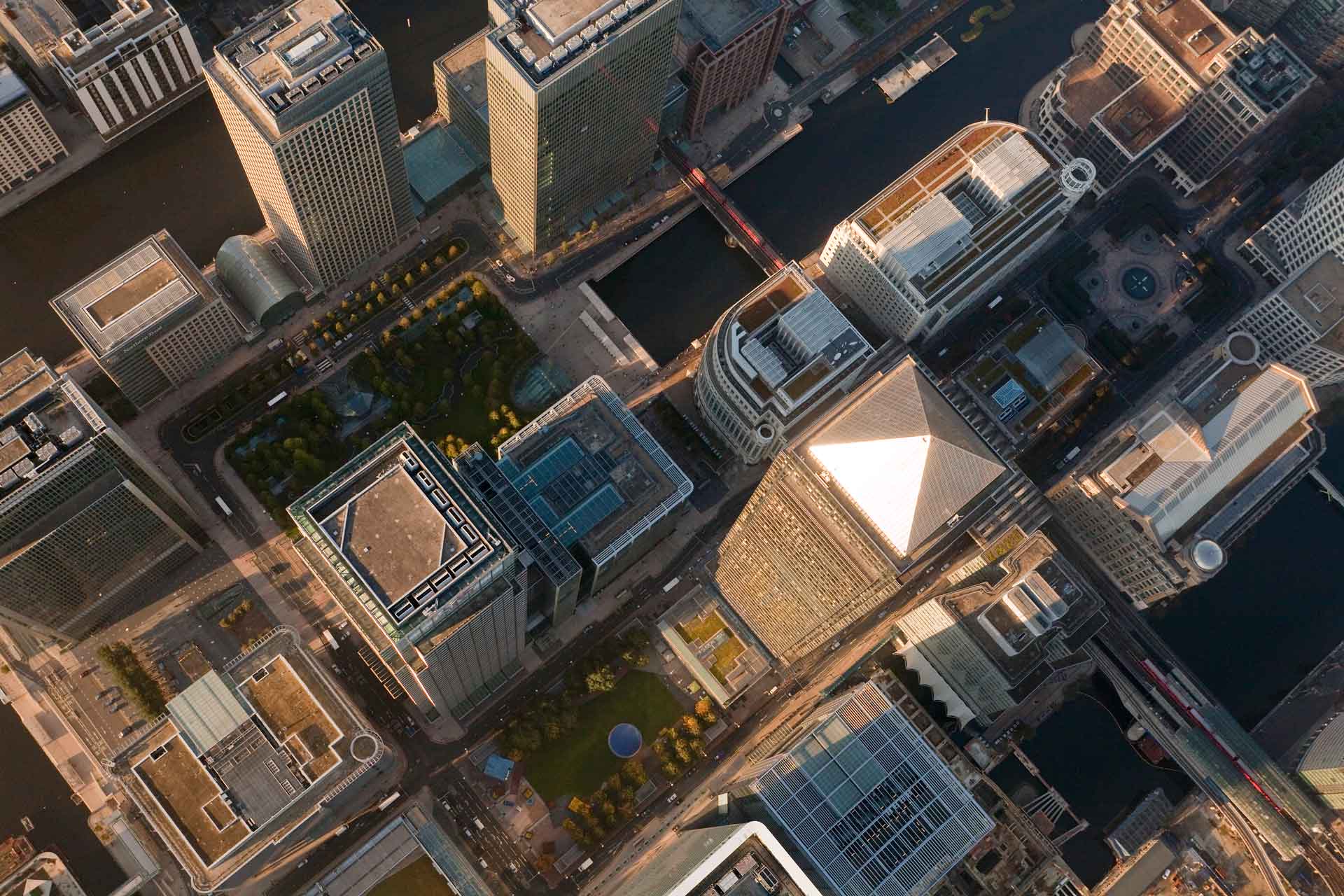

Harnessing technology to navigate SA's property market

Learn about Nedbank’s innovative tools for sustainable property finance in South Africa.

Published 13 Mar 2025 in nedbank:cib/articles/property

Multiply Group and Nedbank Private Equity Successfully Exit Q Link

An incredibly fruitful investment period results in marked growth for a local payment services business.

Published 13 Mar 2025 in nedbank:cib/articles/private-equity

Coronation Fund Managers wins DealMakers’ BEE Deal of the Year

Discover how Coronation’s BEE Deal of the Year recognition will support South Africa’s economic transformation.

