Select Country

Don’t have your Nedbank ID yet?

Nedbank ID single sign-on gives you full digital access to Nedbank’s banking and lifestyle products and services on the Money app or Online Banking.

Log in

Log in to Online Banking or another one of our secured services.

Awards

Deals

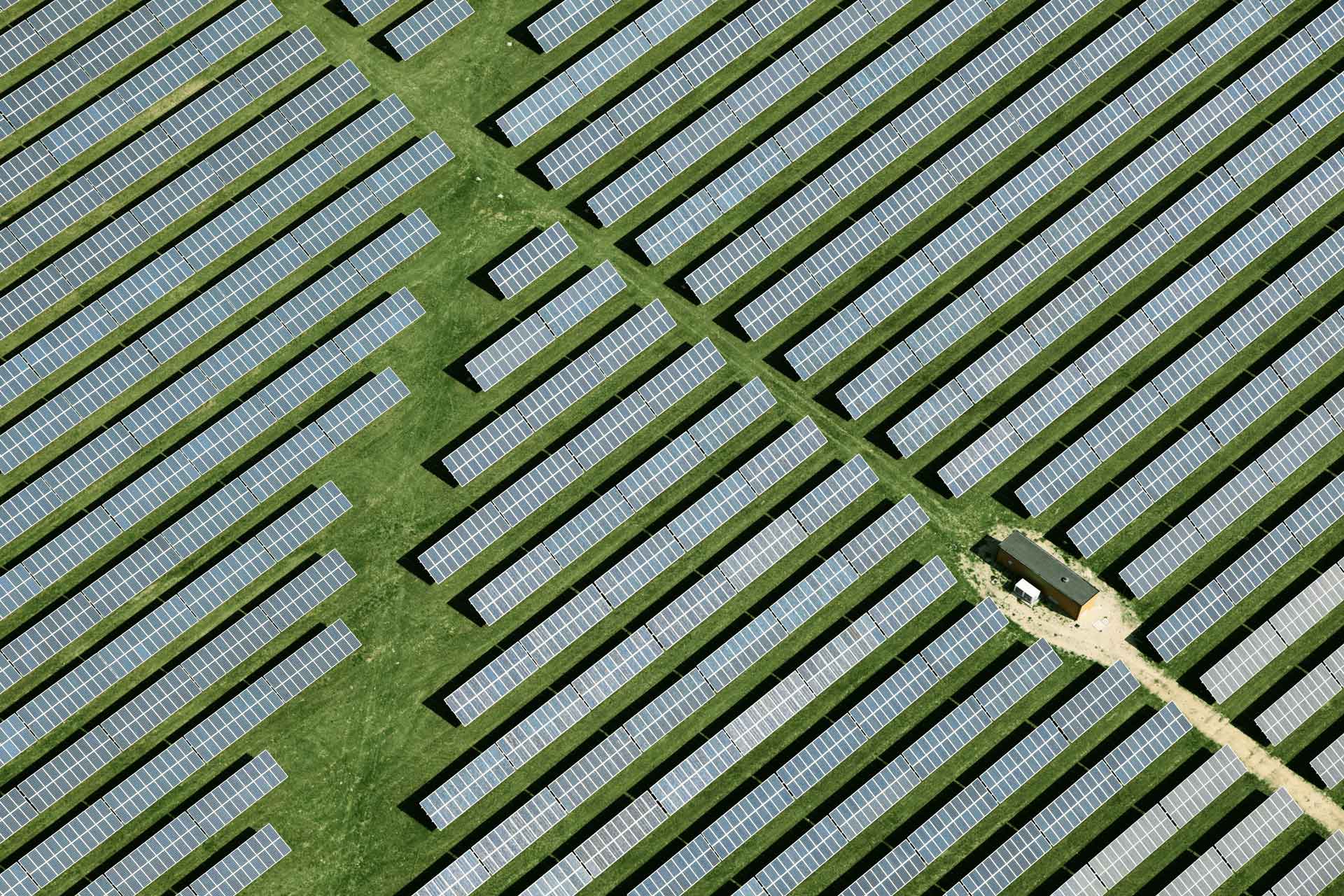

- R4bn Tronox deal funds two 100MW solar plants

- Billions to help Redefine build green properties

- Harmony pursues green goals with R10 billion loan

- Cold solutions finance for cold storage facilities

- International Finance Corporation green bond fund

- Envusa energy deal: The way for renewable energy

- Paladin Energy senior debt funding partnership

- Renewable energy wind farm financing

- Stor-Age’s successful inaugural bond auction

- PlusNet, Peninsula Packaging and Barrier Film Convertors co-investment opportunity | Nedbank CIB

- IFC Green Loan | Nedbank CIB

- AngloGold appoints Nedbank CIB as sole underwriter | Nedbank CIB

- Nedbank CIB Property Finance Team achievement | Nedbank CIB

- PwC Tower, Westlands — Where Kenya's corporate vision meets world-class execution

Women of Corporate Investment Banking

Young Analyst Programme

Articles

- Africa's pathway to a climate-resilient economy

- Commercial property trends 2022

- Green energy in the developing world | Nedbank CIB

- How sustainable finance creates value

- How the property sector recovered in 2023

- FURTHER IMPACT empowerment for entrepreneurs

- There's a new buoyancy around water and sanitation

- What happens when finance meets sustainability?

- Africa’s renewable-energy projects

- Breaking barriers for energy transition in mining

- Nedbank CIB wins big at 2025 IFC Awards

- South Africa leads clean energy transformation

Conferences

Benchmark Reform

Corporate Finance

Financing

Investing

Markets

Transacting

- Login & Register

- Online Banking

- Online Share Trading

- NedFleet

- Register for Nedbank ID

- About us

- Awards

- Deals

- Explore About us

- Awards

- Deals

