Select Country

Don’t have your Nedbank ID yet?

Nedbank ID single sign-on gives you full digital access to Nedbank’s banking and lifestyle products and services on the Money app or Online Banking.

Log in

Log in to Online Banking or another one of our secured services.

Awards

Deals

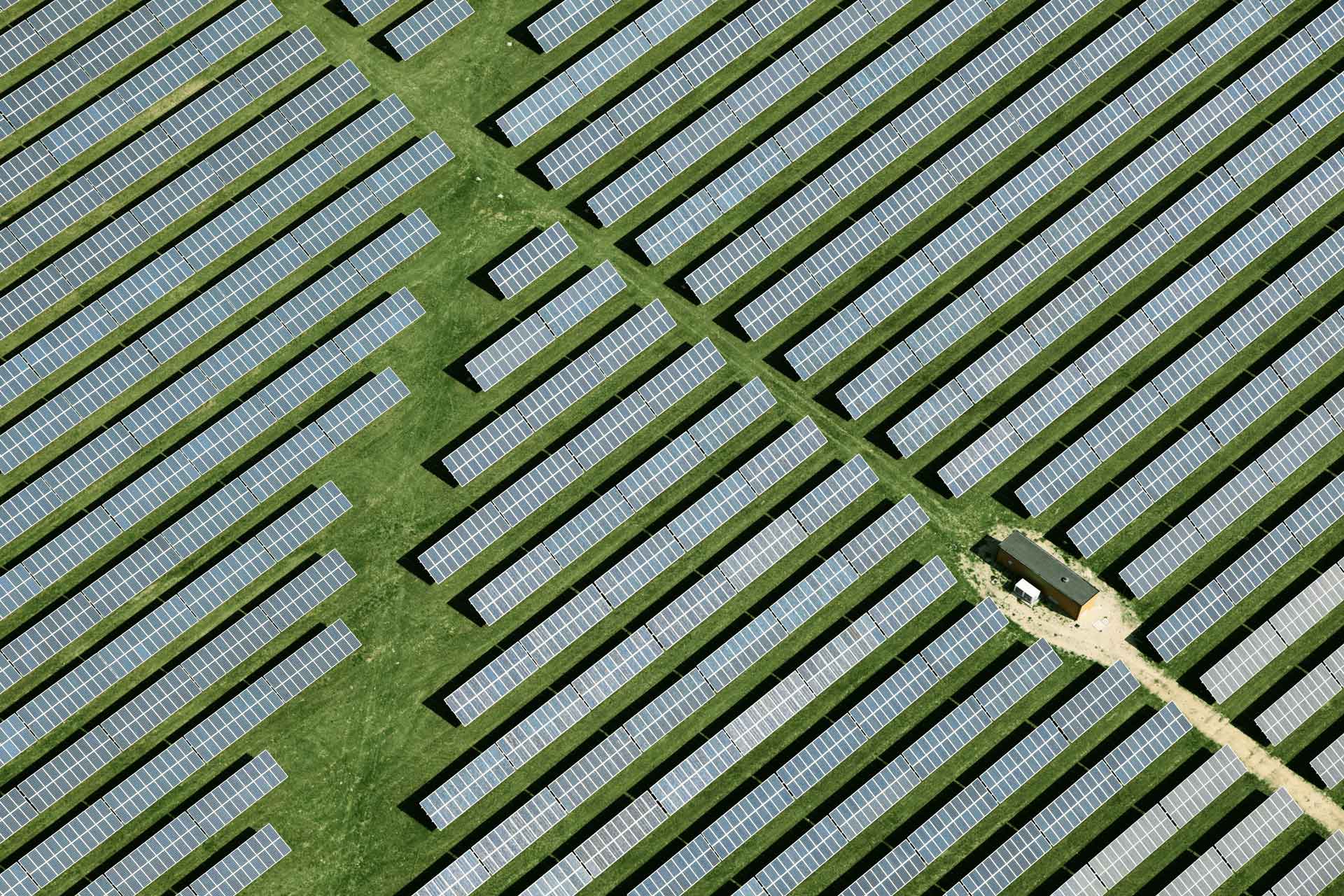

- R4bn Tronox deal funds two 100MW solar plants

- Billions to help Redefine build green properties

- Harmony pursues green goals with R10 billion loan

- Cold solutions finance for cold storage facilities

- International Finance Corporation green bond fund

- Envusa energy deal: The way for renewable energy

- Paladin Energy senior debt funding partnership

- Renewable energy wind farm financing

- Stor-Age’s successful inaugural bond auction

- PlusNet, Peninsula Packaging and Barrier Film Convertors co-investment opportunity | Nedbank CIB

- IFC Green Loan | Nedbank CIB

- AngloGold appoints Nedbank CIB as sole underwriter | Nedbank CIB

- Nedbank CIB Property Finance Team achievement | Nedbank CIB

- PwC Tower, Westlands — Where Kenya's corporate vision meets world-class execution

Women of Corporate Investment Banking

Young Analyst Programme

Articles

- Africa's pathway to a climate-resilient economy

- Commercial property trends 2022

- Green energy in the developing world | Nedbank CIB

- How sustainable finance creates value

- How the property sector recovered in 2023

- FURTHER IMPACT empowerment for entrepreneurs

- There's a new buoyancy around water and sanitation

- What happens when finance meets sustainability?

