Select Country

Don’t have your Nedbank ID yet?

Nedbank ID single sign-on gives you full digital access to Nedbank’s banking and lifestyle products and services on the Money app or Online Banking.

Log in

Log in to Online Banking or another one of our secured services.

Awards

Deals

- R4bn Tronox deal funds two 100MW solar plants

- Billions to help Redefine build green properties

- Harmony pursues green goals with R10 billion loan

- Cold solutions finance for cold storage facilities

- International Finance Corporation green bond fund

- Envusa energy deal: The way for renewable energy

- Paladin Energy senior debt funding partnership

- Renewable energy wind farm financing

- Stor-Age’s successful inaugural bond auction

- PlusNet, Peninsula Packaging and Barrier Film Convertors co-investment opportunity | Nedbank CIB

- IFC Green Loan | Nedbank CIB

- AngloGold appoints Nedbank CIB as sole underwriter | Nedbank CIB

- Nedbank CIB Property Finance Team achievement | Nedbank CIB

- PwC Tower, Westlands — Where Kenya's corporate vision meets world-class execution

Women of Corporate Investment Banking

Young Analyst Programme

Articles

- Africa's pathway to a climate-resilient economy

- Commercial property trends 2022

- Green energy in the developing world | Nedbank CIB

- How sustainable finance creates value

- How the property sector recovered in 2023

- FURTHER IMPACT empowerment for entrepreneurs

- There's a new buoyancy around water and sanitation

- What happens when finance meets sustainability?

- Africa’s renewable-energy projects

- Breaking barriers for energy transition in mining

- Nedbank CIB wins big at 2025 IFC Awards

- South Africa leads clean energy transformation

Conferences

Benchmark Reform

Corporate Finance

Financing

Investing

Markets

Transacting

- Login & Register

- Online Banking

- Online Share Trading

- NedFleet

- Register for Nedbank ID

- About us

- Awards

- Deals

- Explore About us

- Awards

- Deals

- R4bn Tronox deal funds two 100MW solar plants

- Billions to help Redefine build green properties

- Harmony pursues green goals with R10 billion loan

- Cold solutions finance for cold storage facilities

- International Finance Corporation green bond fund

- Envusa energy deal: The way for renewable energy

- Paladin Energy senior debt funding partnership

- Renewable energy wind farm financing

- Stor-Age’s successful inaugural bond auction

- PlusNet, Peninsula Packaging and Barrier Film Convertors co-investment opportunity | Nedbank CIB

- IFC Green Loan | Nedbank CIB

- AngloGold appoints Nedbank CIB as sole underwriter | Nedbank CIB

- Nedbank CIB Property Finance Team achievement | Nedbank CIB

- PwC Tower, Westlands — Where Kenya's corporate vision meets world-class execution

- R4bn Tronox deal funds two 100MW solar plants

- Billions to help Redefine build green properties

- Harmony pursues green goals with R10 billion loan

- Cold solutions finance for cold storage facilities

- International Finance Corporation green bond fund

- Envusa energy deal: The way for renewable energy

- Paladin Energy senior debt funding partnership

- Renewable energy wind farm financing

- Stor-Age’s successful inaugural bond auction

- PlusNet, Peninsula Packaging and Barrier Film Convertors co-investment opportunity | Nedbank CIB

- IFC Green Loan | Nedbank CIB

- AngloGold appoints Nedbank CIB as sole underwriter | Nedbank CIB

- Nedbank CIB Property Finance Team achievement | Nedbank CIB

- PwC Tower, Westlands — Where Kenya's corporate vision meets world-class execution

- Women of Corporate Investment Banking

- Young Analyst Programme

- Articles

- Africa's pathway to a climate-resilient economy

- Commercial property trends 2022

- Green energy in the developing world | Nedbank CIB

- How sustainable finance creates value

- How the property sector recovered in 2023

- FURTHER IMPACT empowerment for entrepreneurs

- There's a new buoyancy around water and sanitation

- What happens when finance meets sustainability?

- Africa’s renewable-energy projects

- Breaking barriers for energy transition in mining

- Nedbank CIB wins big at 2025 IFC Awards

- South Africa leads clean energy transformation

- Africa's pathway to a climate-resilient economy

- Commercial property trends 2022

- Green energy in the developing world | Nedbank CIB

- How sustainable finance creates value

- How the property sector recovered in 2023

- FURTHER IMPACT empowerment for entrepreneurs

- There's a new buoyancy around water and sanitation

- What happens when finance meets sustainability?

