- Overview

- Initiatives

Partner with financial experts who do good

Leading the way

Nedbank is committed to achieving the goals of the Paris Agreement by 2050. We’re doing everything we can to help keep global temperatures from rising more than 1.5 degrees celsius above pre-industrial levels. In addition, we aim to have 100% of our lending and investment activity supporting a net-zero carbon economy and are actively developing carbon pathways to guide our transition to net-zero.

Reaching net-zero by 2050

In line with the Paris Agreement to keep global warming below 2 degrees celsius above pre-industrial levels by 2050, we’re transitioning away from involvement in or funding of fossil fuels, while accelerating our efforts to finance renewable energy solutions.

How we effectively manage climate-related risks and opportunities

Governance

A dedicated Group Climate Resilience Committee that continues to take great strides to ensure that climate-related risks and opportunities translate into governance, strategy, risk management, as well as metrics and targets to reach a net-zero economy by 2050.

Strategy

Integrating climate-related risks and opportunities across our operating, lending and investing activities, contributing to Sustainable Development Goals (SDGs) and offering innovative client solutions to facilitate the transition to a greener economy.

Metrics and targets

Funding of green-embedded energy generation and Renewable Energy Independent Power Producer Procurement Programme (REIPPPP) is double that of oil, thermal-coal, gas and non-renewable power generation.

Risk management

The Three-lines-of-defence Model and coordinated (combined) assurance are actively practiced. Climate risk is also integrated into other risk types, like credit, market, operational and funding, and included in the internal capital adequacy assessment process.

Change should be measurable

We have tangible frameworks and strategies to measure and report our financed emissions and a dedicated team tasked with collecting climate-related data using the latest scientific tools. This way, we’re able to effectively track, manage and disclose our impact on the environment.