- R4bn Tronox deal funds two 100MW solar plants

- Billions to help Redefine build green properties

- Harmony pursues green goals with R10 billion loan

- Cold solutions finance for cold storage facilities

- International Finance Corporation green bond fund

- Envusa energy deal: The way for renewable energy

- Paladin Energy senior debt funding partnership

- Renewable energy wind farm financing

- Stor-Age’s successful inaugural bond auction

- PlusNet, Peninsula Packaging and Barrier Film Convertors co-investment opportunity | Nedbank CIB

- IFC Green Loan | Nedbank CIB

- AngloGold appoints Nedbank CIB as sole underwriter | Nedbank CIB

- Nedbank CIB Property Finance Team achievement | Nedbank CIB

- PwC Tower, Westlands — Where Kenya's corporate vision meets world-class execution

- R4bn Tronox deal funds two 100MW solar plants

- Billions to help Redefine build green properties

- Harmony pursues green goals with R10 billion loan

- Cold solutions finance for cold storage facilities

- International Finance Corporation green bond fund

- Envusa energy deal: The way for renewable energy

- Paladin Energy senior debt funding partnership

- Renewable energy wind farm financing

- Stor-Age’s successful inaugural bond auction

- PlusNet, Peninsula Packaging and Barrier Film Convertors co-investment opportunity | Nedbank CIB

- IFC Green Loan | Nedbank CIB

- AngloGold appoints Nedbank CIB as sole underwriter | Nedbank CIB

- Nedbank CIB Property Finance Team achievement | Nedbank CIB

- PwC Tower, Westlands — Where Kenya's corporate vision meets world-class execution

- Women of Corporate Investment Banking

- Young Analyst Programme

- Articles

- Africa's pathway to a climate-resilient economy

- Commercial property trends 2022

- Green energy in the developing world | Nedbank CIB

- How sustainable finance creates value

- How the property sector recovered in 2023

- FURTHER IMPACT empowerment for entrepreneurs

- There's a new buoyancy around water and sanitation

- What happens when finance meets sustainability?