- Africa’s renewable-energy projects

- Breaking barriers for energy transition in mining

- Nedbank CIB wins big at 2025 IFC Awards

- South Africa leads clean energy transformation

- Conferences

- Benchmark Reform

- Solutions

- Corporate Finance

- Financing

- Investing

- Markets

- Nedbank Business Hub

- Transacting

- Explore Solutions

- Corporate Finance

- Financing

- Investing

- Markets

- Nedbank Business Hub

- Business hub lead form

- Business hub lead form

- Transacting

- Sustainability

- Explore Sustainability

- Contact us

- Explore Contact us

€450m infrastructure deal drives African trade.

€450m infrastructure deal drives African trade.

Staff writer

2 mins

To keep shipping lanes flowing east, upgrade roads going west.

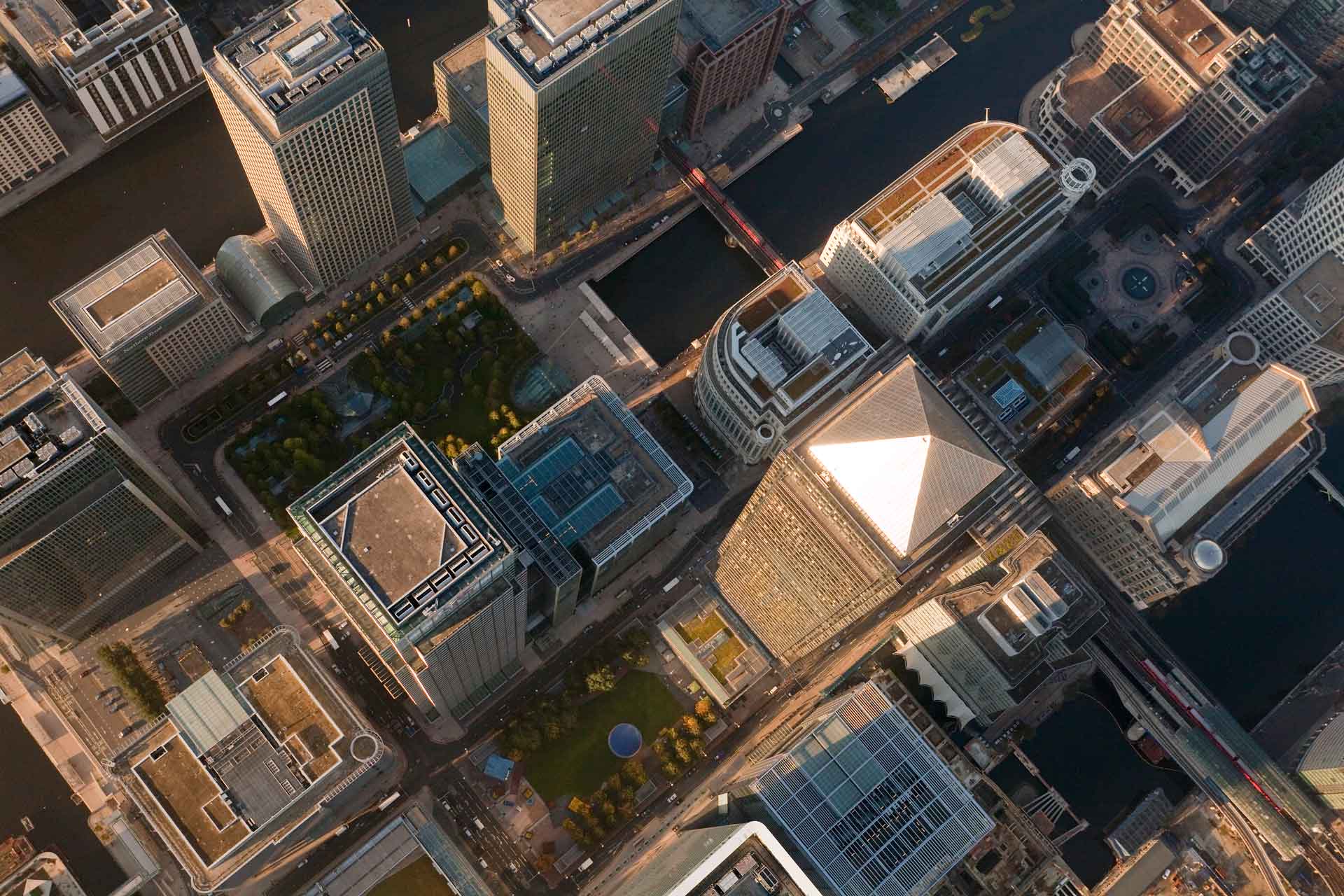

Nedbank Corporate and Investment Banking (CIB) is proud to have participated as lead arranger, in partnership with Deutsche Bank, in closing a €450 million, 7-year lending facility for Tanzania’s Ministry of Finance to finance approximately 50 infrastructure projects set out in its 2022/2023 budget.

Our continued support of infrastructure development in sub-Saharan Africa speaks to our underlying investment philosophy, which holds that infrastructure is the pathway to a thriving economy that provides a foundation for economic growth, inclusive social cohesion and climate resilience. In this regard, the facility for Tanzania will support the construction and rehabilitation of roads, the construction of new hospitals, the rehabilitation and expansion of educational facilities, and will also support potable water and electricity projects across various regions in the country.

Assisting our esteemed clients with tailored financial solutions

The transaction further speaks to Nedbank CIB’s deepening commitment to trade finance across Africa. As African countries, like Tanzania, create a safer, more efficient passage of goods across supply chains – from production centre to ports and beyond, to their ultimate destinations across oceans in export markets – demand for customised trade financing solutions is created. In this arena, Nedbank CIB has developed expertise across the trade finance ecosystem to assist our esteemed clients with tailored financial solutions that take the unique conditions of their sector and country into account.

The transaction sets an example of what can be achieved by creating effective partnerships that are backed by our extensive banking network across Africa for generating far-reaching impact across the continent.

