Select Country

Don’t have your Nedbank ID yet?

Nedbank ID single sign-on gives you full digital access to Nedbank’s banking and lifestyle products and services on the Money app or Online Banking.

Log in

Log in to Online Banking or another one of our secured services.

Awards

Deals

- R4bn Tronox deal funds two 100MW solar plants

- Billions to help Redefine build green properties

- Harmony pursues green goals with R10 billion loan

- Cold solutions finance for cold storage facilities

- International Finance Corporation green bond fund

- Envusa energy deal: The way for renewable energy

- Paladin Energy senior debt funding partnership

- Renewable energy wind farm financing

- Stor-Age’s successful inaugural bond auction

- PlusNet, Peninsula Packaging and Barrier Film Convertors co-investment opportunity | Nedbank CIB

- IFC Green Loan | Nedbank CIB

- AngloGold appoints Nedbank CIB as sole underwriter | Nedbank CIB

- Nedbank CIB Property Finance Team achievement | Nedbank CIB

- PwC Tower, Westlands — Where Kenya's corporate vision meets world-class execution

Women of Corporate Investment Banking

Young Analyst Programme

Articles

- Africa's pathway to a climate-resilient economy

- Commercial property trends 2022

- Green energy in the developing world | Nedbank CIB

- How sustainable finance creates value

- How the property sector recovered in 2023

- FURTHER IMPACT empowerment for entrepreneurs

- There's a new buoyancy around water and sanitation

- What happens when finance meets sustainability?

- Africa’s renewable-energy projects

- Breaking barriers for energy transition in mining

- Nedbank CIB wins big at 2025 IFC Awards

- South Africa leads clean energy transformation

Conferences

Benchmark Reform

Corporate Finance

Financing

Investing

Markets

Transacting

- Login & Register

- Online Banking

- Online Share Trading

- NedFleet

- Register for Nedbank ID

- About us

- Awards

- Deals

- Explore About us

- Awards

- Deals

- R4bn Tronox deal funds two 100MW solar plants

- Billions to help Redefine build green properties

- Harmony pursues green goals with R10 billion loan

- Cold solutions finance for cold storage facilities

- International Finance Corporation green bond fund

- Envusa energy deal: The way for renewable energy

- Paladin Energy senior debt funding partnership

- Renewable energy wind farm financing

- Stor-Age’s successful inaugural bond auction

- PlusNet, Peninsula Packaging and Barrier Film Convertors co-investment opportunity | Nedbank CIB

