Select Country

Don’t have your Nedbank ID yet?

Nedbank ID single sign-on gives you full digital access to Nedbank’s banking and lifestyle products and services on the Money app or Online Banking.

Log in

Log in to Online Banking or another one of our secured services.

Awards

Deals

- R4bn Tronox deal funds two 100MW solar plants

- Billions to help Redefine build green properties

- Harmony pursues green goals with R10 billion loan

- Cold solutions finance for cold storage facilities

- International Finance Corporation green bond fund

- Envusa energy deal: The way for renewable energy

- Paladin Energy senior debt funding partnership

- Renewable energy wind farm financing

- Stor-Age’s successful inaugural bond auction

- PlusNet, Peninsula Packaging and Barrier Film Convertors co-investment opportunity | Nedbank CIB

- IFC Green Loan | Nedbank CIB

- AngloGold appoints Nedbank CIB as sole underwriter | Nedbank CIB

- Nedbank CIB Property Finance Team achievement | Nedbank CIB

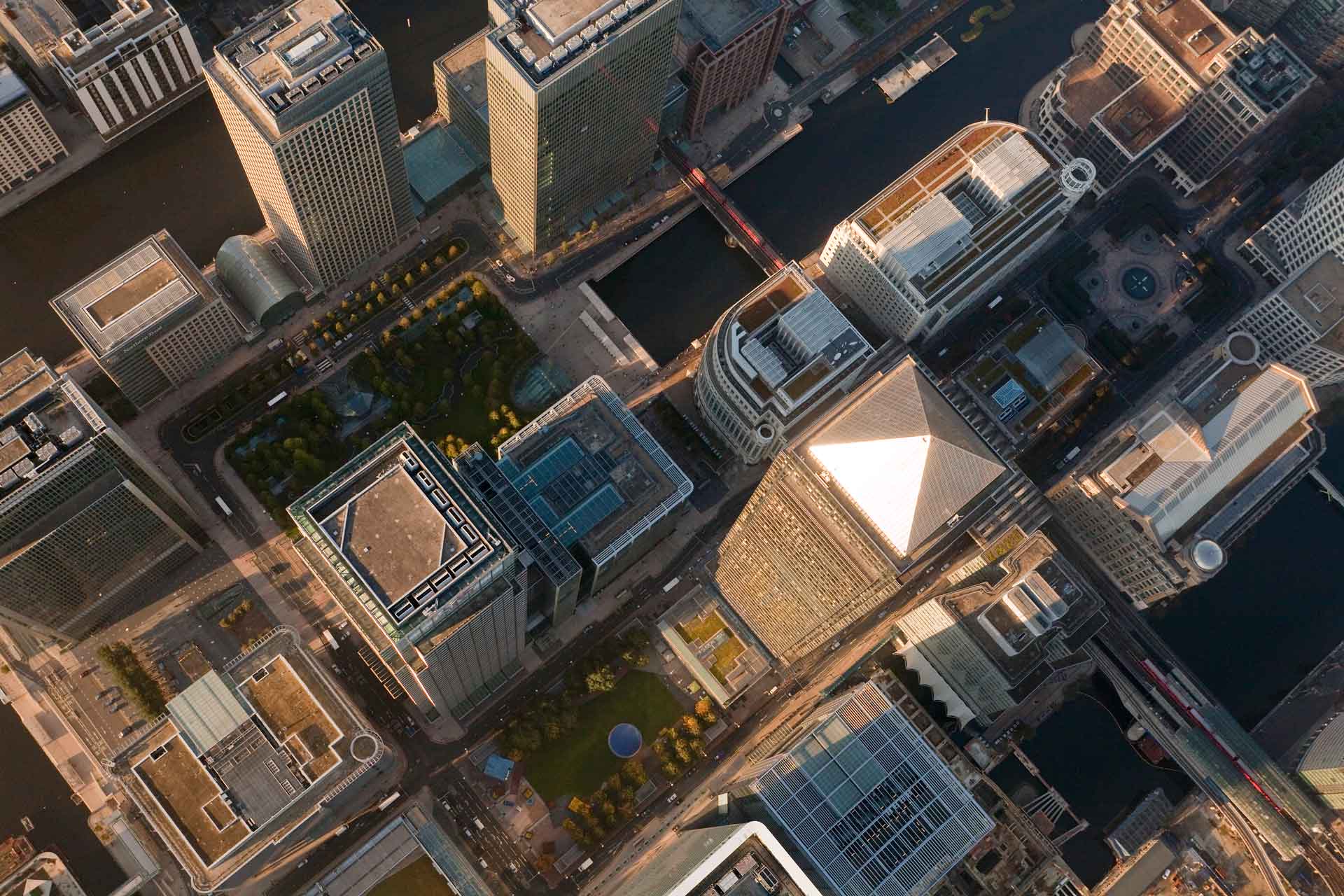

- PwC Tower, Westlands — Where Kenya's corporate vision meets world-class execution

Women of Corporate Investment Banking

Young Analyst Programme

Articles

- Africa's pathway to a climate-resilient economy

- Commercial property trends 2022

- Green energy in the developing world | Nedbank CIB

- How sustainable finance creates value

- How the property sector recovered in 2023

- FURTHER IMPACT empowerment for entrepreneurs

- There's a new buoyancy around water and sanitation

- What happens when finance meets sustainability?