When you see unexpected connections, you see sustainable growth.

Related posts

See allThe growth of sustainable finance in South Africa

As part of an expert panel at the 2022 South African Real Estate Investment Trust Conference, Arvana Singh, Nedbank Head of Sustainable Finance Solutions, shared some thoughts on how sustainable finance in South Africa can help mitigate ESG-related risks.

By Staff writer

Published 30 May 2024 in nedbank:cib/articles/property

The growth of sustainable finance in South Africa

As part of an expert panel at the 2022 South African Real Estate Investment Trust Conference, Arvana Singh, Nedbank Head of Sustainable Finance Solutions, shared some thoughts on how sustainable finance in South Africa can help mitigate ESG-related risks.

Staff writer

Published 30 May 2024

Embedded generation: The next vital developments to an energy-secure South Africa

Improved legislation, aggressive financing terms from funders and assistance from developed countries to aid South Africa in alleviating energy crisis.

By Amith Singh; Head of Energy Finance: NCIB

Published 30 May 2024 in nedbank:cib/articles/investment

Embedded generation: The next vital developments to an energy-secure South Africa

Improved legislation, aggressive financing terms from funders and assistance from developed countries to aid South Africa in alleviating energy crisis.

Amith Singh; Head of Energy Finance: NCIB

Published 30 May 2024

What happens when finance meets sustainability?

Find out at the 25th edition of the Africa Energy Forum (AEF), which will be held in Nairobi, Kenya, from 20 to 23 June 2023. During the event Nedbank CIB will collaborate with other energy sector experts, regulators, utilities, developers, and institutions to identify crucial opportunities that will drive the industry forward.

By Staff writer

Published 23 Jul 2024 in nedbank:cib/articles/sustainability

What happens when finance meets sustainability?

Find out at the 25th edition of the Africa Energy Forum (AEF), which will be held in Nairobi, Kenya, from 20 to 23 June 2023. During the event Nedbank CIB will collaborate with other energy sector experts, regulators, utilities, developers, and institutions to identify crucial opportunities that will drive the industry forward.

Staff writer

Published 23 Jul 2024

Nedbank CIB leads the way in sustainable finance in Africa

Nedbank's Corporate and Investment Banking (CIB) Division has been recognised for its excellence and innovation in sustainable finance by Global Finance, a respected and prestigious international finance magazine.