Published 19 Feb 2025 in nedbank:cib/articles/investment

Connecting the future of energy in South Africa and India

Join the Matla-Urja 2024 to explore energy synergy between South Africa and India.

Published 27 Nov 2024 in nedbank:cib/articles/investment

High returns amid emerging market growth in South Africa

Discover why South Africa is a top investment destination with high returns and strategic opportunities.

Published 14 Nov 2024 in nedbank:cib/articles/energy

Sustainable energy transition and transformation

To drive Africa’s energy future, speak to the pioneers.

Published 07 Nov 2024 in nedbank:cib/articles/energy

Asset-based Finance

Nedbank CIB offers solar energy solutions to suit your business needs.

Published 05 Nov 2024 in nedbank:cib/articles/finance

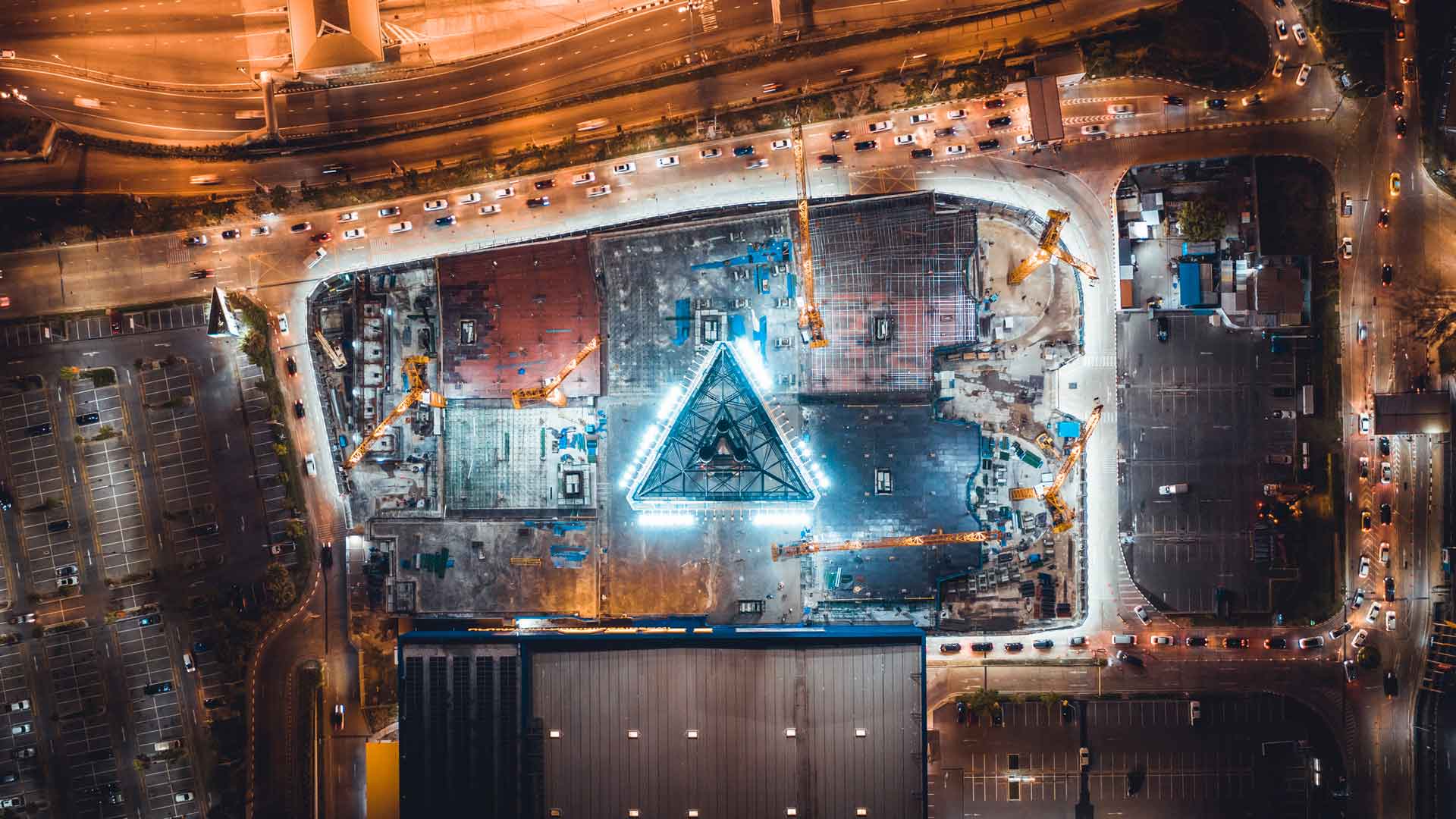

Africa’s data centre boom: Driving digital growth

Africa’s digital transformation is no longer a distant prospect; it is happening now, with data centres playing a pivotal role in this revolution. As these centres drive innovation and economic growth across the continent, they are positioning Africa as a formidable player in the global digital landscape.

