Select Country

Don’t have your Nedbank ID yet?

Nedbank ID single sign-on gives you full digital access to Nedbank’s banking and lifestyle products and services on the Money app or Online Banking.

Log in

Log in to Online Banking or another one of our secured services.

Awards

Deals

- R4bn Tronox deal funds two 100MW solar plants

- Billions to help Redefine build green properties

- Harmony pursues green goals with R10 billion loan

- Cold solutions finance for cold storage facilities

- International Finance Corporation green bond fund

- Envusa energy deal: The way for renewable energy

- Paladin Energy senior debt funding partnership

- Renewable energy wind farm financing

- Stor-Age’s successful inaugural bond auction

- PlusNet, Peninsula Packaging and Barrier Film Convertors co-investment opportunity | Nedbank CIB

- IFC Green Loan | Nedbank CIB

- AngloGold appoints Nedbank CIB as sole underwriter | Nedbank CIB

- Nedbank CIB Property Finance Team achievement | Nedbank CIB

- PwC Tower, Westlands — Where Kenya's corporate vision meets world-class execution

Women of Corporate Investment Banking

Young Analyst Programme

Articles

- Africa's pathway to a climate-resilient economy

- Commercial property trends 2022

- Green energy in the developing world | Nedbank CIB

- How sustainable finance creates value

- How the property sector recovered in 2023

- FURTHER IMPACT empowerment for entrepreneurs

- There's a new buoyancy around water and sanitation

- What happens when finance meets sustainability?

- Africa’s renewable-energy projects

- Breaking barriers for energy transition in mining

- Nedbank CIB wins big at 2025 IFC Awards

- South Africa leads clean energy transformation

Conferences

Benchmark Reform

Corporate Finance

Financing

Investing

Markets

Transacting

- Login & Register

- Online Banking

- Online Share Trading

- NedFleet

- Register for Nedbank ID

- About us

- Awards

- Deals

- Explore About us

- Awards

- Deals

- R4bn Tronox deal funds two 100MW solar plants

- Billions to help Redefine build green properties

- Harmony pursues green goals with R10 billion loan

- Cold solutions finance for cold storage facilities

- International Finance Corporation green bond fund

- Envusa energy deal: The way for renewable energy

- Paladin Energy senior debt funding partnership

- Renewable energy wind farm financing

- Stor-Age’s successful inaugural bond auction

- PlusNet, Peninsula Packaging and Barrier Film Convertors co-investment opportunity | Nedbank CIB

- IFC Green Loan | Nedbank CIB

- AngloGold appoints Nedbank CIB as sole underwriter | Nedbank CIB

- Nedbank CIB Property Finance Team achievement | Nedbank CIB

- PwC Tower, Westlands — Where Kenya's corporate vision meets world-class execution

- R4bn Tronox deal funds two 100MW solar plants

- Billions to help Redefine build green properties

- Harmony pursues green goals with R10 billion loan

- Cold solutions finance for cold storage facilities

- International Finance Corporation green bond fund

- Envusa energy deal: The way for renewable energy

- Paladin Energy senior debt funding partnership

- Renewable energy wind farm financing

- Stor-Age’s successful inaugural bond auction

- PlusNet, Peninsula Packaging and Barrier Film Convertors co-investment opportunity | Nedbank CIB

- IFC Green Loan | Nedbank CIB

- AngloGold appoints Nedbank CIB as sole underwriter | Nedbank CIB

- Nedbank CIB Property Finance Team achievement | Nedbank CIB

- PwC Tower, Westlands — Where Kenya's corporate vision meets world-class execution

- Women of Corporate Investment Banking

- Young Analyst Programme

- Articles

- Africa's pathway to a climate-resilient economy

- Commercial property trends 2022

- Green energy in the developing world | Nedbank CIB

- How sustainable finance creates value

- How the property sector recovered in 2023

- FURTHER IMPACT empowerment for entrepreneurs

- There's a new buoyancy around water and sanitation

- What happens when finance meets sustainability?

- Africa’s renewable-energy projects

- Breaking barriers for energy transition in mining

- Nedbank CIB wins big at 2025 IFC Awards

- South Africa leads clean energy transformation

- Africa's pathway to a climate-resilient economy

- Commercial property trends 2022

- Green energy in the developing world | Nedbank CIB

- How sustainable finance creates value

- How the property sector recovered in 2023

- FURTHER IMPACT empowerment for entrepreneurs

- There's a new buoyancy around water and sanitation

- What happens when finance meets sustainability?