- Africa’s renewable-energy projects

- Breaking barriers for energy transition in mining

- Nedbank CIB wins big at 2025 IFC Awards

- South Africa leads clean energy transformation

Conferences

Benchmark Reform

Corporate Finance

Financing

Investing

Markets

Transacting

- Login & Register

- Online Banking

- Online Share Trading

- NedFleet

- Register for Nedbank ID

- About us

- Awards

- Deals

- Explore About us

- Awards

- Deals

- R4bn Tronox deal funds two 100MW solar plants

- Billions to help Redefine build green properties

- Harmony pursues green goals with R10 billion loan

- Cold solutions finance for cold storage facilities

- International Finance Corporation green bond fund

- Envusa energy deal: The way for renewable energy

- Paladin Energy senior debt funding partnership

- Renewable energy wind farm financing

- Stor-Age’s successful inaugural bond auction

- PlusNet, Peninsula Packaging and Barrier Film Convertors co-investment opportunity | Nedbank CIB

- IFC Green Loan | Nedbank CIB

- AngloGold appoints Nedbank CIB as sole underwriter | Nedbank CIB

- Nedbank CIB Property Finance Team achievement | Nedbank CIB

- PwC Tower, Westlands — Where Kenya's corporate vision meets world-class execution

- R4bn Tronox deal funds two 100MW solar plants

- Billions to help Redefine build green properties

- Harmony pursues green goals with R10 billion loan

- Cold solutions finance for cold storage facilities

- International Finance Corporation green bond fund

- Envusa energy deal: The way for renewable energy

- Paladin Energy senior debt funding partnership

- Renewable energy wind farm financing

- Stor-Age’s successful inaugural bond auction

- PlusNet, Peninsula Packaging and Barrier Film Convertors co-investment opportunity | Nedbank CIB

- IFC Green Loan | Nedbank CIB

- AngloGold appoints Nedbank CIB as sole underwriter | Nedbank CIB

- Nedbank CIB Property Finance Team achievement | Nedbank CIB

- PwC Tower, Westlands — Where Kenya's corporate vision meets world-class execution

- Women of Corporate Investment Banking

- Young Analyst Programme

- Articles

- Africa's pathway to a climate-resilient economy

- Commercial property trends 2022

- Green energy in the developing world | Nedbank CIB

- How sustainable finance creates value

- How the property sector recovered in 2023

- FURTHER IMPACT empowerment for entrepreneurs

- There's a new buoyancy around water and sanitation

- What happens when finance meets sustainability?

- Africa’s renewable-energy projects

- Breaking barriers for energy transition in mining

- Nedbank CIB wins big at 2025 IFC Awards

- South Africa leads clean energy transformation

- Africa's pathway to a climate-resilient economy

- Commercial property trends 2022

- Green energy in the developing world | Nedbank CIB

- How sustainable finance creates value

- How the property sector recovered in 2023

- FURTHER IMPACT empowerment for entrepreneurs

- There's a new buoyancy around water and sanitation

- What happens when finance meets sustainability?

- Africa’s renewable-energy projects

- Breaking barriers for energy transition in mining

- Nedbank CIB wins big at 2025 IFC Awards

- South Africa leads clean energy transformation

- Conferences

- Benchmark Reform

- Solutions

- Corporate Finance

- Financing

- Investing

- Markets

- Nedbank Business Hub

- Transacting

- Explore Solutions

- Corporate Finance

- Financing

- Investing

- Markets

- Nedbank Business Hub

- Business hub lead form

- Business hub lead form

- Transacting

- Sustainability

- Explore Sustainability

- Contact us

- Explore Contact us

South Africa’s healthcare dilemma

South Africa’s healthcare dilemma

Luyanda Njilo, Global Markets Research Analyst at Nedbank Corporate and Investment Banking

3 mins

A 200 000-bed shortfall is likely to stall National Health Insurance ambitions.

In the face of a 200 000 bed deficit, South Africa’s healthcare ambitions hang in the balance, with investors on the sidelines awaiting fiscal clarity, writes Luyanda Njilo, Global Markets Research Analyst at Nedbank Corporate and Investment Banking.