- Africa’s renewable-energy projects

- Breaking barriers for energy transition in mining

- Nedbank CIB wins big at 2025 IFC Awards

- South Africa leads clean energy transformation

- Africa's pathway to a climate-resilient economy

- Commercial property trends 2022

- Green energy in the developing world | Nedbank CIB

- How sustainable finance creates value

- How the property sector recovered in 2023

- FURTHER IMPACT empowerment for entrepreneurs

- There's a new buoyancy around water and sanitation

- What happens when finance meets sustainability?

- Africa’s renewable-energy projects

- Breaking barriers for energy transition in mining

- Nedbank CIB wins big at 2025 IFC Awards

- South Africa leads clean energy transformation

- Conferences

- Benchmark Reform

- Solutions

- Corporate Finance

- Financing

- Investing

- Markets

- Nedbank Business Hub

- Transacting

- Explore Solutions

- Corporate Finance

- Financing

- Investing

- Markets

- Nedbank Business Hub

- Business hub lead form

- Business hub lead form

- Transacting

- Sustainability

- Explore Sustainability

- Contact us

- Explore Contact us

Multiply Group and Nedbank Private Equity Successfully Exit Q Link

Multiply Group and Nedbank Private Equity Successfully Exit Q Link

Staff writer

2 mins

An incredibly fruitful investment period results in marked growth for a local payment services business.

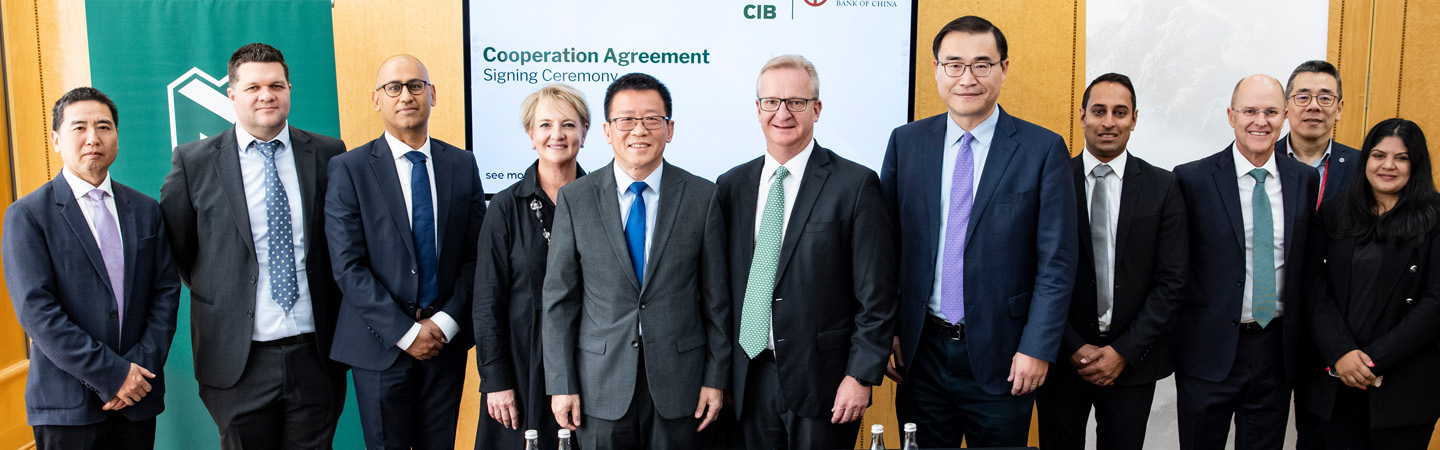

A consortium of private equity investors comprising Multiply Group, Nedbank Private Equity, Apis Partners and former Business Connexion CEO Isaac Mophatlane are pleased to announce the successful disposal of their interests in Q Link to a consortium led by Sanlam Private Equity.

Q Link is a leading independent financial service outsourcing business, providing payment application services software that manages deductions in both the payroll and bank collection streams and is a preferred provider of payment application software to the South African insurance industry and other third-party benefit providers.

