Select Country

Don’t have your Nedbank ID yet?

Nedbank ID single sign-on gives you full digital access to Nedbank’s banking and lifestyle products and services on the Money app or Online Banking.

Log in

Log in to Online Banking or another one of our secured services.

Awards

Deals

- R4bn Tronox deal funds two 100MW solar plants

- Billions to help Redefine build green properties

- Harmony pursues green goals with R10 billion loan

- Cold solutions finance for cold storage facilities

- International Finance Corporation green bond fund

- Envusa energy deal: The way for renewable energy

- Paladin Energy senior debt funding partnership

- Renewable energy wind farm financing

- Stor-Age’s successful inaugural bond auction

- PlusNet, Peninsula Packaging and Barrier Film Convertors co-investment opportunity | Nedbank CIB

- IFC Green Loan | Nedbank CIB

- AngloGold appoints Nedbank CIB as sole underwriter | Nedbank CIB

- Nedbank CIB Property Finance Team achievement | Nedbank CIB

- PwC Tower, Westlands — Where Kenya's corporate vision meets world-class execution

Women of Corporate Investment Banking

Young Analyst Programme

Articles

- Africa's pathway to a climate-resilient economy

- Commercial property trends 2022

- Green energy in the developing world | Nedbank CIB

- How sustainable finance creates value

- How the property sector recovered in 2023

- FURTHER IMPACT empowerment for entrepreneurs

- There's a new buoyancy around water and sanitation

- What happens when finance meets sustainability?

- Africa’s renewable-energy projects

- Breaking barriers for energy transition in mining

- Nedbank CIB wins big at 2025 IFC Awards

- South Africa leads clean energy transformation

Conferences

Benchmark Reform

Corporate Finance

Financing

Investing

Markets

Transacting

- Login & Register

- Online Banking

- Online Share Trading

- NedFleet

- Register for Nedbank ID

- About us

- Awards

- Deals

- Explore About us

- Awards

- Deals

- R4bn Tronox deal funds two 100MW solar plants

- Billions to help Redefine build green properties

- Harmony pursues green goals with R10 billion loan

- Cold solutions finance for cold storage facilities

- International Finance Corporation green bond fund

- Envusa energy deal: The way for renewable energy

- Paladin Energy senior debt funding partnership

- Renewable energy wind farm financing

- Stor-Age’s successful inaugural bond auction

- PlusNet, Peninsula Packaging and Barrier Film Convertors co-investment opportunity | Nedbank CIB

- IFC Green Loan | Nedbank CIB

- AngloGold appoints Nedbank CIB as sole underwriter | Nedbank CIB

- Nedbank CIB Property Finance Team achievement | Nedbank CIB

- PwC Tower, Westlands — Where Kenya's corporate vision meets world-class execution

- R4bn Tronox deal funds two 100MW solar plants

- Billions to help Redefine build green properties

- Harmony pursues green goals with R10 billion loan

- Cold solutions finance for cold storage facilities

- International Finance Corporation green bond fund

- Envusa energy deal: The way for renewable energy

- Paladin Energy senior debt funding partnership

- Renewable energy wind farm financing

- Stor-Age’s successful inaugural bond auction

- PlusNet, Peninsula Packaging and Barrier Film Convertors co-investment opportunity | Nedbank CIB

- IFC Green Loan | Nedbank CIB

- AngloGold appoints Nedbank CIB as sole underwriter | Nedbank CIB

- Nedbank CIB Property Finance Team achievement | Nedbank CIB

- PwC Tower, Westlands — Where Kenya's corporate vision meets world-class execution

- Women of Corporate Investment Banking

- Young Analyst Programme

- Articles

- Africa's pathway to a climate-resilient economy

- Commercial property trends 2022

- Green energy in the developing world | Nedbank CIB

- How sustainable finance creates value

- How the property sector recovered in 2023

- FURTHER IMPACT empowerment for entrepreneurs

- There's a new buoyancy around water and sanitation

- What happens when finance meets sustainability?