President Cyril Ramaphosa signed the National Health Insurance (NHI) Bill this week, a move that signalled the start of a campaign against the legislation that could end up in the Constitutional Court. But the pivotal debate remains: How will South Africa finance the hefty annual price tag of at least R200 billion for proposed universal healthcare.

The discourse on NHI also often overlooks a critical question: Does South Africa possess the necessary healthcare infrastructure required to provide universal care, and if not, what is the cost to develop it and, importantly, the source of funding? Common assumptions suggest that merging public and private sector healthcare infrastructure would suffice but reality paints a different picture. The World Health Organization recommends a standard of 5 hospital beds per 1 000 individuals; South Africa falls well short at 2,1 (4,8 beds per 1000 in the private sector, 1,8 in the public sector).

To meet this international standard, an additional 200 000 beds are necessary, supplementing the existing 127 000. Unfortunately, current trends offer little optimism. Despite a population surge exceeding 50% over 3 decades, the number of hospital beds has remained virtually the same, declining in the public sector and rising in the private sector. Yet, growth in the private sector has stalled over the last decade due to a stagnant medical aid membership, which has kept bed occupancy at just 66%. This imbalance underscores the challenges in fulfilling healthcare demands.

A scant 3% of the government’s health budget is spent on infrastructure, in contrast to the 6% of revenue that the private sector spends on maintenance alone

Compounding the bed scarcity, the NHI Bill stipulates that the NHI Fund – a government-managed monetary reserve for citizen healthcare services – will reimburse only facilities accredited by the Office of Health Standards Compliance. With most public hospitals being non-compliant, immediate, substantial investments would be imperative for refurbishment, in addition to the 200 000 new beds needed if NHI were implemented today. Clinics also reflect this grim scenario, with only half of them meeting the mark of adequacy.

A scant 3% of the government’s health budget is spent on infrastructure, in contrast to the 6% of revenue that the private sector spends on maintenance alone. On paper, South Africa is an attractive prospect for investors in healthcare infrastructure. Its rapidly growing population is also quickly urbanising, creating ideal conditions for good returns. Life expectancy has improved sharply in the last 20 years and continues to trend upwards, suggesting healthcare outcomes are expected to keep improving. Investors are also attracted by negative factors, including South Africa’s obesity rate of almost 30% of the population and the high rate of diabetes.

Given these dynamics, South Africa presents a promising business opportunity for investors interested in addressing the country's need for more hospital beds. Public–private partnerships – with private entities financing the development of hospitals and managing them, while the government contracts for their services – could yield lucrative returns and foster sustained private engagement to satisfy the escalating demand for healthcare.

Related posts

See allNedbank CIB honoured for leadership in sustainable finance

Our ESG-backed approach to lending and financing was recognised at the 2022 Global Finance Sustainable Finance Awards, where we ranked in the top 6% of banks globally and received awards for Outstanding Leadership in Green Bonds and Outstanding Leadership in Transition/Sustainability-linked Bonds.

By Staff writer

Published 11 Jul 2025 in nedbank:cib/deals/esg

Nedbank CIB honoured for leadership in sustainable finance

Our ESG-backed approach to lending and financing was recognised at the 2022 Global Finance Sustainable Finance Awards, where we ranked in the top 6% of banks globally and received awards for Outstanding Leadership in Green Bonds and Outstanding Leadership in Transition/Sustainability-linked Bonds.

Staff writer

Published 11 Jul 2025

South Africa’s healthcare sector requires more investment for equity

There is a need for additional investment in South Africa’s fast-growing healthcare sector to cater for the increasing needs of the country, including addressing the national hospital bed shortfall, says Anél Bosman, Group Managing Executive of Nedbank Corporate and Investment Banking.

By Staff writer

Published 08 Jul 2025 in nedbank:cib/articles/investment

South Africa’s healthcare sector requires more investment for equity

There is a need for additional investment in South Africa’s fast-growing healthcare sector to cater for the increasing needs of the country, including addressing the national hospital bed shortfall, says Anél Bosman, Group Managing Executive of Nedbank Corporate and Investment Banking.

Staff writer

Published 08 Jul 2025

Empowering trade. Enabling growth.

At Nedbank Corporate and Investment Banking, we see the unexpected connections that power sustainable growth. Our trade and supply chain finance solutions are designed to unlock working capital, streamline trade flows, and empower businesses across Africa to thrive in an increasingly interconnected global economy.

By Staff writer

Published 24 Jun 2025 in nedbank:cib/articles/finance

Empowering trade. Enabling growth.

At Nedbank Corporate and Investment Banking, we see the unexpected connections that power sustainable growth. Our trade and supply chain finance solutions are designed to unlock working capital, streamline trade flows, and empower businesses across Africa to thrive in an increasingly interconnected global economy.

Staff writer

Published 24 Jun 2025