“Our investment in Q Link which was alongside Multiply Group and Isaac Mophatlane facilitated a significant BEE investment into Q Link and has proved to be a successful partnership for our consortium and Q Link. Q Link is well positioned to continue its strong growth in the insurance premiums collection space.” said Yougan Moodley, Principal at Nedbank Private Equity.

Matthew Blewett of Multiply Group said “We have enjoyed a successful investment period with Q Link during which time the business has been able to develop and implement new digital collection and payment solutions. In addition, Q Link has expanded its offering to include the short-term insurance industry through its subsidiary QSure. Sanlam Private Equity is an excellent partner for Q Link as it continues its growth aspirations”.

“We are excited about the future prospects of Q Link. Q Link remains an essential service to the country and importantly, it is well positioned to foster greater financial inclusion of our citizens.” said Isaac Mophatlane.

South Africa’s burgeoning Fintech industry continues to be an exciting investment space for both private equity and strategic investors, locally and abroad. Businesses like Q Link are evidence of the enviable financial services and technology intellectual property that still resides in South Africa.

Related posts

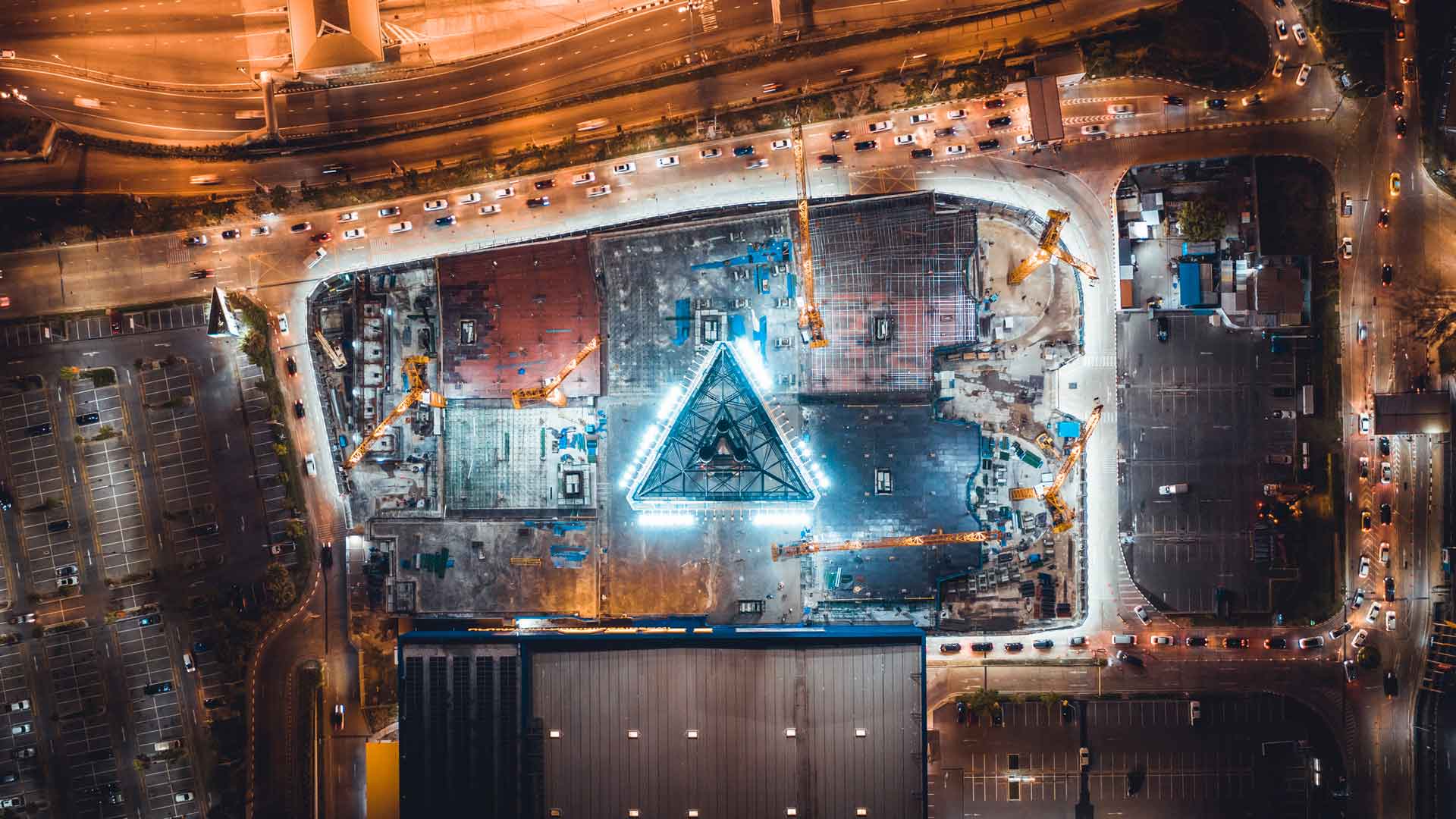

See allAfrica’s data centre boom: Driving digital growth

Africa’s digital transformation is no longer a distant prospect; it is happening now, with data centres playing a pivotal role in this revolution. As these centres drive innovation and economic growth across the continent, they are positioning Africa as a formidable player in the global digital landscape.

By Ilana van Schalkwyk, Sector Lead ICT at Nedbank CIB

Published 21 Oct 2024 in nedbank:cib/articles/innovation

Africa’s data centre boom: Driving digital growth

Africa’s digital transformation is no longer a distant prospect; it is happening now, with data centres playing a pivotal role in this revolution. As these centres drive innovation and economic growth across the continent, they are positioning Africa as a formidable player in the global digital landscape.

Ilana van Schalkwyk, Sector Lead ICT at Nedbank CIB

Published 21 Oct 2024