Published 21 Oct 2024 in nedbank:cib/articles/innovation

Africa’s data centre boom: Driving digital growth

Africa’s digital transformation is no longer a distant prospect; it is happening now, with data centres playing a pivotal role in this revolution. As these centres drive innovation and economic growth across the continent, they are positioning Africa as a formidable player in the global digital landscape.

Published 21 Oct 2024 in nedbank:cib/articles/innovation

Tiger Brands’ strategic moves: a promising turnaround story

Tiger Brands is turning around with strategic moves and cost-saving measures.

Published 21 Oct 2024 in nedbank:cib/articles/investment

NCIB and DP World: Boosting Trade Finance in Africa

Nedbank Corporate and Investment Banking (CIB) is proud to announce a significant strategic partnership with DP World Trade Finance to address the significant working capital challenges of businesses in sub-Saharan Africa (SSA).

Published 11 Oct 2024 in nedbank:cib/articles/finance

NCIB and DP World: Boosting Trade Finance in Africa

Nedbank Corporate and Investment Banking (CIB) is proud to announce a significant strategic partnership with DP World Trade Finance to address the significant working capital challenges of businesses in sub-Saharan Africa (SSA).

Published 11 Oct 2024 in nedbank:cib/articles/finance

Empowering women for climate resilience

As the effects of climate change continue to reshape our world, the demand for inclusive solutions is more urgent than ever. Gender-inclusive finance can drive global climate resilience by empowering women and ensuring they are integral to climate action.

Published 10 Oct 2024 in nedbank:cib/articles/sustainability

Empowering women for climate resilience

As the effects of climate change continue to reshape our world, the demand for inclusive solutions is more urgent than ever. Gender-inclusive finance can drive global climate resilience by empowering women and ensuring they are integral to climate action.

Published 10 Oct 2024 in nedbank:cib/articles/sustainability

Navigating the new landscape of South Africa’s competition policy

Insights on challenges and opportunities for investors and businesses.

Published 30 Sep 2024 in nedbank:cib/articles/investment

Recognising excellence in African real estate

The API Awards showcases top developers, investors, and projects.

Published 20 Sep 2024 in nedbank:cib/articles/property

8,7 MW solar deal powers SAB

To help SAB load more trucks, lessen the load.

Published 17 Sep 2024 in nedbank:cib/deals/energy

€450m infrastructure deal drives African trade.

To keep shipping lanes flowing east, upgrade roads going west.

Published 17 Sep 2024 in nedbank:cib/deals/energy

R4 billion solar project powers titanium mine.

To block out the sun’s worst rays, harness its best.

Published 17 Sep 2024 in nedbank:cib/deals/energy

Local tech revolutionises rescues across the globe.

Saving more lives in the United States starts in South Africa.

Published 17 Sep 2024 in nedbank:cib/deals/energy

€450m infrastructure deal drives African trade.

To keep shipping lanes flowing east, upgrade roads going west.

Published 10 Sep 2024 in nedbank:cib/deals/energy

National Contributor empowers FURTHER IMPACT entrepreneurs

Discover how National Contributor collaborates with FURTHER IMPACT to empower impact entrepreneurs across critical sectors.

Published 22 Aug 2024 in nedbank:cib/articles/partnerships

Why there's a new buoyancy around water and sanitation

The national project pipeline has been cleared, and a multifaceted strategy is being implemented to address municipal dysfunction.

Published 22 Aug 2024 in nedbank:cib/articles/water

Accelerating and scaling Africa’s renewable-energy projects

In Africa more than 600 million people lack access to electricity. At the current pace of electrification millions of Africans are still expected to be without electricity in 2030 unless the pace of electrification is trebled, by connecting more than 90 million people a year. Beyond electrification, African countries should also focus on reducing gaps in access to electricity between urban and rural areas through expanding the electrical grid.

Published 22 Aug 2024 in nedbank:cib/articles/energy

Accelerating and scaling Africa’s renewable-energy projects

In Africa more than 600 million people lack access to electricity. At the current pace of electrification millions of Africans are still expected to be without electricity in 2030 unless the pace of electrification is trebled, by connecting more than 90 million people a year. Beyond electrification, African countries should also focus on reducing gaps in access to electricity between urban and rural areas through expanding the electrical grid.