- Africa’s renewable-energy projects

- Breaking barriers for energy transition in mining

- Nedbank CIB wins big at 2025 IFC Awards

- South Africa leads clean energy transformation

- Africa's pathway to a climate-resilient economy

- Commercial property trends 2022

- Green energy in the developing world | Nedbank CIB

- How sustainable finance creates value

- How the property sector recovered in 2023

- FURTHER IMPACT empowerment for entrepreneurs

- There's a new buoyancy around water and sanitation

- What happens when finance meets sustainability?

- Africa’s renewable-energy projects

- Breaking barriers for energy transition in mining

- Nedbank CIB wins big at 2025 IFC Awards

- South Africa leads clean energy transformation

- Conferences

- Benchmark Reform

- Solutions

- Corporate Finance

- Financing

- Investing

- Markets

- Nedbank Business Hub

- Transacting

- Explore Solutions

- Corporate Finance

- Financing

- Investing

- Markets

- Nedbank Business Hub

- Business hub lead form

- Business hub lead form

- Transacting

- Sustainability

- Explore Sustainability

- Contact us

- Explore Contact us

Nedbank CIB’s awarded Loan of the Year

Nedbank CIB’s awarded Loan of the Year

Staff writer

2 mins

Nedbank CIB has been honoured for its innovative financing solutions

Nedbank Corporate and Investment Banking (CIB) has been recognised with the prestigious Impact Loan of the Year Award at the Environmental Finance Impact Awards. This award honours the bank as a leader in sustainable finance and demonstrates its unwavering commitment to environmental stewardship and socioeconomic development across Africa.

Nedbank plays a key role in driving the continent’s transition towards a greener future

