Select Country

Don’t have your Nedbank ID yet?

Nedbank ID single sign-on gives you full digital access to Nedbank’s banking and lifestyle products and services on the Money app or Online Banking.

Log in

Log in to Online Banking or another one of our secured services.

Awards

Deals

- R4bn Tronox deal funds two 100MW solar plants

- Billions to help Redefine build green properties

- Harmony pursues green goals with R10 billion loan

- Cold solutions finance for cold storage facilities

- International Finance Corporation green bond fund

- Envusa energy deal: The way for renewable energy

- Paladin Energy senior debt funding partnership

- Renewable energy wind farm financing

- Stor-Age’s successful inaugural bond auction

- PlusNet, Peninsula Packaging and Barrier Film Convertors co-investment opportunity | Nedbank CIB

- IFC Green Loan | Nedbank CIB

- AngloGold appoints Nedbank CIB as sole underwriter | Nedbank CIB

- Nedbank CIB Property Finance Team achievement | Nedbank CIB

- PwC Tower, Westlands — Where Kenya's corporate vision meets world-class execution

Women of Corporate Investment Banking

Young Analyst Programme

Articles

- Africa's pathway to a climate-resilient economy

- Commercial property trends 2022

- Green energy in the developing world | Nedbank CIB

- How sustainable finance creates value

- How the property sector recovered in 2023

- FURTHER IMPACT empowerment for entrepreneurs

- There's a new buoyancy around water and sanitation

- What happens when finance meets sustainability?

- Africa’s renewable-energy projects

- Breaking barriers for energy transition in mining

- Nedbank CIB wins big at 2025 IFC Awards

- South Africa leads clean energy transformation

Conferences

Benchmark Reform

Corporate Finance

Financing

Investing

Markets

Transacting

- Login & Register

- Online Banking

- Online Share Trading

- NedFleet

- Register for Nedbank ID

- About us

- Awards

- Deals

- Explore About us

- Awards

- Deals

- R4bn Tronox deal funds two 100MW solar plants

- Billions to help Redefine build green properties

- Harmony pursues green goals with R10 billion loan

- Cold solutions finance for cold storage facilities

- International Finance Corporation green bond fund

- Envusa energy deal: The way for renewable energy

- Paladin Energy senior debt funding partnership

- Renewable energy wind farm financing

- Stor-Age’s successful inaugural bond auction

- PlusNet, Peninsula Packaging and Barrier Film Convertors co-investment opportunity | Nedbank CIB

- IFC Green Loan | Nedbank CIB

- AngloGold appoints Nedbank CIB as sole underwriter | Nedbank CIB

- Nedbank CIB Property Finance Team achievement | Nedbank CIB

- PwC Tower, Westlands — Where Kenya's corporate vision meets world-class execution

- R4bn Tronox deal funds two 100MW solar plants

- Billions to help Redefine build green properties

- Harmony pursues green goals with R10 billion loan

- Cold solutions finance for cold storage facilities

- International Finance Corporation green bond fund

- Envusa energy deal: The way for renewable energy

- Paladin Energy senior debt funding partnership

- Renewable energy wind farm financing

- Stor-Age’s successful inaugural bond auction

- PlusNet, Peninsula Packaging and Barrier Film Convertors co-investment opportunity | Nedbank CIB

- IFC Green Loan | Nedbank CIB

- AngloGold appoints Nedbank CIB as sole underwriter | Nedbank CIB

- Nedbank CIB Property Finance Team achievement | Nedbank CIB

- PwC Tower, Westlands — Where Kenya's corporate vision meets world-class execution

- Women of Corporate Investment Banking

- Young Analyst Programme

- Articles

- Africa's pathway to a climate-resilient economy

- Commercial property trends 2022

- Green energy in the developing world | Nedbank CIB

- How sustainable finance creates value

- How the property sector recovered in 2023

- FURTHER IMPACT empowerment for entrepreneurs

- There's a new buoyancy around water and sanitation

- What happens when finance meets sustainability?

- Africa’s renewable-energy projects

- Breaking barriers for energy transition in mining

- Nedbank CIB wins big at 2025 IFC Awards

- South Africa leads clean energy transformation

- Africa's pathway to a climate-resilient economy

- Commercial property trends 2022

- Green energy in the developing world | Nedbank CIB

- How sustainable finance creates value

- How the property sector recovered in 2023

- FURTHER IMPACT empowerment for entrepreneurs

- There's a new buoyancy around water and sanitation

- What happens when finance meets sustainability?