By Staff writer

Published 23 Jul 2024 in nedbank:cib/articles/sustainability

Nedbank CIB leads the way in sustainable finance in Africa

Nedbank's Corporate and Investment Banking (CIB) Division has been recognised for its excellence and innovation in sustainable finance by Global Finance, a respected and prestigious international finance magazine.

Staff writer

Published 23 Jul 2024

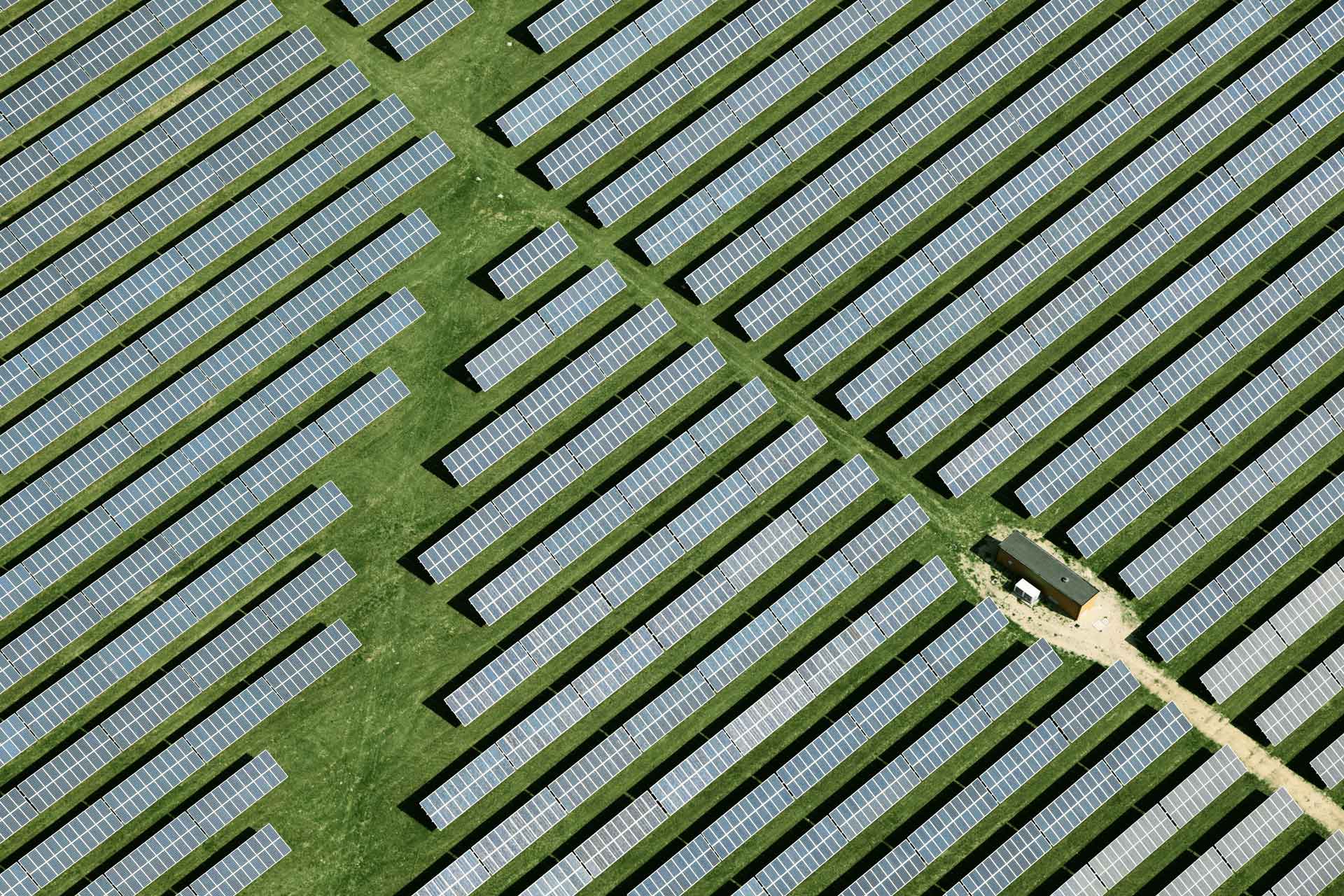

Accelerating and scaling Africa’s renewable-energy projects

In Africa more than 600 million people lack access to electricity. At the current pace of electrification millions of Africans are still expected to be without electricity in 2030 unless the pace of electrification is trebled, by connecting more than 90 million people a year. Beyond electrification, African countries should also focus on reducing gaps in access to electricity between urban and rural areas through expanding the electrical grid.

