Select Country

Don’t have your Nedbank ID yet?

Nedbank ID single sign-on gives you full digital access to Nedbank’s banking and lifestyle products and services on the Money app or Online Banking.

Log in

Log in to Online Banking or another one of our secured services.

Awards

Deals

- R4bn Tronox deal funds two 100MW solar plants

- Billions to help Redefine build green properties

- Harmony pursues green goals with R10 billion loan

- Cold solutions finance for cold storage facilities

- International Finance Corporation green bond fund

- Envusa energy deal: The way for renewable energy

- Paladin Energy senior debt funding partnership

- Renewable energy wind farm financing

- Stor-Age’s successful inaugural bond auction

- PlusNet, Peninsula Packaging and Barrier Film Convertors co-investment opportunity | Nedbank CIB

- IFC Green Loan | Nedbank CIB

- AngloGold appoints Nedbank CIB as sole underwriter | Nedbank CIB

- Nedbank CIB Property Finance Team achievement | Nedbank CIB

- PwC Tower, Westlands — Where Kenya's corporate vision meets world-class execution

Women of Corporate Investment Banking

Young Analyst Programme

Articles

- Africa's pathway to a climate-resilient economy

- Commercial property trends 2022

- Green energy in the developing world | Nedbank CIB

- How sustainable finance creates value

- How the property sector recovered in 2023

- FURTHER IMPACT empowerment for entrepreneurs

- There's a new buoyancy around water and sanitation

- What happens when finance meets sustainability?

- Africa’s renewable-energy projects

- Breaking barriers for energy transition in mining

- Nedbank CIB wins big at 2025 IFC Awards

- South Africa leads clean energy transformation

Conferences

Benchmark Reform

Corporate Finance

Financing

Investing

Markets

Transacting

- Login & Register

- Online Banking

- Online Share Trading

- NedFleet

- Register for Nedbank ID

- About us

- Awards

- Deals

- Explore About us

- Awards

- Deals

- R4bn Tronox deal funds two 100MW solar plants

- Billions to help Redefine build green properties

- Harmony pursues green goals with R10 billion loan

- Cold solutions finance for cold storage facilities

- International Finance Corporation green bond fund

- Envusa energy deal: The way for renewable energy

- Paladin Energy senior debt funding partnership

- Renewable energy wind farm financing

- Stor-Age’s successful inaugural bond auction

- PlusNet, Peninsula Packaging and Barrier Film Convertors co-investment opportunity | Nedbank CIB

- IFC Green Loan | Nedbank CIB

- AngloGold appoints Nedbank CIB as sole underwriter | Nedbank CIB

- Nedbank CIB Property Finance Team achievement | Nedbank CIB

- PwC Tower, Westlands — Where Kenya's corporate vision meets world-class execution

- R4bn Tronox deal funds two 100MW solar plants

- Billions to help Redefine build green properties

- Harmony pursues green goals with R10 billion loan

- Cold solutions finance for cold storage facilities

- International Finance Corporation green bond fund

- Envusa energy deal: The way for renewable energy

- Paladin Energy senior debt funding partnership

- Renewable energy wind farm financing

- Stor-Age’s successful inaugural bond auction

- PlusNet, Peninsula Packaging and Barrier Film Convertors co-investment opportunity | Nedbank CIB

- IFC Green Loan | Nedbank CIB

- AngloGold appoints Nedbank CIB as sole underwriter | Nedbank CIB

- Nedbank CIB Property Finance Team achievement | Nedbank CIB

- PwC Tower, Westlands — Where Kenya's corporate vision meets world-class execution

- Women of Corporate Investment Banking

- Young Analyst Programme

- Articles

- Africa's pathway to a climate-resilient economy

- Commercial property trends 2022

- Green energy in the developing world | Nedbank CIB

- How sustainable finance creates value

- How the property sector recovered in 2023

- FURTHER IMPACT empowerment for entrepreneurs

- There's a new buoyancy around water and sanitation

- What happens when finance meets sustainability?