Accelerating and scaling Africa’s renewable-energy projects

In Africa more than 600 million people lack access to electricity. At the current pace of electrification millions of Africans are still expected to be without electricity in 2030 unless the pace of electrification is trebled, by connecting more than 90 million people a year. Beyond electrification, African countries should also focus on reducing gaps in access to electricity between urban and rural areas through expanding the electrical grid.

By Hlatse Nkune

Published 22 Aug 2024 in nedbank:cib/articles/energy

Accelerating and scaling Africa’s renewable-energy projects

In Africa more than 600 million people lack access to electricity. At the current pace of electrification millions of Africans are still expected to be without electricity in 2030 unless the pace of electrification is trebled, by connecting more than 90 million people a year. Beyond electrification, African countries should also focus on reducing gaps in access to electricity between urban and rural areas through expanding the electrical grid.

Hlatse Nkune

Published 22 Aug 2024

Nedbank CIB leads the way in sustainable finance in Africa

Nedbank's Corporate and Investment Banking (CIB) Division has been recognised for its excellence and innovation in sustainable finance by Global Finance, a respected and prestigious international finance magazine.

By Staff writer

Published 23 Jul 2024 in nedbank:cib/articles/sustainability

Nedbank CIB leads the way in sustainable finance in Africa

Nedbank's Corporate and Investment Banking (CIB) Division has been recognised for its excellence and innovation in sustainable finance by Global Finance, a respected and prestigious international finance magazine.

Staff writer

Published 23 Jul 2024

Earth Day: Investing in the green transition

Nedbank Corporate and Investment Banking (CIB) is leading the transition to a resilient future through its commitment to sustainable finance. By developing transformative solutions, we empower businesses to not only thrive in a shifting economic landscape but also lead in the effort to make it greener. Through bold innovation and strategic expertise, we are shaping a world where financial success and environmental responsibility are interconnected, creating lasting value for generations to come.