- Africa’s renewable-energy projects

- Breaking barriers for energy transition in mining

- Nedbank CIB wins big at 2025 IFC Awards

- South Africa leads clean energy transformation

Conferences

Benchmark Reform

Corporate Finance

Financing

Investing

Markets

Transacting

- Login & Register

- Online Banking

- Online Share Trading

- NedFleet

- Register for Nedbank ID

- About us

- Awards

- Deals

- Explore About us

- Awards

- Deals

- R4bn Tronox deal funds two 100MW solar plants

- Billions to help Redefine build green properties

- Harmony pursues green goals with R10 billion loan

- Cold solutions finance for cold storage facilities

- International Finance Corporation green bond fund

- Envusa energy deal: The way for renewable energy

- Paladin Energy senior debt funding partnership

- Renewable energy wind farm financing

- Stor-Age’s successful inaugural bond auction

- PlusNet, Peninsula Packaging and Barrier Film Convertors co-investment opportunity | Nedbank CIB

- IFC Green Loan | Nedbank CIB

- AngloGold appoints Nedbank CIB as sole underwriter | Nedbank CIB

- Nedbank CIB Property Finance Team achievement | Nedbank CIB

- PwC Tower, Westlands — Where Kenya's corporate vision meets world-class execution

- R4bn Tronox deal funds two 100MW solar plants

- Billions to help Redefine build green properties

- Harmony pursues green goals with R10 billion loan

- Cold solutions finance for cold storage facilities

- International Finance Corporation green bond fund

- Envusa energy deal: The way for renewable energy

- Paladin Energy senior debt funding partnership

- Renewable energy wind farm financing

- Stor-Age’s successful inaugural bond auction

- PlusNet, Peninsula Packaging and Barrier Film Convertors co-investment opportunity | Nedbank CIB

- IFC Green Loan | Nedbank CIB

- AngloGold appoints Nedbank CIB as sole underwriter | Nedbank CIB

- Nedbank CIB Property Finance Team achievement | Nedbank CIB

- PwC Tower, Westlands — Where Kenya's corporate vision meets world-class execution

- Women of Corporate Investment Banking

- Young Analyst Programme

- Articles

- Africa's pathway to a climate-resilient economy

- Commercial property trends 2022

- Green energy in the developing world | Nedbank CIB

- How sustainable finance creates value

- How the property sector recovered in 2023

- FURTHER IMPACT empowerment for entrepreneurs

- There's a new buoyancy around water and sanitation

- What happens when finance meets sustainability?

- Africa’s renewable-energy projects

- Breaking barriers for energy transition in mining

- Nedbank CIB wins big at 2025 IFC Awards

- South Africa leads clean energy transformation

- Africa's pathway to a climate-resilient economy

- Commercial property trends 2022

- Green energy in the developing world | Nedbank CIB

- How sustainable finance creates value

- How the property sector recovered in 2023

- FURTHER IMPACT empowerment for entrepreneurs

- There's a new buoyancy around water and sanitation

- What happens when finance meets sustainability?

- Africa’s renewable-energy projects

- Breaking barriers for energy transition in mining

- Nedbank CIB wins big at 2025 IFC Awards

- South Africa leads clean energy transformation

- Conferences

- Benchmark Reform

- Solutions

- Corporate Finance

- Financing

- Investing

- Markets

- Nedbank Business Hub

- Transacting

- Explore Solutions

- Corporate Finance

- Financing

- Investing

- Markets

- Nedbank Business Hub

- Business hub lead form

- Business hub lead form

- Transacting

- Sustainability

- Explore Sustainability

- Contact us

- Explore Contact us

NCIB Property Finance makes history funding the first real estate investment trust in Ghana

NCIB Property Finance makes history funding the first real estate investment trust in Ghana

Staff writer

2 mins

The REIT paves the way for a more diversified real estate market in Ghana, giving retail and institutional investors more investment options.

The Nedbank Corporate and Investment Banking (CIB) Property Finance Division has made history by funding the first real estate investment trust (REIT) in Ghana. The CIB Property Finance Team announced today that it has funded the acquisition of One Airport Square by the Sentinel Commercial REIT (Sentinel REIT).

