Select Country

Don’t have your Nedbank ID yet?

Nedbank ID single sign-on gives you full digital access to Nedbank’s banking and lifestyle products and services on the Money app or Online Banking.

Log in

Log in to Online Banking or another one of our secured services.

Awards

Deals

- R4bn Tronox deal funds two 100MW solar plants

- Billions to help Redefine build green properties

- Harmony pursues green goals with R10 billion loan

- Cold solutions finance for cold storage facilities

- International Finance Corporation green bond fund

- Envusa energy deal: The way for renewable energy

- Paladin Energy senior debt funding partnership

- Renewable energy wind farm financing

- Stor-Age’s successful inaugural bond auction

- PlusNet, Peninsula Packaging and Barrier Film Convertors co-investment opportunity | Nedbank CIB

- IFC Green Loan | Nedbank CIB

- AngloGold appoints Nedbank CIB as sole underwriter | Nedbank CIB

- Nedbank CIB Property Finance Team achievement | Nedbank CIB

- PwC Tower, Westlands — Where Kenya's corporate vision meets world-class execution

Women of Corporate Investment Banking

Young Analyst Programme

Articles

- Africa's pathway to a climate-resilient economy

- Commercial property trends 2022

- Green energy in the developing world | Nedbank CIB

- How sustainable finance creates value

- How the property sector recovered in 2023

- FURTHER IMPACT empowerment for entrepreneurs

- There's a new buoyancy around water and sanitation

- What happens when finance meets sustainability?

- Africa’s renewable-energy projects

- Breaking barriers for energy transition in mining

- Nedbank CIB wins big at 2025 IFC Awards

- South Africa leads clean energy transformation

Conferences

Benchmark Reform

Corporate Finance

Financing

Investing

Markets

Transacting

- Login & Register

- Online Banking

- Online Share Trading

- NedFleet

- Register for Nedbank ID

- About us

- Awards

- Deals

- Explore About us

- Awards

- Deals

- R4bn Tronox deal funds two 100MW solar plants

- Billions to help Redefine build green properties

- Harmony pursues green goals with R10 billion loan

- Cold solutions finance for cold storage facilities

- International Finance Corporation green bond fund

- Envusa energy deal: The way for renewable energy

- Paladin Energy senior debt funding partnership

- Renewable energy wind farm financing

- Stor-Age’s successful inaugural bond auction

- PlusNet, Peninsula Packaging and Barrier Film Convertors co-investment opportunity | Nedbank CIB

- IFC Green Loan | Nedbank CIB

- AngloGold appoints Nedbank CIB as sole underwriter | Nedbank CIB

- Nedbank CIB Property Finance Team achievement | Nedbank CIB

- PwC Tower, Westlands — Where Kenya's corporate vision meets world-class execution

- R4bn Tronox deal funds two 100MW solar plants

- Billions to help Redefine build green properties

- Harmony pursues green goals with R10 billion loan

- Cold solutions finance for cold storage facilities

- International Finance Corporation green bond fund

- Envusa energy deal: The way for renewable energy

- Paladin Energy senior debt funding partnership

- Renewable energy wind farm financing

- Stor-Age’s successful inaugural bond auction

- PlusNet, Peninsula Packaging and Barrier Film Convertors co-investment opportunity | Nedbank CIB

- IFC Green Loan | Nedbank CIB

- AngloGold appoints Nedbank CIB as sole underwriter | Nedbank CIB

- Nedbank CIB Property Finance Team achievement | Nedbank CIB

- PwC Tower, Westlands — Where Kenya's corporate vision meets world-class execution

- Women of Corporate Investment Banking

- Young Analyst Programme

- Articles

- Africa's pathway to a climate-resilient economy

- Commercial property trends 2022

- Green energy in the developing world | Nedbank CIB

- How sustainable finance creates value

- How the property sector recovered in 2023

- FURTHER IMPACT empowerment for entrepreneurs

- There's a new buoyancy around water and sanitation

- What happens when finance meets sustainability?

- Africa’s renewable-energy projects

- Breaking barriers for energy transition in mining

- Nedbank CIB wins big at 2025 IFC Awards

- South Africa leads clean energy transformation

- Africa's pathway to a climate-resilient economy

- Commercial property trends 2022

- Green energy in the developing world | Nedbank CIB

- How sustainable finance creates value

- How the property sector recovered in 2023

- FURTHER IMPACT empowerment for entrepreneurs

- There's a new buoyancy around water and sanitation

- What happens when finance meets sustainability?