- Africa’s renewable-energy projects

- Breaking barriers for energy transition in mining

- Nedbank CIB wins big at 2025 IFC Awards

- South Africa leads clean energy transformation

- Africa's pathway to a climate-resilient economy

- Commercial property trends 2022

- Green energy in the developing world | Nedbank CIB

- How sustainable finance creates value

- How the property sector recovered in 2023

- FURTHER IMPACT empowerment for entrepreneurs

- There's a new buoyancy around water and sanitation

- What happens when finance meets sustainability?

- Africa’s renewable-energy projects

- Breaking barriers for energy transition in mining

- Nedbank CIB wins big at 2025 IFC Awards

- South Africa leads clean energy transformation

- Conferences

- Benchmark Reform

- Solutions

- Corporate Finance

- Financing

- Investing

- Markets

- Nedbank Business Hub

- Transacting

- Explore Solutions

- Corporate Finance

- Financing

- Investing

- Markets

- Nedbank Business Hub

- Business hub lead form

- Business hub lead form

- Transacting

- Sustainability

- Explore Sustainability

- Contact us

- Explore Contact us

Property valuations and trends in SA set to remain a mixed bag in 2022

Property valuations and trends in SA set to remain a mixed bag in 2022

Staff writer

2 mins

Commercial property values decreased again in 2021, at a slower pace than 2020.

According to Ridwaan Loonat, Nedbank’s Senior Property Analyst, the listed-property sector saw an average decrease in property values of roughly 2,8% over the course of the year, which brings the total decrease in value since the start of the Covid-19 pandemic to around 10,5%. A broad range of valuation changes were evident across the listed-property sector .

As in 2020, the South African Property Owners Association (Sapoa) all-property capitalisation rates continued to move upwards in 2021 (0,4% in the first half of the year) but, here too, sectors were impacted differently, which contributed to the broad range of adjustments referred to above.

Valuations are expected to steady in 2022 and reductions will become more property-specific over the coming year. However, there is still uncertainty and downside risk evident in the market, particularly for offices where vacancies increased significantly over the course of last year. That said, there are definite indications that office-based working remains important to many employers and employees alike; so, a wholesale move to remote working is not on the cards. In addition, some of the existing vacant space is also being used for office-to-residential conversions.

Claire Denny of Nedbank Property Partners has noted the following trends and opportunities in the various property sectors:

- Locally listed property funds continue to dispose of non-core assets, with this clearly still being regarded as an opportunity by various private sector players.

- Locally listed property funds also continue to show an interest in offshore acquisitions and developments (more recently in the logistics space), due to the perceived growth potential in some of the offshore jurisdictions, underpinned by the benefit of diversification and net operating income growth.

- Hospitality property prices have been extremely hard hit by the pandemic. Increased supply in this sector has been muted and, if optimism improves, it could see a recovery – a potential situation that is prompting interest among some investors.

- A number of office-to-residential conversions are being planned, or are in progress, with continued interest expected in well-located and reasonably-priced residential units that offer access to various facilities and amenities. Interest in these assets is linked, however, to affordability.

