Select Country

Don’t have your Nedbank ID yet?

Nedbank ID single sign-on gives you full digital access to Nedbank’s banking and lifestyle products and services on the Money app or Online Banking.

Log in

Log in to Online Banking or another one of our secured services.

Awards

Deals

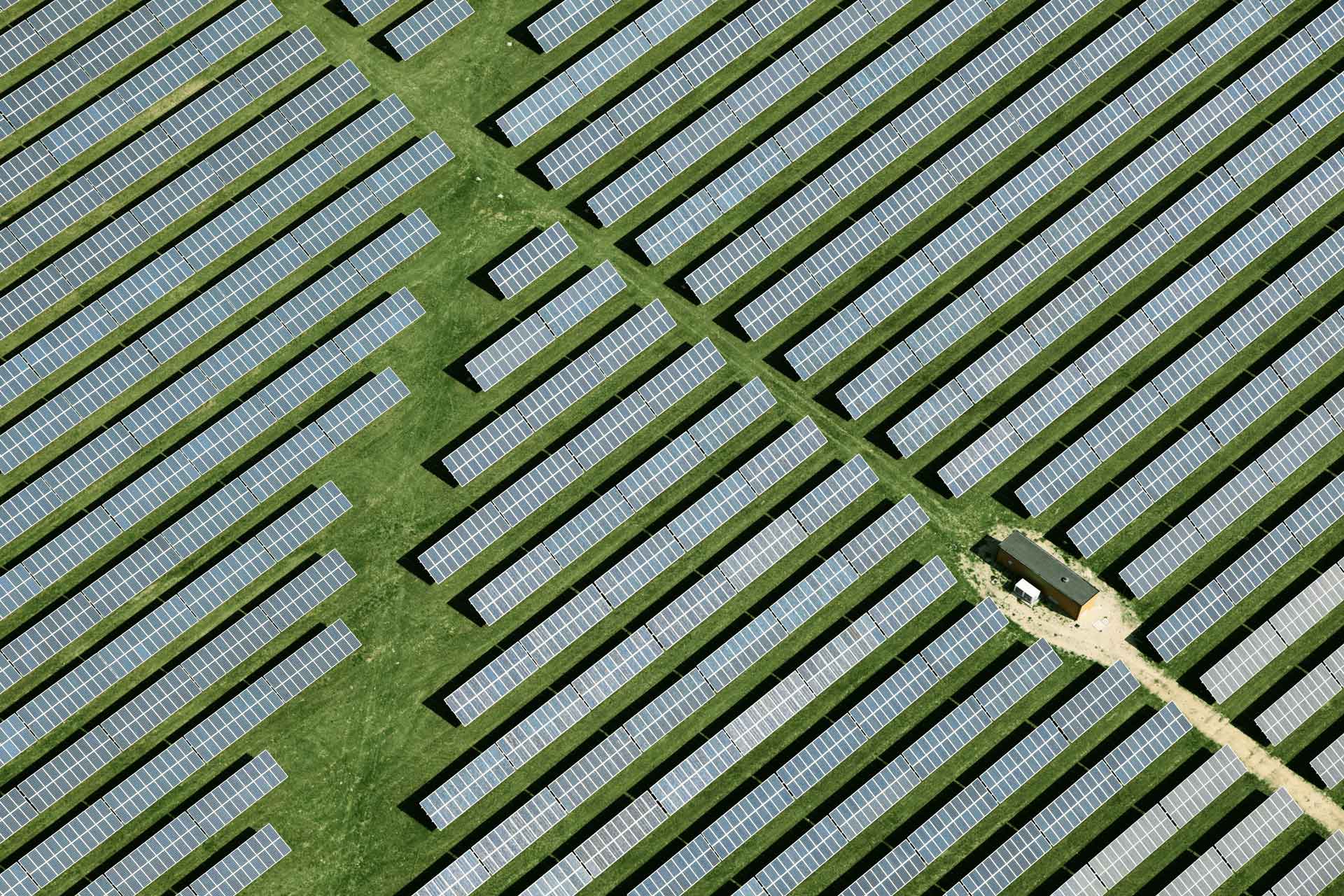

- R4bn Tronox deal funds two 100MW solar plants

- Billions to help Redefine build green properties

- Harmony pursues green goals with R10 billion loan

- Cold solutions finance for cold storage facilities

- International Finance Corporation green bond fund

- Envusa energy deal: The way for renewable energy

- Paladin Energy senior debt funding partnership

- Renewable energy wind farm financing

- Stor-Age’s successful inaugural bond auction

- PlusNet, Peninsula Packaging and Barrier Film Convertors co-investment opportunity | Nedbank CIB