Published 22 Aug 2024 in nedbank:cib/articles/energy

Nedbank CIB gives ENGIE solar projects the green light

Nedbank CIB structures R2,5 billion solar financing deal for leading renewable energy player ENGIE. Visit our website for more.

Published 22 Aug 2024 in nedbank:cib/deals/energy

South Africa consumer spending expected to recover over the next 24 months

Nedbank CIB predict a recovery in South African consumer spending over the next 24 months, driven by lower interest rates, stronger currency and reforms.

Published 01 Aug 2024 in nedbank:cib/articles/investment

Transforming trade finance in West Africa

Discover how collaboration between banks, development finance institutions, and insurers is transforming trade finance in West Africa.

Published 23 Jul 2024 in nedbank:cib/articles/finance

Acquisition of Chill by Alterra Capital Partners

Nedbank CIB Corporate Finance provides corporate and strategic advice in the acquisition of Chill by Alterra Capital Partners

Published 23 Jul 2024 in nedbank:cib/articles/corporate-finance

Nedbank CIB leads the way in sustainable finance in Africa

Nedbank's Corporate and Investment Banking (CIB) Division has been recognised for its excellence and innovation in sustainable finance by Global Finance, a respected and prestigious international finance magazine.

Published 23 Jul 2024 in nedbank:cib/articles/sustainability

Nedbank CIB leads the way in sustainable finance in Africa

Nedbank's Corporate and Investment Banking (CIB) Division has been recognised for its excellence and innovation in sustainable finance by Global Finance, a respected and prestigious international finance magazine.

Published 23 Jul 2024 in nedbank:cib/articles/sustainability

R2,5bn funding platform unleashes 850MW of clean energy

Nedbank CIB structures bespoke solution for 100% black-owned power producer

Published 23 Jul 2024 in nedbank:cib/deals/energy

Renewable energy deal spurs Anglo American’s decarbonisation journey

Nedbank Corporate and Investment Banking (Nedbank CIB) played a key role in leading the financing of 520 MW wind and solar projects to financial close.

Published 23 Jul 2024 in nedbank:cib/deals/energy

What happens when finance meets sustainability?

Find out at the 25th edition of the Africa Energy Forum (AEF), which will be held in Nairobi, Kenya, from 20 to 23 June 2023. During the event Nedbank CIB will collaborate with other energy sector experts, regulators, utilities, developers, and institutions to identify crucial opportunities that will drive the industry forward.

Published 23 Jul 2024 in nedbank:cib/articles/sustainability

What happens when finance meets sustainability?

Find out at the 25th edition of the Africa Energy Forum (AEF), which will be held in Nairobi, Kenya, from 20 to 23 June 2023. During the event Nedbank CIB will collaborate with other energy sector experts, regulators, utilities, developers, and institutions to identify crucial opportunities that will drive the industry forward.