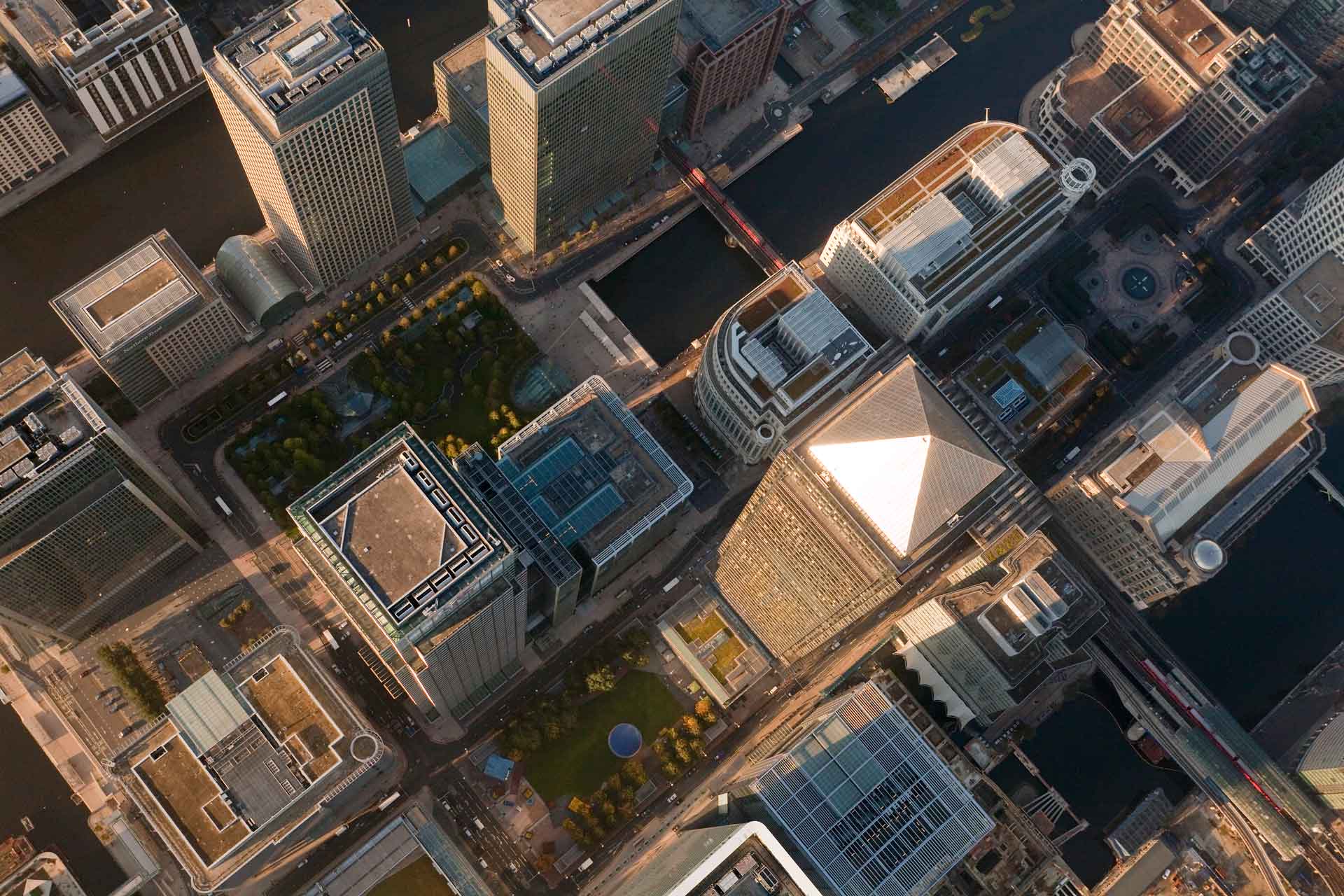

- The industrial sector has proven to be the darling for developers and investors, with a particularly large degree of interest and activity around logistics. This trend is likely to have legs in the longer term, but the question is whether assets have already priced this in.

- Student accommodation has been significantly impacted by Covid-19 from a cash flow perspective. This is generally regarded to be temporary in nature, with a shortage of supply expected over the longer term. Again, there is keen interest in this sector, with parties investing resources in the development of innovative approaches to address supply shortages.

- Convenience, rural and township retail have generally proven resilient through the pandemic, with a fair amount of activity around, and investor interest in, these assets being evident.

- The environmental, social and governance (ESG) theme has picked up steam over the course of 2021. From an investor point of view, ESG-investing is a growing topic of interest for board members and trustees who want to see the impact that their funds are having on society. There is a general consensus that this is a fast-growing area that will become increasingly important, particularly given the acceleration of regulation and shareholder activism in the space. In addition, savings and supplemented property revenue are increasingly being seen from innovative funding and energy-saving installation structures. In December 2021, Nedbank CIB, in partnership with the IFC, announced the successful structuring and arrangement of a R1,09 billion Green Residential Development Bond for Nedbank Limited issued under its domestic medium-term note programme and listed on the Sustainability Segment of the JSE on 10 December 2021. This innovative instrument was a first of its kind for a commercial bank in Africa. Also noteworthy in this space is that the Minister of the Department of Mineral Resources and Energy has introduced new regulations on Energy Performance Certificates for buildings in South Africa in December 2020. These regulations require certain privately owned buildings and government-owned buildings to obtain an Energy Performance Certificate before December 2022.