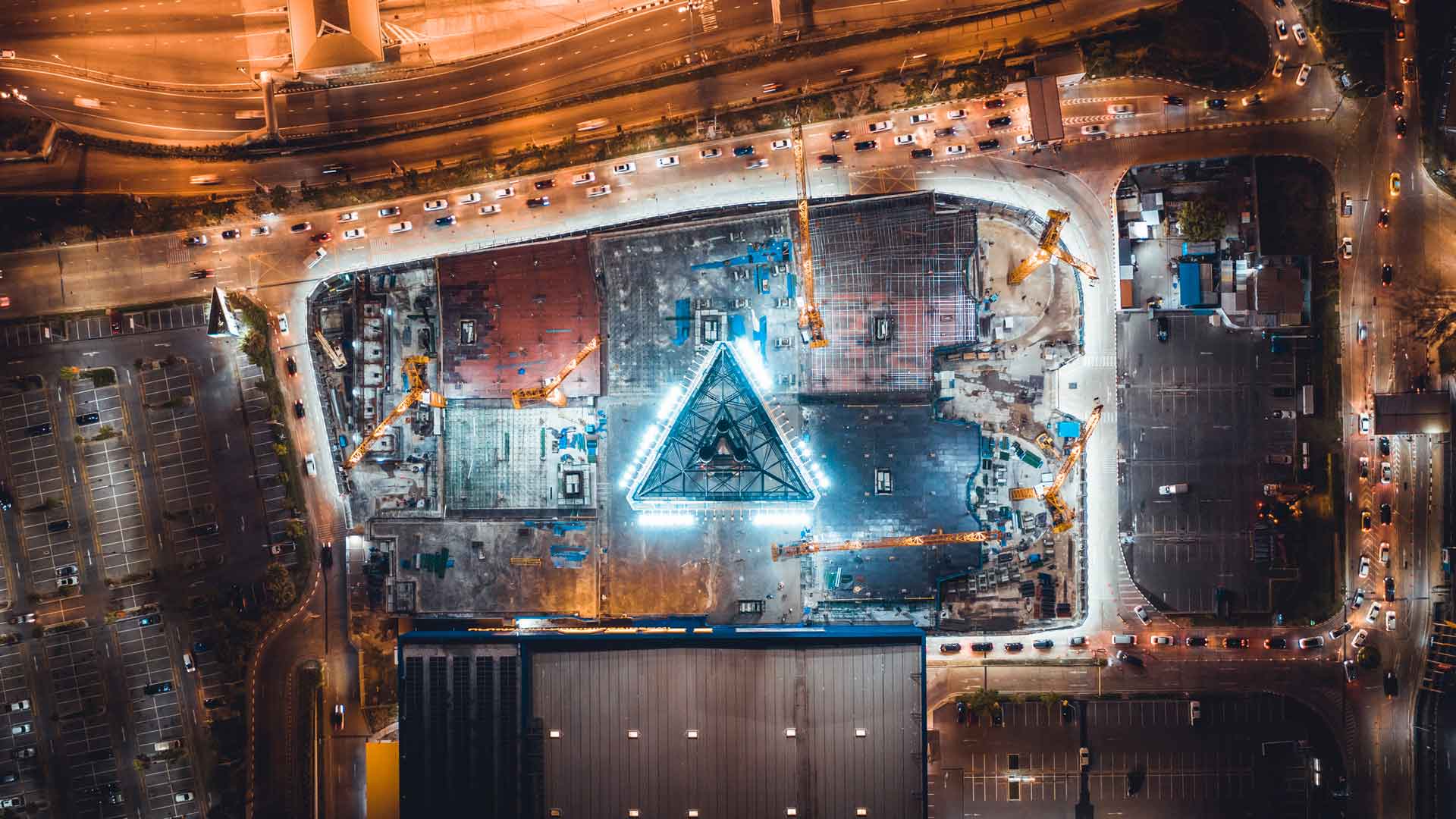

One Airport Square is an iconic Grade A building in the prime area of Accra’s Airport City. The Sentinel REIT is the first REIT to be licensed under the current REIT guidelines from the Securities and Exchange Commission (SEC) of Ghana. This landmark deal marks a milestone for both CIB Property Finance and the Ghanaian real estate market, as it introduces a new and innovative way of investing in commercial property.

REITs are entities that own and operate income-producing real estate assets and distribute most of their income to shareholders. REITs offer investors the benefits of regular and stable income, capital growth, liquidity, and diversification.

One Airport Square, a 9-story mixed-use building with a commercial space of 2 000 m² and office space of 15 000 m², was acquired through a combination of equity and debt financing. Several local and international investors provided equity capital, while CIB Property Finance provided the debt components of the acquisition, comprising a term loan facility and a short-term bridge facility. CIB Property Finance also provided bridging finance to the seller in respect of deferred payment to facilitate the transaction.