- IFC Green Loan | Nedbank CIB

- AngloGold appoints Nedbank CIB as sole underwriter | Nedbank CIB

- Nedbank CIB Property Finance Team achievement | Nedbank CIB

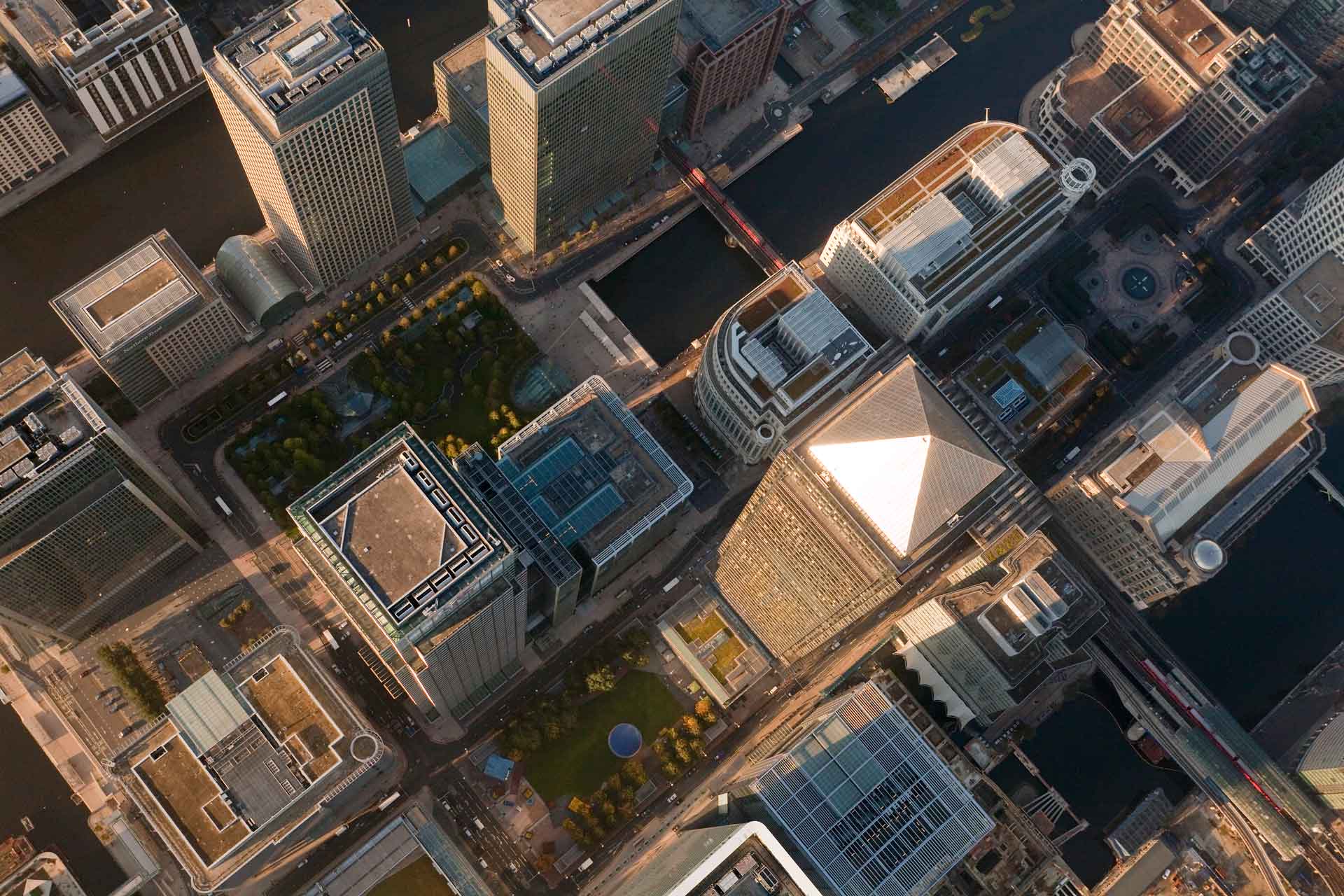

- PwC Tower, Westlands — Where Kenya's corporate vision meets world-class execution

Women of Corporate Investment Banking

Young Analyst Programme

Articles

- Africa's pathway to a climate-resilient economy

- Commercial property trends 2022

- Green energy in the developing world | Nedbank CIB

- How sustainable finance creates value

- How the property sector recovered in 2023

- FURTHER IMPACT empowerment for entrepreneurs

- There's a new buoyancy around water and sanitation

- What happens when finance meets sustainability?