- Digitisation is also gaining momentum in the property market. For example, online marketing and sales of residential properties picked up in spectacular fashion since lockdown regulations were announced in March 2020. Loyalty applications are being used in student accommodation, rewarding positive payment and other behaviour with various benefits. Nedbank is making use of exciting new technology called OpenSpace to track and monitor progress on building sites for the shared benefit of the bank and its clients.

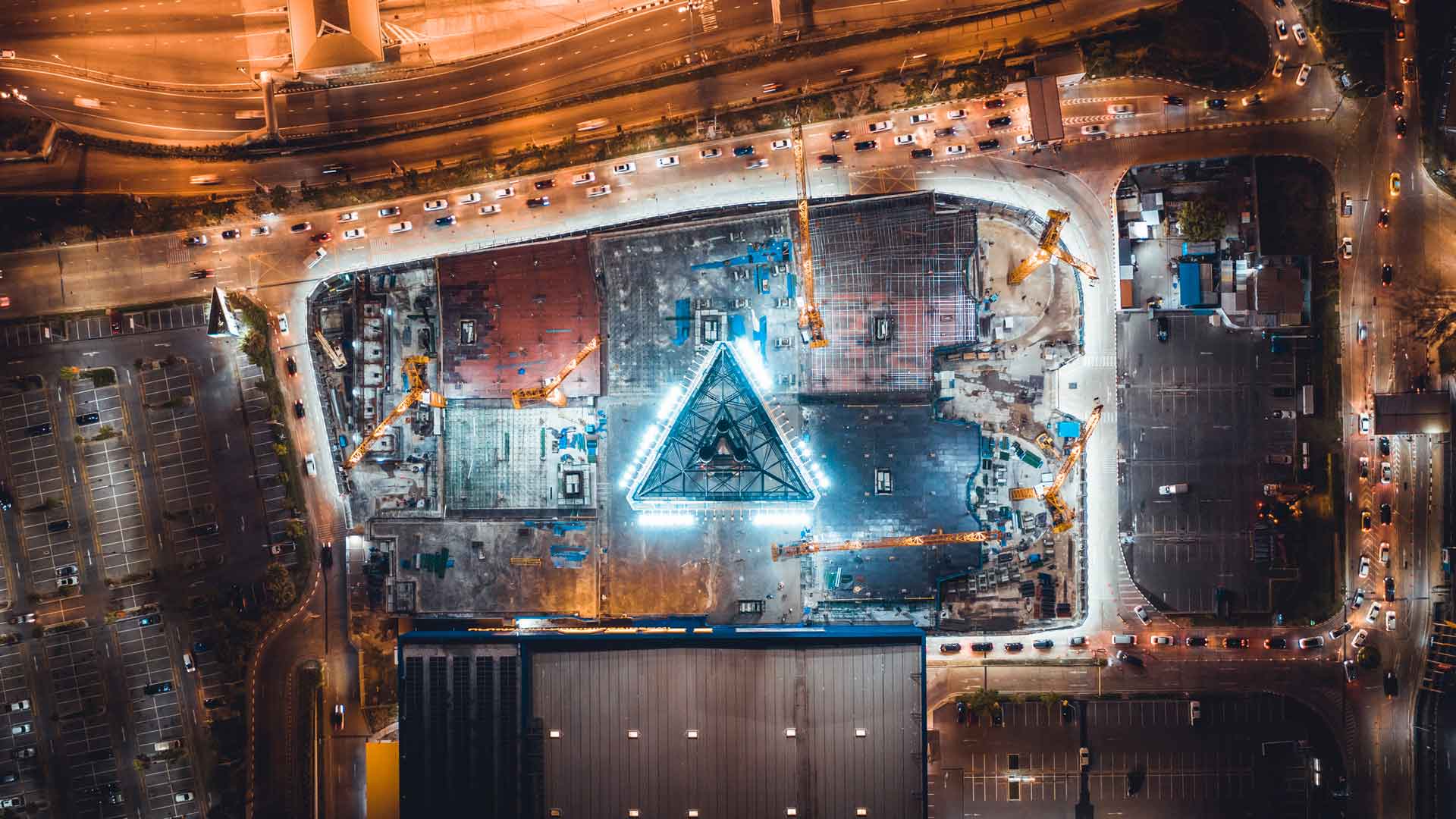

- Investment in data centres is expected to grow significantly over the next few years, and South Africa is no exception. Accelerated digitisation, edge computing, increased data traffic and collection, are all driving an urgent need to manage, store and protect these escalating volumes of data.

- Finally, from an offshore perspective, global transactional volumes have rebounded recently, with figures in 2020/21 well above those seen in 2008. According to Loonat, investors continue their search for stable cashflows that offer growth, which has seen healthcare, self-storage, multi-family and logistics real estate investment trusts trading at premiums to net asset value. Investment into the retail sector has been showing signs of improvement, with some investors calling the bottom on valuation declines given the recovery in footfall and tenant turnover.

All in all, Denny believes that commercial property will see increased activity in 2022. However, she emphasises that strong property fundamentals, as well as innovative, hands-on asset management, will continue to be key going forward, with economic growth also being a critical driver of this sector.

Related posts

See allSustainability in Africa’s hospitality property sector

Nedbank Corporate and Investment Banking (NCIB) has taken another significant step in advancing sustainable property finance across Africa with the successful conclusion of a €19.4 million sustainability-linked development and term loan for Kasada in Senegal. This unique transaction in hospitality property finance will drive measurable environmental and social impact in the local community.

By Staff writer

Published 04 Jun 2025 in nedbank:cib/articles/property