- IFC Green Loan | Nedbank CIB

- AngloGold appoints Nedbank CIB as sole underwriter | Nedbank CIB

- Nedbank CIB Property Finance Team achievement | Nedbank CIB

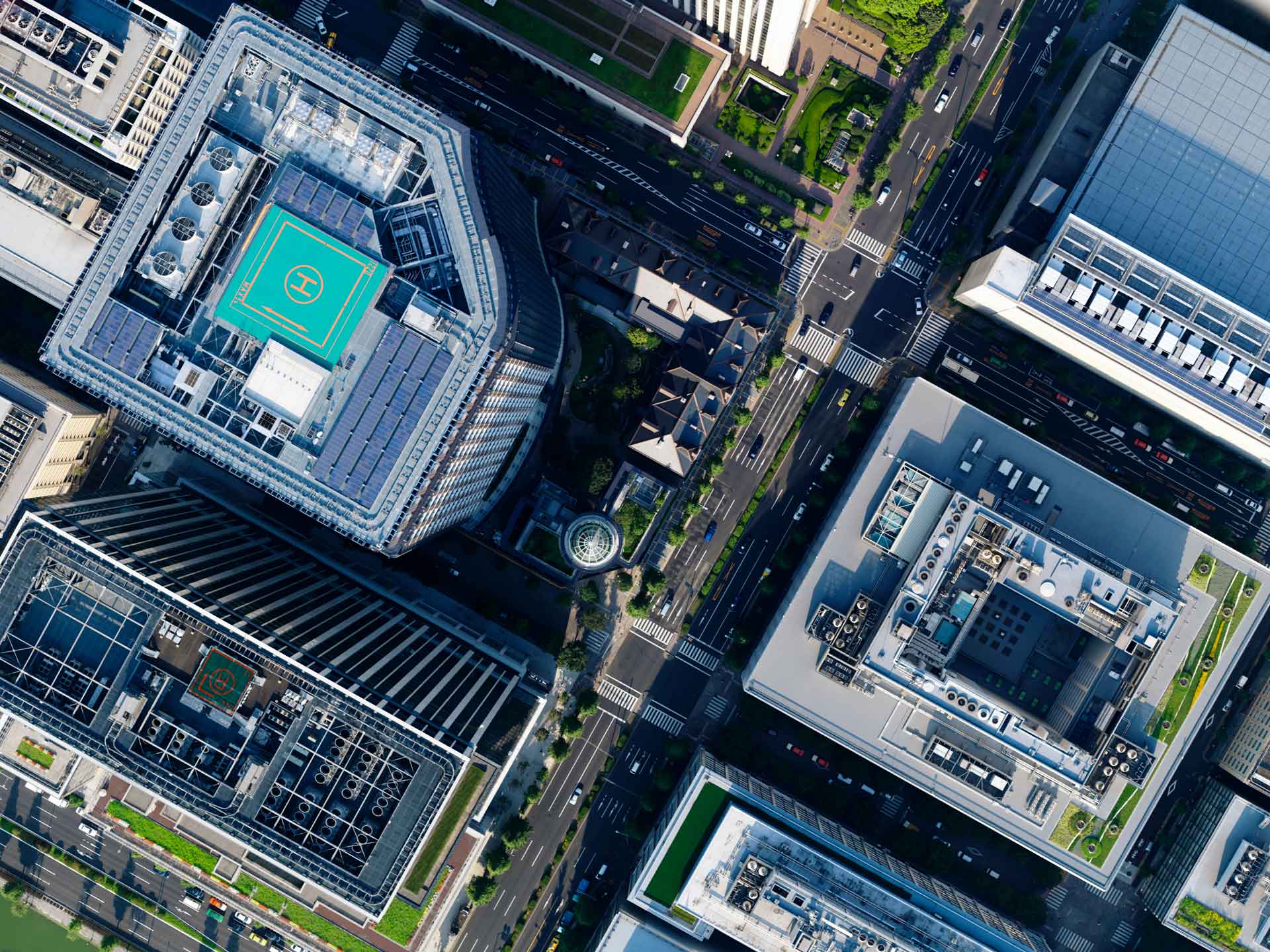

- PwC Tower, Westlands — Where Kenya's corporate vision meets world-class execution

- R4bn Tronox deal funds two 100MW solar plants

- Billions to help Redefine build green properties

- Harmony pursues green goals with R10 billion loan

- Cold solutions finance for cold storage facilities

- International Finance Corporation green bond fund

- Envusa energy deal: The way for renewable energy

- Paladin Energy senior debt funding partnership

- Renewable energy wind farm financing

- Stor-Age’s successful inaugural bond auction

- PlusNet, Peninsula Packaging and Barrier Film Convertors co-investment opportunity | Nedbank CIB

- IFC Green Loan | Nedbank CIB

- AngloGold appoints Nedbank CIB as sole underwriter | Nedbank CIB

- Nedbank CIB Property Finance Team achievement | Nedbank CIB

- PwC Tower, Westlands — Where Kenya's corporate vision meets world-class execution

- Women of Corporate Investment Banking

- Young Analyst Programme

- Articles

- Africa's pathway to a climate-resilient economy

- Commercial property trends 2022

- Green energy in the developing world | Nedbank CIB

- How sustainable finance creates value

- How the property sector recovered in 2023

- FURTHER IMPACT empowerment for entrepreneurs

- There's a new buoyancy around water and sanitation

- What happens when finance meets sustainability?

- Africa’s renewable-energy projects

- Breaking barriers for energy transition in mining

- Nedbank CIB wins big at 2025 IFC Awards

- South Africa leads clean energy transformation

- Africa's pathway to a climate-resilient economy

- Commercial property trends 2022

- Green energy in the developing world | Nedbank CIB

- How sustainable finance creates value

- How the property sector recovered in 2023

- FURTHER IMPACT empowerment for entrepreneurs

- There's a new buoyancy around water and sanitation

- What happens when finance meets sustainability?