By Hlatse Nkune

Published 22 Aug 2024 in nedbank:cib/articles/energy

Accelerating and scaling Africa’s renewable-energy projects

In Africa more than 600 million people lack access to electricity. At the current pace of electrification millions of Africans are still expected to be without electricity in 2030 unless the pace of electrification is trebled, by connecting more than 90 million people a year. Beyond electrification, African countries should also focus on reducing gaps in access to electricity between urban and rural areas through expanding the electrical grid.

Hlatse Nkune

Published 22 Aug 2024

Empowering women for climate resilience

As the effects of climate change continue to reshape our world, the demand for inclusive solutions is more urgent than ever. Gender-inclusive finance can drive global climate resilience by empowering women and ensuring they are integral to climate action.

By Mbali Kubheka, Associate Principal: Sustainable Finance Solutions at Nedbank CIB

Published 10 Oct 2024 in nedbank:cib/articles/sustainability

Empowering women for climate resilience

As the effects of climate change continue to reshape our world, the demand for inclusive solutions is more urgent than ever. Gender-inclusive finance can drive global climate resilience by empowering women and ensuring they are integral to climate action.

Mbali Kubheka, Associate Principal: Sustainable Finance Solutions at Nedbank CIB

Published 10 Oct 2024

Earth Day: Investing in the green transition

Nedbank Corporate and Investment Banking (CIB) is leading the transition to a resilient future through its commitment to sustainable finance. By developing transformative solutions, we empower businesses to not only thrive in a shifting economic landscape but also lead in the effort to make it greener. Through bold innovation and strategic expertise, we are shaping a world where financial success and environmental responsibility are interconnected, creating lasting value for generations to come.

By Staff writer

Published 21 Apr 2025 in nedbank:cib/articles/sustainability

Earth Day: Investing in the green transition

Nedbank Corporate and Investment Banking (CIB) is leading the transition to a resilient future through its commitment to sustainable finance. By developing transformative solutions, we empower businesses to not only thrive in a shifting economic landscape but also lead in the effort to make it greener. Through bold innovation and strategic expertise, we are shaping a world where financial success and environmental responsibility are interconnected, creating lasting value for generations to come.

Staff writer

Published 21 Apr 2025

Sustainability in Africa’s hospitality property sector

Nedbank Corporate and Investment Banking (NCIB) has taken another significant step in advancing sustainable property finance across Africa with the successful conclusion of a €19.4 million sustainability-linked development and term loan for Kasada in Senegal. This unique transaction in hospitality property finance will drive measurable environmental and social impact in the local community.

By Staff writer

Published 04 Jun 2025 in nedbank:cib/articles/property

Sustainability in Africa’s hospitality property sector

Nedbank Corporate and Investment Banking (NCIB) has taken another significant step in advancing sustainable property finance across Africa with the successful conclusion of a €19.4 million sustainability-linked development and term loan for Kasada in Senegal. This unique transaction in hospitality property finance will drive measurable environmental and social impact in the local community.

Staff writer

Published 04 Jun 2025

Nedbank CIB honoured for leadership in sustainable finance

Our ESG-backed approach to lending and financing was recognised at the 2022 Global Finance Sustainable Finance Awards, where we ranked in the top 6% of banks globally and received awards for Outstanding Leadership in Green Bonds and Outstanding Leadership in Transition/Sustainability-linked Bonds.

By Staff writer

Published 11 Jul 2025 in nedbank:cib/deals/esg

Nedbank CIB honoured for leadership in sustainable finance

Our ESG-backed approach to lending and financing was recognised at the 2022 Global Finance Sustainable Finance Awards, where we ranked in the top 6% of banks globally and received awards for Outstanding Leadership in Green Bonds and Outstanding Leadership in Transition/Sustainability-linked Bonds.

Staff writer

Published 11 Jul 2025