Sustainability in Africa’s hospitality property sector

Nedbank Corporate and Investment Banking (NCIB) has taken another significant step in advancing sustainable property finance across Africa with the successful conclusion of a €19.4 million sustainability-linked development and term loan for Kasada in Senegal. This unique transaction in hospitality property finance will drive measurable environmental and social impact in the local community.

Staff writer

Published 04 Jun 2025

NCIB Property Finance makes history funding the first real estate investment trust in Ghana

The REIT paves the way for a more diversified real estate market in Ghana, giving retail and institutional investors more investment options.

By Staff writer

Published 30 May 2024 in nedbank:cib/articles/property

Key factors in the recovery of the property sector in 2023

Gary Garrett, Managing Executive of Property Finance at Nedbank Corporate and Investment Banking, participated in an expert panel at the 2022 South African Real Estate Investment Trust Conference where he reflected on the response of the property sector to recent challenges.

By Staff writer

Published 30 May 2024 in nedbank:cib/articles/property

Key factors in the recovery of the property sector in 2023

Gary Garrett, Managing Executive of Property Finance at Nedbank Corporate and Investment Banking, participated in an expert panel at the 2022 South African Real Estate Investment Trust Conference where he reflected on the response of the property sector to recent challenges.

Staff writer

Published 30 May 2024

The growth of sustainable finance in South Africa

As part of an expert panel at the 2022 South African Real Estate Investment Trust Conference, Arvana Singh, Nedbank Head of Sustainable Finance Solutions, shared some thoughts on how sustainable finance in South Africa can help mitigate ESG-related risks.

By Staff writer

Published 30 May 2024 in nedbank:cib/articles/property

The growth of sustainable finance in South Africa

As part of an expert panel at the 2022 South African Real Estate Investment Trust Conference, Arvana Singh, Nedbank Head of Sustainable Finance Solutions, shared some thoughts on how sustainable finance in South Africa can help mitigate ESG-related risks.

Staff writer

Published 30 May 2024