- Africa’s renewable-energy projects

- Breaking barriers for energy transition in mining

- Nedbank CIB wins big at 2025 IFC Awards

- South Africa leads clean energy transformation

- Conferences

- Benchmark Reform

- Solutions

- Corporate Finance

- Financing

- Investing

- Markets

- Nedbank Business Hub

- Transacting

- Explore Solutions

- Corporate Finance

- Financing

- Investing

- Markets

- Nedbank Business Hub

- Business hub lead form

- Business hub lead form

- Transacting

- Sustainability

- Explore Sustainability

- Contact us

- Explore Contact us

Nedbank CIB triumphs at the Global Finance Sustainable Finance Awards

Nedbank CIB triumphs at the Global Finance Sustainable Finance Awards

Staff writer

2 mins

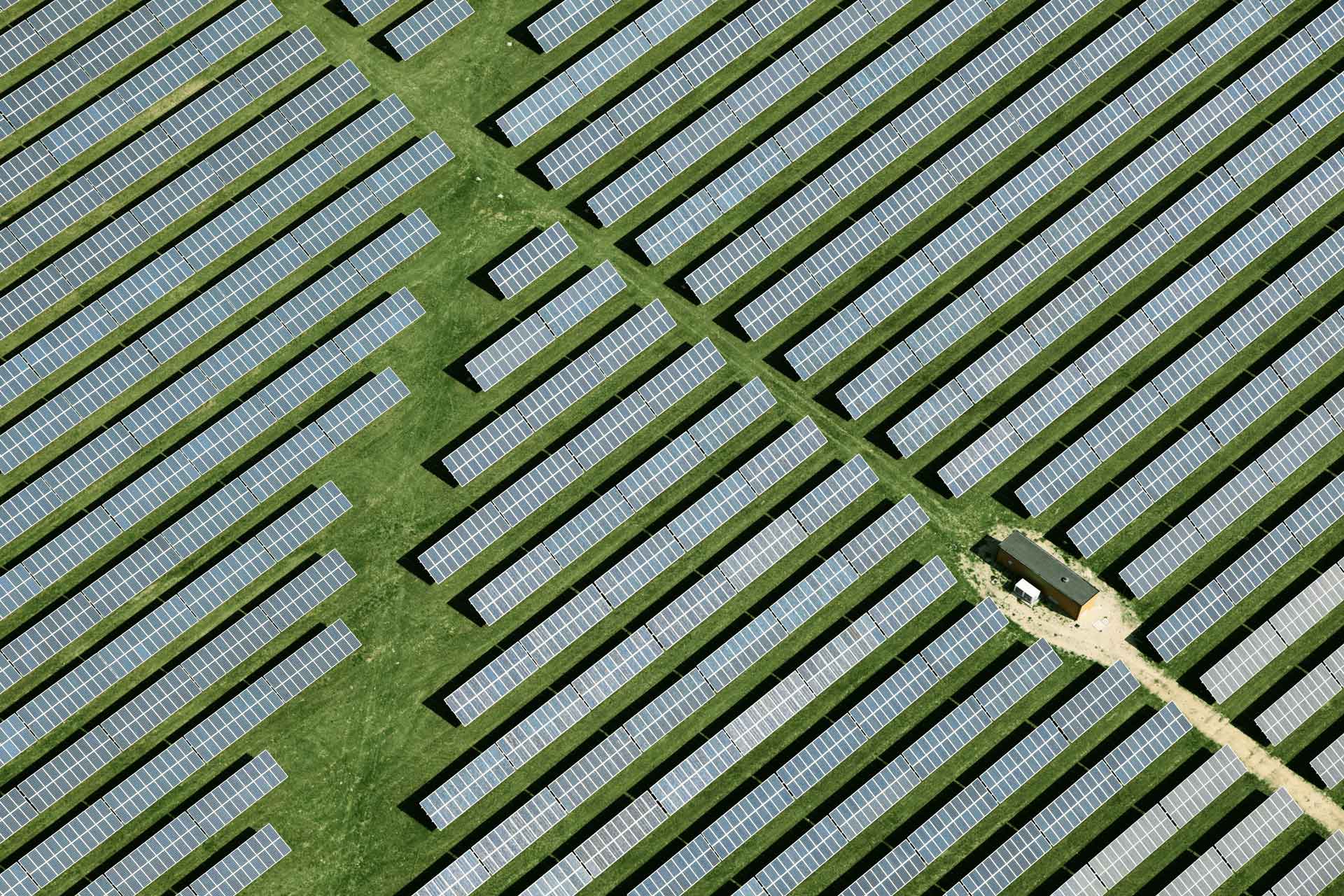

Discover how Nedbank CIB’s sustainable finance initiatives earned us the 2025 Global Finance Award.

Global Finance Sustainable Finance Awards

Global Finance has announced the winners of its fifth annual Sustainable Finance Awards, honouring achievements in 2025. Winners have been chosen in 53 countries, territories, and districts. Honourees have also been chosen in multiple global and regional categories.

This awards programme recognises global, regional, and local leadership in sustainable finance – funding for initiatives designed to mitigate the negative impacts of climate change and help build a more sustainable future.