By Staff writer

Published 21 Apr 2025 in nedbank:cib/articles/sustainability

Earth Day: Investing in the green transition

Nedbank Corporate and Investment Banking (CIB) is leading the transition to a resilient future through its commitment to sustainable finance. By developing transformative solutions, we empower businesses to not only thrive in a shifting economic landscape but also lead in the effort to make it greener. Through bold innovation and strategic expertise, we are shaping a world where financial success and environmental responsibility are interconnected, creating lasting value for generations to come.

Staff writer

Published 21 Apr 2025

South Africa consumer spending expected to recover over the next 24 months

Nedbank CIB predict a recovery in South African consumer spending over the next 24 months, driven by lower interest rates, stronger currency and reforms.

By Reezwana Sumad, Shaun Chauke and Paul Steegers, Senior Equity Research Analysts at Nedbank CIB

Published 01 Aug 2024 in nedbank:cib/articles/investment

South Africa consumer spending expected to recover over the next 24 months

Nedbank CIB predict a recovery in South African consumer spending over the next 24 months, driven by lower interest rates, stronger currency and reforms.

Reezwana Sumad, Shaun Chauke and Paul Steegers, Senior Equity Research Analysts at Nedbank CIB

Published 01 Aug 2024

What happens when finance meets sustainability?

Find out at the 25th edition of the Africa Energy Forum (AEF), which will be held in Nairobi, Kenya, from 20 to 23 June 2023. During the event Nedbank CIB will collaborate with other energy sector experts, regulators, utilities, developers, and institutions to identify crucial opportunities that will drive the industry forward.

By Staff writer

Published 23 Jul 2024 in nedbank:cib/articles/sustainability

What happens when finance meets sustainability?

Find out at the 25th edition of the Africa Energy Forum (AEF), which will be held in Nairobi, Kenya, from 20 to 23 June 2023. During the event Nedbank CIB will collaborate with other energy sector experts, regulators, utilities, developers, and institutions to identify crucial opportunities that will drive the industry forward.

Staff writer

Published 23 Jul 2024

Empowering women for climate resilience

As the effects of climate change continue to reshape our world, the demand for inclusive solutions is more urgent than ever. Gender-inclusive finance can drive global climate resilience by empowering women and ensuring they are integral to climate action.

By Mbali Kubheka, Associate Principal: Sustainable Finance Solutions at Nedbank CIB

Published 10 Oct 2024 in nedbank:cib/articles/sustainability

Empowering women for climate resilience

As the effects of climate change continue to reshape our world, the demand for inclusive solutions is more urgent than ever. Gender-inclusive finance can drive global climate resilience by empowering women and ensuring they are integral to climate action.

Mbali Kubheka, Associate Principal: Sustainable Finance Solutions at Nedbank CIB

Published 10 Oct 2024

The growth of sustainable finance in South Africa

As part of an expert panel at the 2022 South African Real Estate Investment Trust Conference, Arvana Singh, Nedbank Head of Sustainable Finance Solutions, shared some thoughts on how sustainable finance in South Africa can help mitigate ESG-related risks.

By Staff writer

Published 30 May 2024 in nedbank:cib/articles/property

The growth of sustainable finance in South Africa

As part of an expert panel at the 2022 South African Real Estate Investment Trust Conference, Arvana Singh, Nedbank Head of Sustainable Finance Solutions, shared some thoughts on how sustainable finance in South Africa can help mitigate ESG-related risks.

Staff writer

Published 30 May 2024

Key factors in the recovery of the property sector in 2023

Gary Garrett, Managing Executive of Property Finance at Nedbank Corporate and Investment Banking, participated in an expert panel at the 2022 South African Real Estate Investment Trust Conference where he reflected on the response of the property sector to recent challenges.

By Staff writer

Published 30 May 2024 in nedbank:cib/articles/property

Key factors in the recovery of the property sector in 2023

Gary Garrett, Managing Executive of Property Finance at Nedbank Corporate and Investment Banking, participated in an expert panel at the 2022 South African Real Estate Investment Trust Conference where he reflected on the response of the property sector to recent challenges.