- Africa’s renewable-energy projects

- Breaking barriers for energy transition in mining

- Nedbank CIB wins big at 2025 IFC Awards

- South Africa leads clean energy transformation

- Conferences

- Benchmark Reform

- Solutions

- Corporate Finance

- Financing

- Investing

- Markets

- Nedbank Business Hub

- Transacting

- Explore Solutions

- Corporate Finance

- Financing

- Investing

- Markets

- Nedbank Business Hub

- Business hub lead form

- Business hub lead form

- Transacting

- Sustainability

- Explore Sustainability

- Contact us

- Explore Contact us

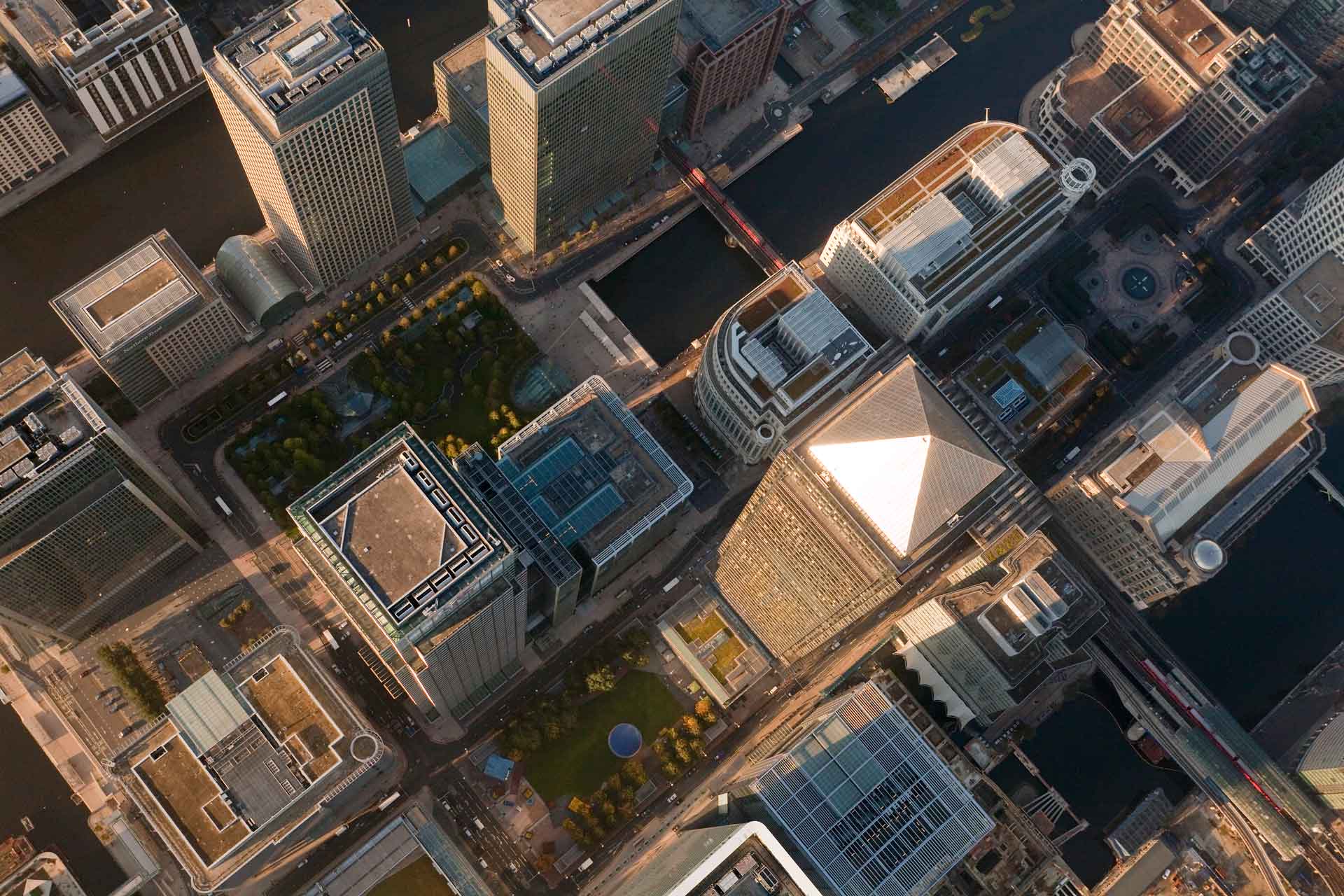

Harnessing technology to navigate SA's property market

Harnessing technology to navigate SA's property market

Staff writer

2 mins

Learn about Nedbank’s innovative tools for sustainable property finance in South Africa.

Harnessing technology to navigate South Africa's property market

‘Navigating the complexities of South Africa's property market requires a blend of innovative technology and market insights’, writes Myurie Naidoo, Principal of Property Finance, Sustainability, Reporting and Automation at Nedbank Corporate and Investment Banking (NCIB).

In the ever-changing landscape of South Africa's property market, 2024 presents challenges and opportunities. As the climate crisis escalates, the importance of financial institutions in fostering a sustainable future has reached a pivotal point.