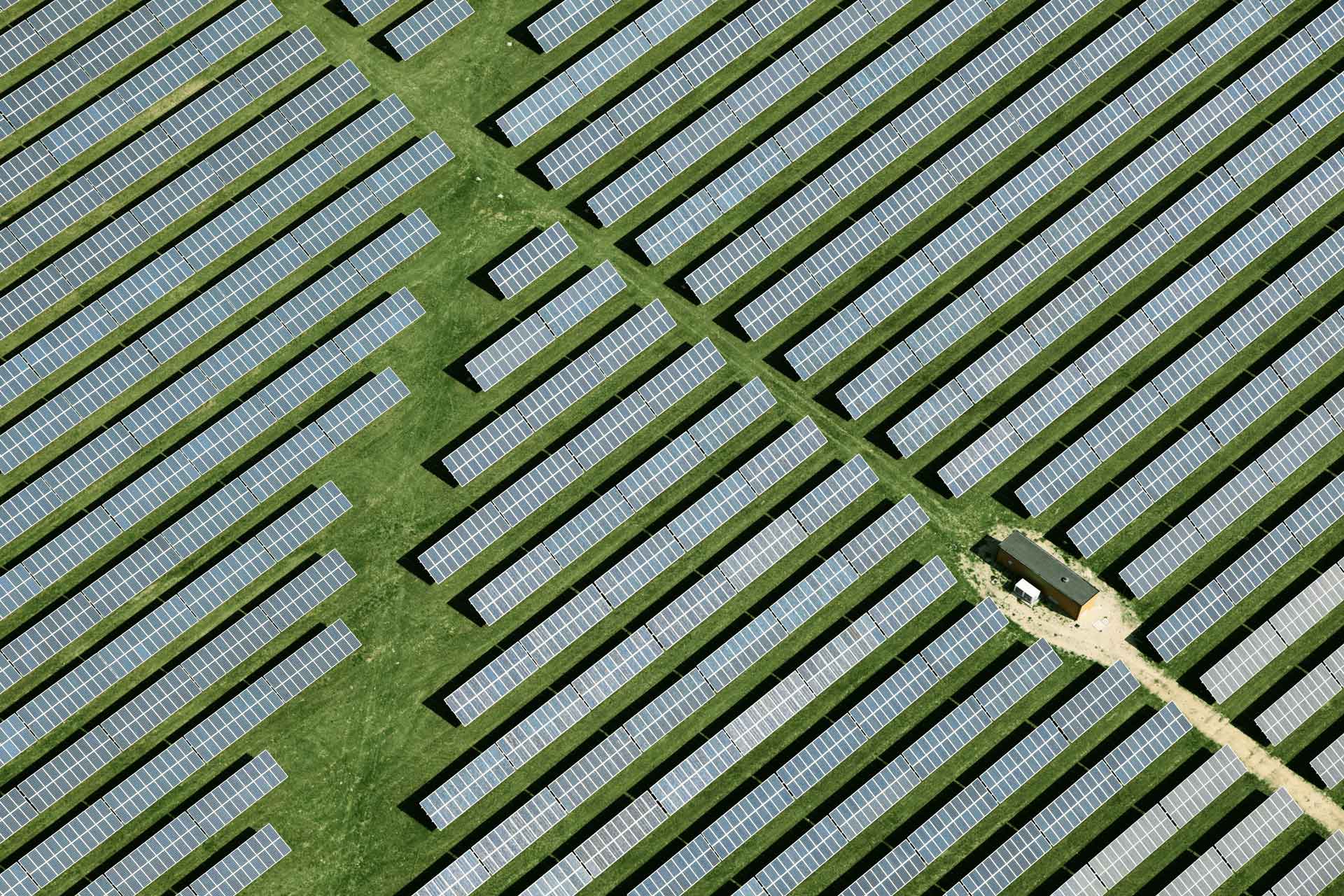

This award was given for Nedbank CIB’s key role in structuring a R2.5 billion green loan for ENGIE Southern Africa and its partner Pele Green Energy. The transaction supports the construction and development of the Grootspruit and Graspan solar plants, which form part of South Africa’s Renewable Energy Independent Power Producer Procurement Programme (REIPPP) Round 5. With a combined capacity of 150 MW, these projects represent a significant step towards improving energy security and addressing the country’s ongoing power challenges.

Marcelo Soares, Chief Financial Officer at ENGIE Southern Africa, highlighted the significance of this transaction: 'This innovative financing highlights ENGIE’s dedication to accelerating South Africa’s renewable energy transition while addressing critical energy security challenges. By partnering with leaders like Nedbank CIB, we are advancing impactful solutions for a sustainable future.'

By adhering to international best practices, including the Green Loan Principles, Climate Bonds Initiative (CBI) Standards, and South Africa’s Green Finance Taxonomy, the project has set a benchmark for sustainable finance in the region.

Boosting energy security and green solutions

The primary objective of this project is to help solve South Africa’s electricity issues by adding renewable energy to the national grid. This aligns with the overall aim to move towards a greener economy and tackling major economic challenges in the country. These efforts are essential to creating a sustainable energy ecosystem that benefits future generations.

By structuring a financing package that includes environmental goals, Nedbank CIB encourages using renewable energy while promoting responsible energy development. This creative approach shows the transformative potential of blending financial expertise with sustainability objectives.

Working together effectively

Nedbank CIB’s collaboration with ENGIE Southern Africa and Pele Green Energy highlights the power of strategic partnerships in achieving impactful results. As the sole sustainability coordinator, joint global mandated lead arranger, and original lender, Nedbank CIB played a critical role in ensuring that this deal was financially viable without compromising on its environmental integrity.

Gqi Raoleka, Chief Executive Officer of Pele Energy Group, emphasised the importance of collaboration: 'This award is a testament to the power of partnership and innovation in addressing South Africa’s energy challenges. By joining forces with Nedbank CIB and ENGIE, Pele Green Energy is proud to contribute to the country’s renewable goals while fostering sustainable economic growth. Projects like Grootspruit and Graspan exemplify our commitment to delivering impactful solutions that power a greener and more secure future for all South Africans.'