Furthermore, the Global Finance Sustainable Finance Awards reflect the innovation, achievement, strategy, progressive, and inspirational changes within the global financial community and climate finance, which Nedbank Corporate and Investment Banking (CIB) is proud to have been recognised for.

Nedbank CIB’s achievements in sustainable finance

The Global Finance Awards voted Nedbank CIB as the overall country winner for Best Bank for Sustainable Finance in South Africa for 2025. This is the second consecutive year we’re receiving this award, demonstrating our expertise and leadership in sustainable finance.

This remarkable achievement is a testament to Nedbank CIB's commitment and our expertise and leadership when it comes to driving sustainability and environmental responsibility within the financial sector.

As a market leader in the delivery of innovative renewable energy solutions and sustainable finance solutions as well as an advisory partner to many leading South African organisations, Nedbank CIB has shown versatility across multiple genres, paired with strong deal execution capabilities and alignment with our clients’ financial strategies.

Key sustainable finance initiatives by Nedbank CIB

We believe that by having aligned our business strategy to deliver innovative solutions with sustainability at its heart, we are making positive impact on the planet and society, while enhancing long-term financial performance and resilience in climate finance.

We offer a range of products and services that support the transition to a low-carbon economy and foster social inclusion through our sustainable finance solutions. These include sustainability structuring and co-ordinating large impactful transactions across the loan and bond capital markets.

Impact of Nedbank CIB’s sustainable finance projects

Nedbank CIB is a purpose-led organisation that is intentional about the value we create and the impact we have on our employees, clients, shareholders, and society at large.

On 7 November 2024, Nedbank CIB issued its debut Sustainability Tier 2 note – a groundbreaking move due to its diverse 'use of proceeds' categories, supporting climate-smart agriculture, affordable housing for women, and water infrastructure. This issuance makes Nedbank the first South African bank to tackle this combination of critical local issues in a single note, attracting investors with its robust structure and record low pricing for a Tier 2 note at the time of issuance. The bond addresses social and environmental challenges, combining the 3 key areas highlighted above into an innovative solution that meets real needs.

How Nedbank CIB is leading in sustainable banking

Nedbank CIB has had many firsts demonstrating our leading position in energy and sustainability. Some of these are listed below:

- First South African company to proactively table climate-related resolutions – passed by its shareholders.

- First bank in South Africa to join the UNEP FI principles for responsible banking.

- First African bank to adopt the equator principles.

- First South African bank to list a renewable energy bond on the green bond segment of the JSE in 2019.

- First South African bank to have issued a USD sustainability-linked loan with bespoke KPI indicators linked to a reduction in carbon emissions.

The importance of sustainable finance in today’s world

Financing sustainable business has strong financial and broader societal benefits, which is why sustainable finance continues to gain traction.

Related posts

See allNedbank CIB honoured for leadership in sustainable finance

Our ESG-backed approach to lending and financing was recognised at the 2022 Global Finance Sustainable Finance Awards, where we ranked in the top 6% of banks globally and received awards for Outstanding Leadership in Green Bonds and Outstanding Leadership in Transition/Sustainability-linked Bonds.

By Staff writer

Published 11 Jul 2025 in nedbank:cib/deals/esg

Nedbank CIB honoured for leadership in sustainable finance

Our ESG-backed approach to lending and financing was recognised at the 2022 Global Finance Sustainable Finance Awards, where we ranked in the top 6% of banks globally and received awards for Outstanding Leadership in Green Bonds and Outstanding Leadership in Transition/Sustainability-linked Bonds.

Staff writer

Published 11 Jul 2025

South Africa’s healthcare sector requires more investment for equity

There is a need for additional investment in South Africa’s fast-growing healthcare sector to cater for the increasing needs of the country, including addressing the national hospital bed shortfall, says Anél Bosman, Group Managing Executive of Nedbank Corporate and Investment Banking.

By Staff writer

Published 08 Jul 2025 in nedbank:cib/articles/investment

South Africa’s healthcare sector requires more investment for equity

There is a need for additional investment in South Africa’s fast-growing healthcare sector to cater for the increasing needs of the country, including addressing the national hospital bed shortfall, says Anél Bosman, Group Managing Executive of Nedbank Corporate and Investment Banking.

Staff writer

Published 08 Jul 2025

Empowering trade. Enabling growth.

At Nedbank Corporate and Investment Banking, we see the unexpected connections that power sustainable growth. Our trade and supply chain finance solutions are designed to unlock working capital, streamline trade flows, and empower businesses across Africa to thrive in an increasingly interconnected global economy.

By Staff writer

Published 24 Jun 2025 in nedbank:cib/articles/finance

Empowering trade. Enabling growth.

At Nedbank Corporate and Investment Banking, we see the unexpected connections that power sustainable growth. Our trade and supply chain finance solutions are designed to unlock working capital, streamline trade flows, and empower businesses across Africa to thrive in an increasingly interconnected global economy.

Staff writer

Published 24 Jun 2025