Published 23 Jul 2024 in nedbank:cib/articles/sustainability

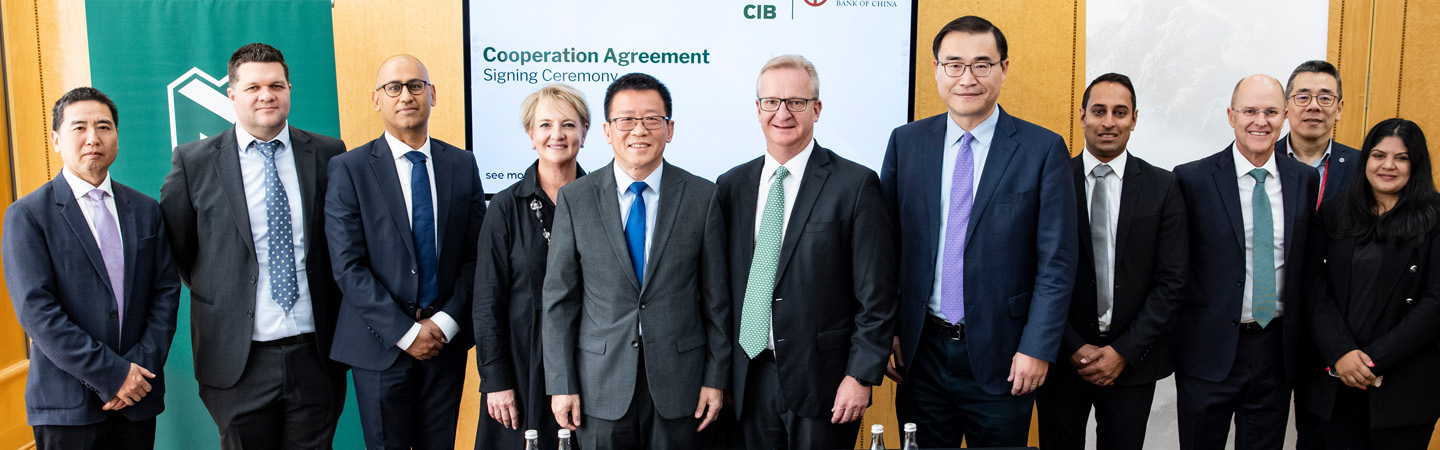

Nedbank CIB and Bank of China Strategic Partnership

Nedbank CIB and Bank of China enhance their collaboration to facilitate increased business flows between China and Africa.

Published 23 Jul 2024 in nedbank:cib/articles/partnerships

R35 billion to power South Africa

Nedbank CIB invests billions into creating a stable power supply in South Africa

Published 12 Jul 2024 in nedbank:cib/deals/energy

NCIB Property Finance makes history funding the first real estate investment trust in Ghana

The REIT paves the way for a more diversified real estate market in Ghana, giving retail and institutional investors more investment options.

Published 30 May 2024 in nedbank:cib/articles/property

Nedbank CIB Corporate Finance Team scoops 2 Ansarada DealMakers awards

The Ansarada DealMakers Awards is a highly respected annual event that recognises the most impactful transactions in the South African corporate finance industry.

Published 30 May 2024 in nedbank:cib/articles/corporate-finance

Nedbank assists National Treasury in raising US$3 billion

Investors across the UK, North America, Europe, Asia and Africa contribute to a US$3,billion bond concluded for South Africa.

Published 30 May 2024 in nedbank:cib/deals/investment

Embedded generation: The next vital developments to an energy-secure South Africa

Improved legislation, aggressive financing terms from funders and assistance from developed countries to aid South Africa in alleviating energy crisis.

Published 30 May 2024 in nedbank:cib/articles/investment

Nedbank invests in RapidDeploy to deliver life-saving rapid response technology to public safety

A tech company borne out of personal tragedy receives a loan to further develop their service that saves lives.

Published 30 May 2024 in nedbank:cib/articles/investment

Bonds, Loans and Sukuk Africa Awards

Most innovative and groundbreaking deals from sovereign, corporate and financial institution issuers and borrowers on the continent

Published 30 May 2024 in nedbank:cib/deals/sustainability

Key factors in the recovery of the property sector in 2023

Gary Garrett, Managing Executive of Property Finance at Nedbank Corporate and Investment Banking, participated in an expert panel at the 2022 South African Real Estate Investment Trust Conference where he reflected on the response of the property sector to recent challenges.

Published 30 May 2024 in nedbank:cib/articles/property

Key factors in the recovery of the property sector in 2023

Gary Garrett, Managing Executive of Property Finance at Nedbank Corporate and Investment Banking, participated in an expert panel at the 2022 South African Real Estate Investment Trust Conference where he reflected on the response of the property sector to recent challenges.

Published 30 May 2024 in nedbank:cib/articles/property

The growth of sustainable finance in South Africa

As part of an expert panel at the 2022 South African Real Estate Investment Trust Conference, Arvana Singh, Nedbank Head of Sustainable Finance Solutions, shared some thoughts on how sustainable finance in South Africa can help mitigate ESG-related risks.

Published 30 May 2024 in nedbank:cib/articles/property

The growth of sustainable finance in South Africa

As part of an expert panel at the 2022 South African Real Estate Investment Trust Conference, Arvana Singh, Nedbank Head of Sustainable Finance Solutions, shared some thoughts on how sustainable finance in South Africa can help mitigate ESG-related risks.

Published 30 May 2024 in nedbank:cib/articles/property

Increasingly competitive IPP sector set to catalyse M&A activity

Clean energy has become a global priority in recent years.

Published 30 May 2024 in nedbank:cib/articles/corporate-finance

Property valuations and trends in SA set to remain a mixed bag in 2022

Commercial property values decreased again in 2021, at a slower pace than 2020.

Published 30 May 2024 in nedbank:cib/articles/property

100 mini hospitals built in rural Zambia

To deliver babies safely, find a good construction site.

Published 29 Apr 2024 in nedbank:cib/deals/energy