- Africa’s renewable-energy projects

- Breaking barriers for energy transition in mining

- Nedbank CIB wins big at 2025 IFC Awards

- South Africa leads clean energy transformation

Conferences

Benchmark Reform

Corporate Finance

Financing

Investing

Markets

Transacting

- Login & Register

- Online Banking

- Online Share Trading

- NedFleet

- Register for Nedbank ID

- About us

- Awards

- Deals

- Explore About us

- Awards

- Deals

- R4bn Tronox deal funds two 100MW solar plants

- Billions to help Redefine build green properties

- Harmony pursues green goals with R10 billion loan

- Cold solutions finance for cold storage facilities

- International Finance Corporation green bond fund

- Envusa energy deal: The way for renewable energy

- Paladin Energy senior debt funding partnership

- Renewable energy wind farm financing

- Stor-Age’s successful inaugural bond auction

- PlusNet, Peninsula Packaging and Barrier Film Convertors co-investment opportunity | Nedbank CIB

- IFC Green Loan | Nedbank CIB

- AngloGold appoints Nedbank CIB as sole underwriter | Nedbank CIB

- Nedbank CIB Property Finance Team achievement | Nedbank CIB

- PwC Tower, Westlands — Where Kenya's corporate vision meets world-class execution

- R4bn Tronox deal funds two 100MW solar plants

- Billions to help Redefine build green properties

- Harmony pursues green goals with R10 billion loan

- Cold solutions finance for cold storage facilities

- International Finance Corporation green bond fund

- Envusa energy deal: The way for renewable energy

- Paladin Energy senior debt funding partnership

- Renewable energy wind farm financing

- Stor-Age’s successful inaugural bond auction

- PlusNet, Peninsula Packaging and Barrier Film Convertors co-investment opportunity | Nedbank CIB

- IFC Green Loan | Nedbank CIB

- AngloGold appoints Nedbank CIB as sole underwriter | Nedbank CIB

- Nedbank CIB Property Finance Team achievement | Nedbank CIB

- PwC Tower, Westlands — Where Kenya's corporate vision meets world-class execution

- Women of Corporate Investment Banking

- Young Analyst Programme

- Articles

- Africa's pathway to a climate-resilient economy

- Commercial property trends 2022

- Green energy in the developing world | Nedbank CIB

- How sustainable finance creates value

- How the property sector recovered in 2023

- FURTHER IMPACT empowerment for entrepreneurs

- There's a new buoyancy around water and sanitation

- What happens when finance meets sustainability?

- Africa’s renewable-energy projects

- Breaking barriers for energy transition in mining

- Nedbank CIB wins big at 2025 IFC Awards

- South Africa leads clean energy transformation

- Africa's pathway to a climate-resilient economy

- Commercial property trends 2022

- Green energy in the developing world | Nedbank CIB

- How sustainable finance creates value

- How the property sector recovered in 2023

- FURTHER IMPACT empowerment for entrepreneurs

- There's a new buoyancy around water and sanitation

- What happens when finance meets sustainability?

- Africa’s renewable-energy projects

- Breaking barriers for energy transition in mining

- Nedbank CIB wins big at 2025 IFC Awards

- South Africa leads clean energy transformation

- Conferences

- Benchmark Reform

- Solutions

- Corporate Finance

- Financing

- Investing

- Markets

- Nedbank Business Hub

- Transacting

- Explore Solutions

- Corporate Finance

- Financing

- Investing

- Markets

- Nedbank Business Hub

- Business hub lead form

- Business hub lead form

- Transacting

- Sustainability

- Explore Sustainability

- Contact us

- Explore Contact us

Local tech revolutionises rescues across the globe.

Local tech revolutionises rescues across the globe.

Staff writer

2 mins

Saving more lives in the United States starts in South Africa.

One of Nedbank Corporate and Investment Banking’s venture capital success stories, making an incredible impact internationally, is the result of a partnership between Nedbank and the South African emergency response platform, RapidDeploy.

Nedbank was the 1st South African company to invest in RapidDeploy, which was established in Cape Town, and has since revolutionised rescue operations as far afield as the United States.

RapidDeploy is the industry’s only truly open and integrated response platform, transforming 911 communications centres of any size into data-centric organisations. RapidDeploy achieves new levels of situational awareness and reduces 911 response times by seamlessly integrating 3rd-party data, ensuring that it is available when, where and how telecommunicators and 1st responders need it. The company’s cloud-native platform includes analytics and mapping applications.