Staff writer

Published 30 May 2024

South Africa’s healthcare sector requires more investment for equity

There is a need for additional investment in South Africa’s fast-growing healthcare sector to cater for the increasing needs of the country, including addressing the national hospital bed shortfall, says Anél Bosman, Group Managing Executive of Nedbank Corporate and Investment Banking.

By Staff writer

Published 08 Jul 2025 in nedbank:cib/articles/investment

South Africa’s healthcare sector requires more investment for equity

There is a need for additional investment in South Africa’s fast-growing healthcare sector to cater for the increasing needs of the country, including addressing the national hospital bed shortfall, says Anél Bosman, Group Managing Executive of Nedbank Corporate and Investment Banking.

Staff writer

Published 08 Jul 2025

Nedbank CIB Corporate Finance Team scoops 2 Ansarada DealMakers awards

The Ansarada DealMakers Awards is a highly respected annual event that recognises the most impactful transactions in the South African corporate finance industry.

By Staff writer

Published 30 May 2024 in nedbank:cib/articles/corporate-finance

NCIB Property Finance makes history funding the first real estate investment trust in Ghana

The REIT paves the way for a more diversified real estate market in Ghana, giving retail and institutional investors more investment options.

By Staff writer

Published 30 May 2024 in nedbank:cib/articles/property

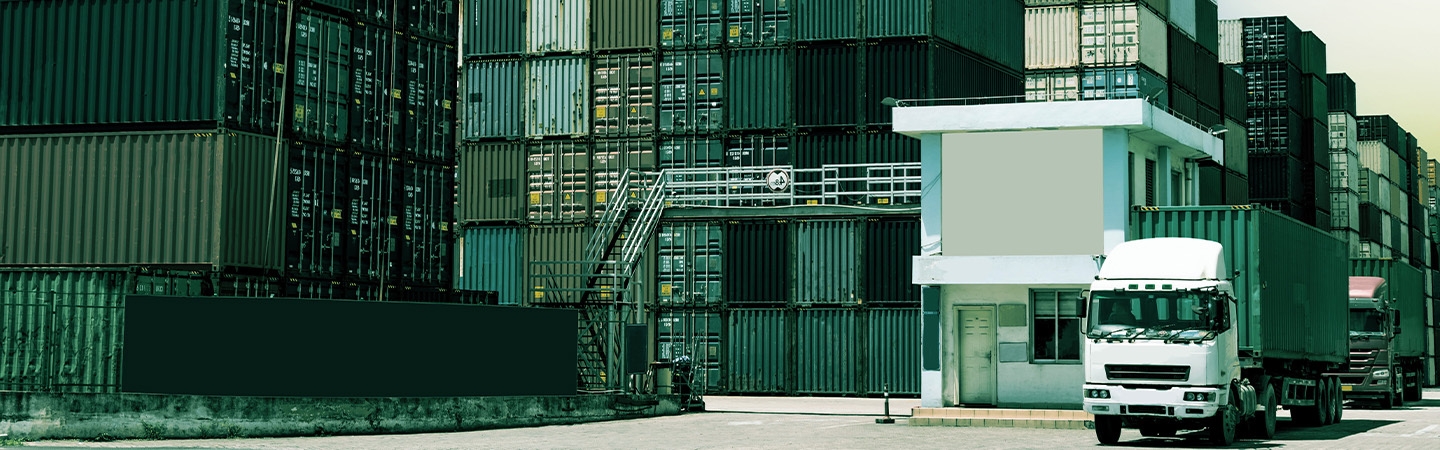

Empowering trade. Enabling growth.

At Nedbank Corporate and Investment Banking, we see the unexpected connections that power sustainable growth. Our trade and supply chain finance solutions are designed to unlock working capital, streamline trade flows, and empower businesses across Africa to thrive in an increasingly interconnected global economy.

By Staff writer

Published 24 Jun 2025 in nedbank:cib/articles/finance

Empowering trade. Enabling growth.

At Nedbank Corporate and Investment Banking, we see the unexpected connections that power sustainable growth. Our trade and supply chain finance solutions are designed to unlock working capital, streamline trade flows, and empower businesses across Africa to thrive in an increasingly interconnected global economy.