The Sentinel REIT is a close-ended scheme that aims to provide investors with regular and stable income with sustainable growth, liquidity and capital growth per share from investments in commercial real estate. The strategy for the REIT is to invest in a portfolio of commercial real estate assets that have attractive investment fundamentals in terms of prime location, architectural design, stable tenant base and properly structured leases. It aims to achieve long-term appreciation of its assets and maximise returns on capital employed.

The REIT presents an opportunity for discerning investors to balance their investment portfolio by investing in assets that generate cash flow that is hedged against any depreciation of the Ghanaian cedi and to participate in a stable and consistent stream.

'We are pleased to have supported Sentinel in closing the first Ghanaian REIT under the new SEC guidelines. Nedbank CIB leveraged its intellectual capital to enable the structuring and delivery of a multifaceted funding solution in support of this landmark transaction. The REIT sector offers potential for growth as institutional investors diversify their investment portfolio with real estate income-generating assets underpinned by strong investment fundamentals. As a leading REIT and property lender on the continent, we are pleased to have had a key role in making this happen,' said Edem Dzakpasu, West Africa Regional Executive for Nedbank CIB.

CIB Property Finance assisted with the acquisition of Sentinel’s first seed asset. The One Airport Square property was originally owned by one of Nedbank’s clients, Actis. As Nedbank already knew the property, it enabled a seamless transaction between the 2 parties. A key part of enabling a seamless transaction was providing short-term bridging facilities to both clients.

The REIT is a game-changer for the Ghanaian real estate market, as it opens new opportunities for retail and institutional investors to access high-quality commercial property assets and paves the way for a more diversified real estate market in Ghana, giving retail and institutional investors more investment options.

'We are proud to be part of this landmark deal, which demonstrates our expertise and capabilities to manage large transactions in West Africa seamlessly. We have a long-standing relationship with Actis, and we are delighted to welcome Sentinel as a new client. We look forward to supporting their growth and expansion in the region. We believe that the REIT sector has a lot of potential in Ghana, and we are excited to be the first lender to fund the first REIT in the country,' said Gerhard Zeelie, Divisional Executive of Nedbank CIB Property Finance Africa.

Nedbank CIB Property Finance

Go to our siteRelated posts

See allThe growth of sustainable finance in South Africa

As part of an expert panel at the 2022 South African Real Estate Investment Trust Conference, Arvana Singh, Nedbank Head of Sustainable Finance Solutions, shared some thoughts on how sustainable finance in South Africa can help mitigate ESG-related risks.

By Staff writer

Published 30 May 2024 in nedbank:cib/articles/property

The growth of sustainable finance in South Africa

As part of an expert panel at the 2022 South African Real Estate Investment Trust Conference, Arvana Singh, Nedbank Head of Sustainable Finance Solutions, shared some thoughts on how sustainable finance in South Africa can help mitigate ESG-related risks.

Staff writer

Published 30 May 2024

Key factors in the recovery of the property sector in 2023

Gary Garrett, Managing Executive of Property Finance at Nedbank Corporate and Investment Banking, participated in an expert panel at the 2022 South African Real Estate Investment Trust Conference where he reflected on the response of the property sector to recent challenges.

By Staff writer

Published 30 May 2024 in nedbank:cib/articles/property

Key factors in the recovery of the property sector in 2023

Gary Garrett, Managing Executive of Property Finance at Nedbank Corporate and Investment Banking, participated in an expert panel at the 2022 South African Real Estate Investment Trust Conference where he reflected on the response of the property sector to recent challenges.

Staff writer

Published 30 May 2024

NCIB Property Finance makes history funding the first real estate investment trust in Ghana

The REIT paves the way for a more diversified real estate market in Ghana, giving retail and institutional investors more investment options.

By Staff writer

Published 30 May 2024 in nedbank:cib/articles/property

Sustainability in Africa’s hospitality property sector

Nedbank Corporate and Investment Banking (NCIB) has taken another significant step in advancing sustainable property finance across Africa with the successful conclusion of a €19.4 million sustainability-linked development and term loan for Kasada in Senegal. This unique transaction in hospitality property finance will drive measurable environmental and social impact in the local community.

By Staff writer

Published 04 Jun 2025 in nedbank:cib/articles/property

Sustainability in Africa’s hospitality property sector

Nedbank Corporate and Investment Banking (NCIB) has taken another significant step in advancing sustainable property finance across Africa with the successful conclusion of a €19.4 million sustainability-linked development and term loan for Kasada in Senegal. This unique transaction in hospitality property finance will drive measurable environmental and social impact in the local community.

Staff writer

Published 04 Jun 2025