This partnership reflects a shared commitment to combating climate change through innovative, scalable solutions, and it underscores the importance of multi-stakeholder collaboration in achieving long-term environmental objectives. It also highlights Nedbank CIB’s leadership in tackling tough issues using custom financial models that blend economic growth with environmental objectives.

Changing South Africa’s energy scene

These solar power plants are expected to lower South Africa’s need for fossil fuels. By boosting renewable energy capacity on the grid, these projects will help meet climate targets and improve the quality of life.

Additionally, this green loan setup emphasises the importance that the financial sector plays in promoting sustainable development across the continent. By tying loan conditions to environmental performance metrics, it ensures responsibility and long-lasting sustainability in the energy sector.

Leading sustainable finance forward

Nedbank CIB’s win at the Environmental Finance Impact Awards reaffirms its standing as a leader in sustainable finance. This achievement reflects not only its expertise but also its purpose-driven approach to aligning financial solutions with broader social and environmental objectives.

Anél Bosman, Managing Executive at Nedbank CIB, reinforced this commitment: 'This award is a testament to our unwavering commitment to our clients and South Africa. We leverage our financial expertise and innovative financing solutions to drive sustainable development. By supporting these critical infrastructure projects, we are advancing our country's renewable energy goals, energy security, and economic growth.'

Looking forward, Nedbank CIB plans to grow its range of sustainability-focused deals. By encouraging innovation and collaboration, they hope to drive positive change across Africa and beyond while setting new benchmarks for financial institutions focusing on enabling sustainable growth.

A commitment to eco-friendly growth

As the financial sector continues to evolve, Nedbank CIB’s leadership in sustainable finance will play a critical role in shaping Africa’s transition towards a greener, more inclusive economy. By tackling big problems like energy security and climate change, the bank has shown how financial expertise can serve as a force for good in building a more sustainable future.

Related posts

See allNedbank CIB honoured for leadership in sustainable finance

Our ESG-backed approach to lending and financing was recognised at the 2022 Global Finance Sustainable Finance Awards, where we ranked in the top 6% of banks globally and received awards for Outstanding Leadership in Green Bonds and Outstanding Leadership in Transition/Sustainability-linked Bonds.

By Staff writer

Published 11 Jul 2025 in nedbank:cib/deals/esg

Nedbank CIB honoured for leadership in sustainable finance

Our ESG-backed approach to lending and financing was recognised at the 2022 Global Finance Sustainable Finance Awards, where we ranked in the top 6% of banks globally and received awards for Outstanding Leadership in Green Bonds and Outstanding Leadership in Transition/Sustainability-linked Bonds.

Staff writer

Published 11 Jul 2025

South Africa’s healthcare sector requires more investment for equity

There is a need for additional investment in South Africa’s fast-growing healthcare sector to cater for the increasing needs of the country, including addressing the national hospital bed shortfall, says Anél Bosman, Group Managing Executive of Nedbank Corporate and Investment Banking.

By Staff writer

Published 08 Jul 2025 in nedbank:cib/articles/investment

South Africa’s healthcare sector requires more investment for equity

There is a need for additional investment in South Africa’s fast-growing healthcare sector to cater for the increasing needs of the country, including addressing the national hospital bed shortfall, says Anél Bosman, Group Managing Executive of Nedbank Corporate and Investment Banking.

Staff writer

Published 08 Jul 2025

Empowering trade. Enabling growth.

At Nedbank Corporate and Investment Banking, we see the unexpected connections that power sustainable growth. Our trade and supply chain finance solutions are designed to unlock working capital, streamline trade flows, and empower businesses across Africa to thrive in an increasingly interconnected global economy.

By Staff writer

Published 24 Jun 2025 in nedbank:cib/articles/finance

Empowering trade. Enabling growth.

At Nedbank Corporate and Investment Banking, we see the unexpected connections that power sustainable growth. Our trade and supply chain finance solutions are designed to unlock working capital, streamline trade flows, and empower businesses across Africa to thrive in an increasingly interconnected global economy.

Staff writer

Published 24 Jun 2025