The tech start-up was formed by Steven Raucher and Brett Meyerowitz after they had encountered antiquated, legacy technology that was available within South Africa’s public safety sector. Raucher experienced a personal tragedy when his brother drowned at sea and, to honour him, volunteered for the National Sea Rescue Institute (NSRI) of South Africa. This is where he came to realise that the emergency tools available could not achieve what was needed to respond to people and ultimately save lives urgently and efficiently. Meyerowitz came to the same conclusion as a volunteer paramedic around the same time, and RapidDeploy was born with the primary purpose of saving lives through reduced response times.

Johann van Zyl, Head of Principal and Alternative Investment at Nedbank Corporate and Investment Banking explains that the bank’s decision to invest in RapidDeploy was based on the strong alignment of the company’s innovation-led business model with Nedbank’s policy of investing in world-leading businesses and technologies that can deliver sustainable positive impact. 'The fact that RapidDeploy technology is saving lives in the true sense, means that this venture capital technology investment gives good effect to our purpose of applying our financial expertise to do good.'

RapidDeploy and numerous local emergency communications centres bring modern technology to public safety

Since moving its headquarters to Austin, Texas in the United States, RapidDeploy has partnered with 9 states and numerous local emergency communications centres to bring modern technology to public safety across the country. Rescue stories are regularly received from clients, in which they share the impact of the technology. In 1 Kansas example, a rescue took place where a caller had experienced a stroke and couldn’t talk. Another, in Navajo County, Arizona told of a kidnapping victim being rescued. In Sarasota County, Florida a caller explained how they’d been located during a hurricane. These are among thousands of other successful international rescues, enabled by RapidDeploy’s technology.

It’s a testament to Nedbank Corporate and Investment Banking’s ability to identify opportunities to grow businesses while growing the system that it is inextricably part of, which makes ecosystem thinking such a valuable tool. It’s this approach that blends expertise with cross-sector experience to see the connections that other investors might miss, which creates sustainable growth that ripples out into the world beyond. And it is what informs Nedbank’s venture capital mandate to invest in, and partner with, disruptive category-defining technology companies like RapidDeploy.

While headquartered in the United States, RapidDeploy remains true to its roots, with part of its engineering and product team based in South Africa. Although the company is currently focused on public safety in the United States, receiving additional investment from global firms opens possibilities to expand their operations. In so doing, they aim to complete their mission of starting from humble beginnings in South Africa to implementing tech that saves lives and transforms communities across the globe.

When you see unexpected connections, you see sustainable growth.

Related posts

See allThe growth of sustainable finance in South Africa

As part of an expert panel at the 2022 South African Real Estate Investment Trust Conference, Arvana Singh, Nedbank Head of Sustainable Finance Solutions, shared some thoughts on how sustainable finance in South Africa can help mitigate ESG-related risks.

By Staff writer

Published 30 May 2024 in nedbank:cib/articles/property

The growth of sustainable finance in South Africa

As part of an expert panel at the 2022 South African Real Estate Investment Trust Conference, Arvana Singh, Nedbank Head of Sustainable Finance Solutions, shared some thoughts on how sustainable finance in South Africa can help mitigate ESG-related risks.

Staff writer

Published 30 May 2024

Embedded generation: The next vital developments to an energy-secure South Africa

Improved legislation, aggressive financing terms from funders and assistance from developed countries to aid South Africa in alleviating energy crisis.

By Amith Singh; Head of Energy Finance: NCIB

Published 30 May 2024 in nedbank:cib/articles/investment

Embedded generation: The next vital developments to an energy-secure South Africa

Improved legislation, aggressive financing terms from funders and assistance from developed countries to aid South Africa in alleviating energy crisis.

Amith Singh; Head of Energy Finance: NCIB

Published 30 May 2024

What happens when finance meets sustainability?

Find out at the 25th edition of the Africa Energy Forum (AEF), which will be held in Nairobi, Kenya, from 20 to 23 June 2023. During the event Nedbank CIB will collaborate with other energy sector experts, regulators, utilities, developers, and institutions to identify crucial opportunities that will drive the industry forward.

By Staff writer

Published 23 Jul 2024 in nedbank:cib/articles/sustainability

What happens when finance meets sustainability?

Find out at the 25th edition of the Africa Energy Forum (AEF), which will be held in Nairobi, Kenya, from 20 to 23 June 2023. During the event Nedbank CIB will collaborate with other energy sector experts, regulators, utilities, developers, and institutions to identify crucial opportunities that will drive the industry forward.

Staff writer

Published 23 Jul 2024

Nedbank CIB leads the way in sustainable finance in Africa

Nedbank's Corporate and Investment Banking (CIB) Division has been recognised for its excellence and innovation in sustainable finance by Global Finance, a respected and prestigious international finance magazine.