As the country’s leading commercial property financier, Nedbank is fully aware of these responsibilities. The crucial question is: How does Nedbank use technology and data analytics in such a complex environment?

Understanding the climate geolocation tool

Physical risk to property assets due to climate change poses a considerable challenge. NCIB’s approach is its cClimate gGeolocation tool, an interactive map that is quickly becoming essential in property finance. This map isn’t just another digital tool; it pulls together data from various sources, giving a complete view of the bank's financed portfolio. At the core of its development was the need to understand properties that are more at risk of climate change due to their location.

Incorporating climate scenario overlays and property risk scores

Nedbank has taken a forward-thinking approach by integrating climate scenario overlays through these climate risk assessment tools. These overlays offer detailed insights into how specific climate events such as floods, wildfires, hail, and lightning could impact the bank’s mortgage portfolios. Each property is given a risk score based on its exposure to these events, allowing for a more nuanced understanding of potential risks.

This data-driven strategy goes beyond merely recognising risks; it enables Nedbank and its clients to address and reduce those risks proactively. By embedding these insights into strategic planning, Nedbank ensures that it remains at the forefront of sustainable property finance in South Africa, enabling the bank and its clients to navigate the challenges that a changing climate poses.

The tool’s functionality was extended to provide essential insights into client concentrations, sector trends and nodal development activity. For development projects, Nedbank partnered with OpenSpace to provide a value-added service to clients.

OpenSpace’s technology allows for real-time monitoring of construction sites.

Real-time monitoring with OpenSpace

Nedbank’s partnership with OpenSpace shows how modern technology can change how things are done. OpenSpace’s technology allows for real-time monitoring of construction sites through 360-degree street views, accessible via an app. This isn’t a tech gimmick but a real improvement in project management.

Real-time tracking allows project teams to resolve issues quickly and ensures stakeholders get timely and accurate updates. Although the adoption of this technology was slow at first, when its benefits had become clear, demand grew. Today, Nedbank is the largest user of OpenSpace technology globally, reflecting its commitment to innovation in property finance.

Leading the way in sustainability in property finance

Nedbank’s commitment to sustainability goes far beyond technological tools. The bank has set up a team of green-accredited experts specialising in the International Finance Corporation’s Excellence in Design for Greater Excellence (IFC EDGE) certification – a globally recognised green building standard.

This team has already reached significant milestones, such as the certification of Attacq’s Nexus 1 building in the Waterfall precinct. This project spans 7 363 square metres and is South Africa’s first commercial building to achieve EDGE and Green Star certifications.

Nedbank’s involvement in the Nexus 1 project clearly shows its role as a driver of change in the real estate sector. By promoting resource-efficient construction and strong environmental standards, the bank responds to market demands and leads the industry towards more sustainable practices.

Nedbank’s role in sustainable property finance

For Nedbank, green finance is not just a trend but a core part of its strategy. As the bank continues to grow its in-house expertise and use data analytics, it remains committed to helping clients navigate the complexities of climate change.

This focus ensures that Nedbank is assisting its clients with today’s challenges and preparing them to thrive in the future. Ultimately, Nedbank’s approach to property finance is about more than managing risks. It is about leading the way towards a sustainable future.

By leading in technological innovation and sustainable practices, Nedbank establishes itself as a responsible and progressive financial institution within South Africa’s property market. Strategic real estate investment not only offers potential financial returns, but also plays a crucial role in promoting environmentally responsible development practices.

Related posts

See allThe growth of sustainable finance in South Africa

As part of an expert panel at the 2022 South African Real Estate Investment Trust Conference, Arvana Singh, Nedbank Head of Sustainable Finance Solutions, shared some thoughts on how sustainable finance in South Africa can help mitigate ESG-related risks.

By Staff writer

Published 30 May 2024 in nedbank:cib/articles/property

The growth of sustainable finance in South Africa

As part of an expert panel at the 2022 South African Real Estate Investment Trust Conference, Arvana Singh, Nedbank Head of Sustainable Finance Solutions, shared some thoughts on how sustainable finance in South Africa can help mitigate ESG-related risks.

Staff writer

Published 30 May 2024

South Africa’s healthcare sector requires more investment for equity

There is a need for additional investment in South Africa’s fast-growing healthcare sector to cater for the increasing needs of the country, including addressing the national hospital bed shortfall, says Anél Bosman, Group Managing Executive of Nedbank Corporate and Investment Banking.

By Staff writer

Published 08 Jul 2025 in nedbank:cib/articles/investment

South Africa’s healthcare sector requires more investment for equity

There is a need for additional investment in South Africa’s fast-growing healthcare sector to cater for the increasing needs of the country, including addressing the national hospital bed shortfall, says Anél Bosman, Group Managing Executive of Nedbank Corporate and Investment Banking.

Staff writer

Published 08 Jul 2025