The future of sector coverage is green

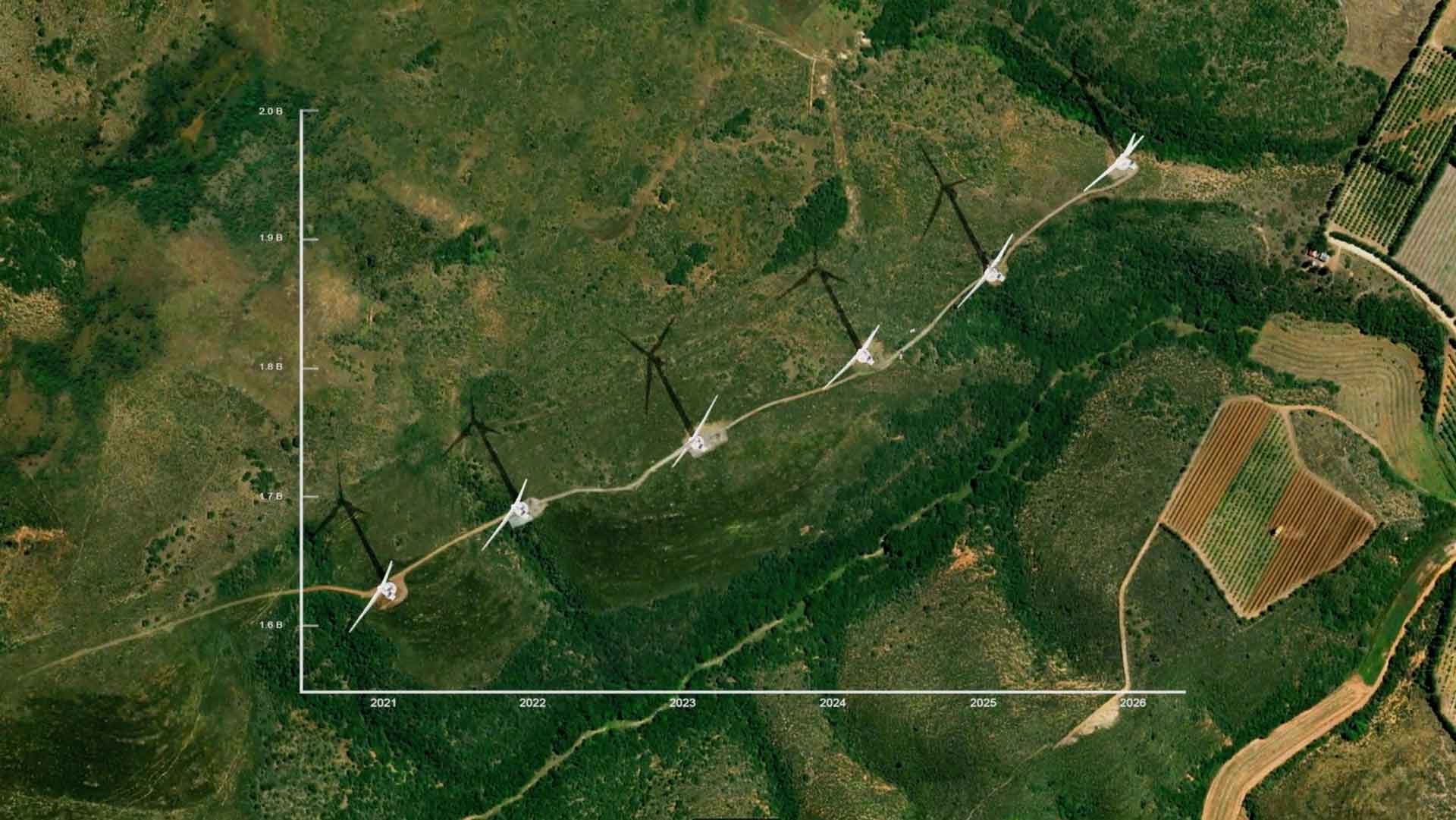

As the first South African commercial bank to launch a green bond on the JSE, we raised R1,7 billion to fund solar and renewable energy projects, R14 billion of exposure to green-certified properties, and R11 billion for buildings containing sustainable features. We have also financed a broad range of sustainable projects and initiatives in the energy, property and agriculture sector.

Energy

Energy Partner group

Nedbank provided debt finance for over 70 projects with a capital value of over R600 million, which includes solar, refrigeration, steam, and lighting assets.

Tronox

Nedbank acted as joint-mandated lead arranger of R3 billion in debt funding for two 100MW solar PV projects.

SOLA Group

Nedbank is the only lender to South Africa’s first wheeling project, the Adams 10 MW solar PV facility, to sell power to Amazon Web Services.

Property

Redefine Green Bond

We successfully structured and implemented a R1,65 billion green bond as part of a R5 billion debt-refinancing package for Redefine Properties Limited (Redefine).

Vukile Property Fund

We successfully structured and implemented a R200 million green loan facility for Vukile Property Fund. The green loan was the first “use of proceeds” loan structured and concluded by Nedbank.

Old Mutual loan

We successfully implemented a new R500 million sustainability-linked term loan facility for Old Mutual Property.

Agriculture

Shade-netting finance

Our shade-netting finance offering is available to medium to large clients in the horticulture sector. In 2022, shade-netting finance deals totalling R43 million were completed, with a further R280 million pending payout or assessment.

Over R1,3 billion to keep our waterways and cities clean

Recycling

Mpact collects over 620 000 tons of paper and plastic recyclables per year from pre- and post-consumer sources. Their liquid packaging recycling plant can recycle 24 000 tons of used liquid cartons a year, effectively saving 65 240 m3 of landfill space. We recently refinanced its funding facilities in the amount of R1 billion.

Water

Nedbank provided a R133 million revolving credit facility to Silulumanzi for their capex programme to improve service delivery and maintain water infrastructure in the concession's peri-urban areas.

Find out more about our sustainability initiatives

Get a callbackClean water and sanitation

Improve water quality, reduce the number of people suffering from water scarcity and protect and restore water-related ecosystems.

Affordable and clean energy

Increase use of renewable energy sources by expanding infrastructure and upgrading technology to double the global rate at which we improve energy efficienc

Industry, innovation and infrastructure

Develop quality, reliable, sustainable and resilient infrastructure to support economic development and human well-being and increase access to information and communications technology.

Sustainable cities and communities

Ensure that by 2030 everyone has access to adequate, safe and affordable housing and transport, basic services and air pollutants and waste in cities is reduced.

Responsible consumption and production

Achieve the sustainable management and efficient use of natural resources by reducing food waste and food losses along production and supply chains as well as to decrease waste through prevention, reduction, recycling and reuse.

Life on land

Ensure the conservation, restoration and sustainable use of terrestrial and inland clean water ecosystems through measures to prevent the introduction and reduce the impact of invasive alien species.