By Staff writer

Published 23 Jul 2024 in nedbank:cib/articles/sustainability

Nedbank CIB leads the way in sustainable finance in Africa

Nedbank's Corporate and Investment Banking (CIB) Division has been recognised for its excellence and innovation in sustainable finance by Global Finance, a respected and prestigious international finance magazine.

Staff writer

Published 23 Jul 2024

Accelerating and scaling Africa’s renewable-energy projects

In Africa more than 600 million people lack access to electricity. At the current pace of electrification millions of Africans are still expected to be without electricity in 2030 unless the pace of electrification is trebled, by connecting more than 90 million people a year. Beyond electrification, African countries should also focus on reducing gaps in access to electricity between urban and rural areas through expanding the electrical grid.

By Hlatse Nkune

Published 22 Aug 2024 in nedbank:cib/articles/energy

Accelerating and scaling Africa’s renewable-energy projects

In Africa more than 600 million people lack access to electricity. At the current pace of electrification millions of Africans are still expected to be without electricity in 2030 unless the pace of electrification is trebled, by connecting more than 90 million people a year. Beyond electrification, African countries should also focus on reducing gaps in access to electricity between urban and rural areas through expanding the electrical grid.

Hlatse Nkune

Published 22 Aug 2024

Empowering women for climate resilience

As the effects of climate change continue to reshape our world, the demand for inclusive solutions is more urgent than ever. Gender-inclusive finance can drive global climate resilience by empowering women and ensuring they are integral to climate action.

By Mbali Kubheka, Associate Principal: Sustainable Finance Solutions at Nedbank CIB

Published 10 Oct 2024 in nedbank:cib/articles/sustainability

Empowering women for climate resilience

As the effects of climate change continue to reshape our world, the demand for inclusive solutions is more urgent than ever. Gender-inclusive finance can drive global climate resilience by empowering women and ensuring they are integral to climate action.

Mbali Kubheka, Associate Principal: Sustainable Finance Solutions at Nedbank CIB

Published 10 Oct 2024

Earth Day: Investing in the green transition

Nedbank Corporate and Investment Banking (CIB) is leading the transition to a resilient future through its commitment to sustainable finance. By developing transformative solutions, we empower businesses to not only thrive in a shifting economic landscape but also lead in the effort to make it greener. Through bold innovation and strategic expertise, we are shaping a world where financial success and environmental responsibility are interconnected, creating lasting value for generations to come.

By Staff writer

Published 21 Apr 2025 in nedbank:cib/articles/sustainability

Earth Day: Investing in the green transition

Nedbank Corporate and Investment Banking (CIB) is leading the transition to a resilient future through its commitment to sustainable finance. By developing transformative solutions, we empower businesses to not only thrive in a shifting economic landscape but also lead in the effort to make it greener. Through bold innovation and strategic expertise, we are shaping a world where financial success and environmental responsibility are interconnected, creating lasting value for generations to come.

Staff writer

Published 21 Apr 2025

Sustainability in Africa’s hospitality property sector

Nedbank Corporate and Investment Banking (NCIB) has taken another significant step in advancing sustainable property finance across Africa with the successful conclusion of a €19.4 million sustainability-linked development and term loan for Kasada in Senegal. This unique transaction in hospitality property finance will drive measurable environmental and social impact in the local community.

By Staff writer

Published 04 Jun 2025 in nedbank:cib/articles/property

Sustainability in Africa’s hospitality property sector

Nedbank Corporate and Investment Banking (NCIB) has taken another significant step in advancing sustainable property finance across Africa with the successful conclusion of a €19.4 million sustainability-linked development and term loan for Kasada in Senegal. This unique transaction in hospitality property finance will drive measurable environmental and social impact in the local community.

Staff writer

Published 04 Jun 2025

Nedbank CIB honoured for leadership in sustainable finance

Our ESG-backed approach to lending and financing was recognised at the 2022 Global Finance Sustainable Finance Awards, where we ranked in the top 6% of banks globally and received awards for Outstanding Leadership in Green Bonds and Outstanding Leadership in Transition/Sustainability-linked Bonds.

By Staff writer

Published 11 Jul 2025 in nedbank:cib/deals/esg

Nedbank CIB honoured for leadership in sustainable finance

Our ESG-backed approach to lending and financing was recognised at the 2022 Global Finance Sustainable Finance Awards, where we ranked in the top 6% of banks globally and received awards for Outstanding Leadership in Green Bonds and Outstanding Leadership in Transition/Sustainability-linked Bonds.

Staff writer

Published 11 Jul 2025