- Africa’s renewable-energy projects

- Breaking barriers for energy transition in mining

- Nedbank CIB wins big at 2025 IFC Awards

- South Africa leads clean energy transformation

- Conferences

- Benchmark Reform

- Solutions

- Corporate Finance

- Financing

- Investing

- Markets

- Nedbank Business Hub

- Transacting

- Explore Solutions

- Corporate Finance

- Financing

- Investing

- Markets

- Nedbank Business Hub

- Business hub lead form

- Business hub lead form

- Transacting

- Sustainability

- Explore Sustainability

- Contact us

- Explore Contact us

R10bn loan takes Harmony closer to renewable energy goal

R10bn loan takes Harmony closer to renewable energy goal

Staff writer

2 mins

Harmony Gold's solar photovoltaic projects see a boost thanks to green loan.

In June 2022, sustainable gold mining and exploration company, Harmony Gold, appointed Nedbank CIB to help them refinance and upsize its key corporate debt facilities. The R10 billion green loan – coordinated and structured by Nedbank CIB – has been used exclusively to finance the construction of Harmony’s second phase of solar photovoltaic projects.

As a result, Harmony’s renewable energy generation has increased by 137MW, keeping the company’s decarbonization strategy on track. This includes the goal of having 30% of their energy mix originating from renewable sources by 2027. And, thanks to Nedbank CIB’s green loan, this goal is well within reach.

An independent party, global climate consultancy Carbon Trust, was also brought in to confirm that Nedbank CIB's loan is aligned with the core components of the Loan Market Association green loan- and sustainability-linked loan principles.

But the impact of the R10 billion loan goes far beyond the environment. It will see Harmony making a marked difference in South Africa in areas like increased employment and fiscal contribution.

Nedbank CIB recognises that environmentally sensitive mining is a non-negotiable in South Africa's efforts to move towards a lower-carbon future and is, therefore, delighted to have been a part of Harmony Gold's green ambitions.

Related posts

See allNCIB plays key role in SA Corporate’s acquisition and subsequent delisting of Indluplace

Nedbank Corporate and Investment Banking (CIB), recently played a pivotal role in the successful acquisition and subsequent delisting by SA Corporate Real Estate Limited (“SA Corporate”) of Indluplace Properties Limited (“Indluplace”). Acting through our Corporate Finance team, CIB served as the exclusive corporate advisor and transaction sponsor in the transaction, which involved the integration of Indluplace Properties Limited ("Indluplace") into SA Corporate's portfolio.

By Staff writer

Published 23 Jul 2024 in nedbank:cib/deals/property

NCIB plays key role in SA Corporate’s acquisition and subsequent delisting of Indluplace

Nedbank Corporate and Investment Banking (CIB), recently played a pivotal role in the successful acquisition and subsequent delisting by SA Corporate Real Estate Limited (“SA Corporate”) of Indluplace Properties Limited (“Indluplace”). Acting through our Corporate Finance team, CIB served as the exclusive corporate advisor and transaction sponsor in the transaction, which involved the integration of Indluplace Properties Limited ("Indluplace") into SA Corporate's portfolio.

Staff writer

Published 23 Jul 2024

US$102m syndication for ETG Agri Inputs FZE

Our Agricultural Commodities, Syndication, and Distribution (S&D) Teams are pleased to announce the conclusion of a US$102 million agricultural commodity syndication for ETG Agri Inputs FZE, a company within ETG’s Agri Inputs and Fertilizer Vertical.

By Staff writer

Published 18 Oct 2024 in nedbank:cib/deals

US$102m syndication for ETG Agri Inputs FZE

Our Agricultural Commodities, Syndication, and Distribution (S&D) Teams are pleased to announce the conclusion of a US$102 million agricultural commodity syndication for ETG Agri Inputs FZE, a company within ETG’s Agri Inputs and Fertilizer Vertical.

Staff writer

Published 18 Oct 2024