Staff writer

Published 24 Jun 2025

Sustainability in Africa’s hospitality property sector

Nedbank Corporate and Investment Banking (NCIB) has taken another significant step in advancing sustainable property finance across Africa with the successful conclusion of a €19.4 million sustainability-linked development and term loan for Kasada in Senegal. This unique transaction in hospitality property finance will drive measurable environmental and social impact in the local community.

By Staff writer

Published 04 Jun 2025 in nedbank:cib/articles/property

Sustainability in Africa’s hospitality property sector

Nedbank Corporate and Investment Banking (NCIB) has taken another significant step in advancing sustainable property finance across Africa with the successful conclusion of a €19.4 million sustainability-linked development and term loan for Kasada in Senegal. This unique transaction in hospitality property finance will drive measurable environmental and social impact in the local community.

Staff writer

Published 04 Jun 2025

Why there's a new buoyancy around water and sanitation

The national project pipeline has been cleared, and a multifaceted strategy is being implemented to address municipal dysfunction.

By Thiago Almeida, Divisional Executive at Nedbank Corporate Investment Banking

Published 22 Aug 2024 in nedbank:cib/articles/water

Embedded generation: The next vital developments to an energy-secure South Africa

Improved legislation, aggressive financing terms from funders and assistance from developed countries to aid South Africa in alleviating energy crisis.

By Amith Singh; Head of Energy Finance: NCIB

Published 30 May 2024 in nedbank:cib/articles/investment

Embedded generation: The next vital developments to an energy-secure South Africa

Improved legislation, aggressive financing terms from funders and assistance from developed countries to aid South Africa in alleviating energy crisis.

Amith Singh; Head of Energy Finance: NCIB

Published 30 May 2024

Transforming trade finance in West Africa

Discover how collaboration between banks, development finance institutions, and insurers is transforming trade finance in West Africa.

By Craig Weitz, Principal of Africa Infrastructure Finance, and Alicia Ellman, Senior Sales Associate for Nedbank Corporate and Investment Banking (CIB)

Published 23 Jul 2024 in nedbank:cib/articles/finance

Transforming trade finance in West Africa

Discover how collaboration between banks, development finance institutions, and insurers is transforming trade finance in West Africa.

Craig Weitz, Principal of Africa Infrastructure Finance, and Alicia Ellman, Senior Sales Associate for Nedbank Corporate and Investment Banking (CIB)

Published 23 Jul 2024

NCIB and DP World: Boosting Trade Finance in Africa

Nedbank Corporate and Investment Banking (CIB) is proud to announce a significant strategic partnership with DP World Trade Finance to address the significant working capital challenges of businesses in sub-Saharan Africa (SSA).

By Staff writer

Published 11 Oct 2024 in nedbank:cib/articles/finance

NCIB and DP World: Boosting Trade Finance in Africa

Nedbank Corporate and Investment Banking (CIB) is proud to announce a significant strategic partnership with DP World Trade Finance to address the significant working capital challenges of businesses in sub-Saharan Africa (SSA).

Staff writer

Published 11 Oct 2024

Nedbank CIB honoured for leadership in sustainable finance

Our ESG-backed approach to lending and financing was recognised at the 2022 Global Finance Sustainable Finance Awards, where we ranked in the top 6% of banks globally and received awards for Outstanding Leadership in Green Bonds and Outstanding Leadership in Transition/Sustainability-linked Bonds.

By Staff writer

Published 11 Jul 2025 in nedbank:cib/deals/esg

Nedbank CIB honoured for leadership in sustainable finance

Our ESG-backed approach to lending and financing was recognised at the 2022 Global Finance Sustainable Finance Awards, where we ranked in the top 6% of banks globally and received awards for Outstanding Leadership in Green Bonds and Outstanding Leadership in Transition/Sustainability-linked Bonds.

Staff writer

Published 11 Jul 2025