- Africa’s renewable-energy projects

- Breaking barriers for energy transition in mining

- Nedbank CIB wins big at 2025 IFC Awards

- South Africa leads clean energy transformation

- Conferences

- Benchmark Reform

- Solutions

- Corporate Finance

- Financing

- Investing

- Markets

- Nedbank Business Hub

- Transacting

- Explore Solutions

- Corporate Finance

- Financing

- Investing

- Markets

- Nedbank Business Hub

- Business hub lead form

- Business hub lead form

- Transacting

- Sustainability

- Explore Sustainability

- Contact us

- Explore Contact us

Asset-based Finance

Asset-based Finance

Staff writer

2 mins

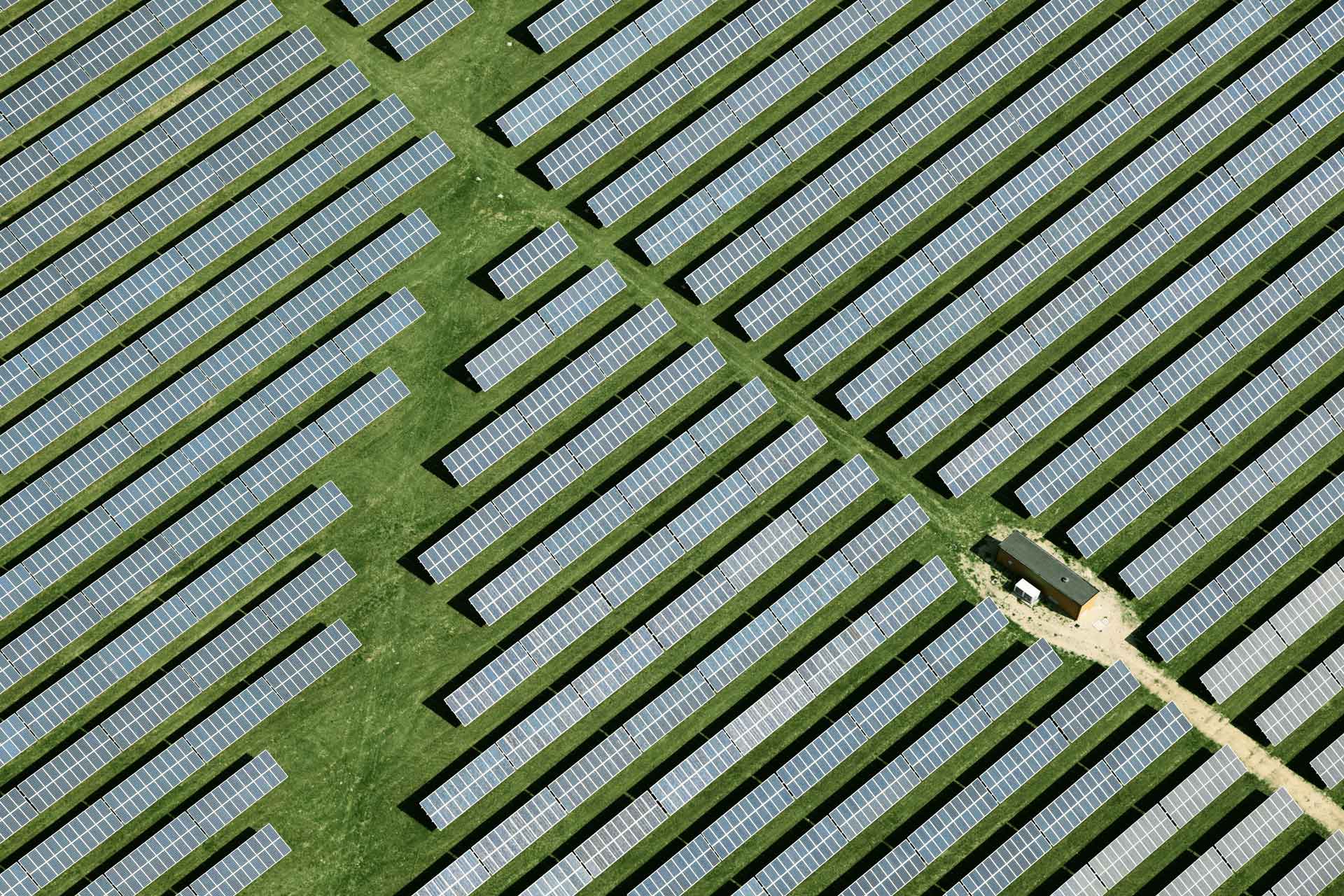

Nedbank CIB offers solar energy solutions to suit your business needs.

Generate sufficient clean energy for your business requirements, reduce energy consumption and maintain your business operations, with innovative financing options from Nedbank.

Renewable Energy

Renewable energy protects your business against revenue loss and production interruptions caused by power outages.

Nedbank structures innovative financing solutions with a repayment period of up to 10 years, using your energy savings in structuring repayments while conserving your business cash flow, as well as insuring these type assets at competitive rates.

The cost of solar investment can be offset against the savings on electricity costs.

Start your solar journey with Nedbank Corporate Investment Banking and Avo

Nedbank Corporate Investment Banking offers you solar energy solutions to suit your business needs. Maintain operations with clean energy for your business, while reducing energy consumption.

We finance the following equipment:

-

Photovoltaic (PV panels)

-

Biomass equipment

-

Hydro-electricity equipment

-

Avo Solar C&I solar installations

-

Solar concentration (heat equipment)

-

Wind turbines

-

Other proven energy hardware solutions

-

Verifiable energy-efficiency equipment

Our services:

-

Advisory

-

Design

-

Energy audits and business case development

-

Sourcing

-

Project Management

-

Turn-key installations

-

Technical assurance

-

Innovative financing options and insurance

How does Nedbank Asset-based Finance Solar work?

Step 1: Assessment and Understanding of your business.

Initial assessment of the energy needs of the business determined through telephonic and physical interactions including site visits.

Step 2: Advice and Consultation.

Based on the assessment of your business, you will be advised on the various options to optimise your energy use and how best to supplement through your own generation.

Step 3: Engineering and Solution design.

Our expert engineers ensure the technical needs are met and draft specifications for your renewable energy solution.

Step 4: Procurement.

Avo Solar C&I is technology agnostic and has relationships with major suppliers to ensure best pricing and quality products.

Step 5: Installation, Construction and Ongoing Maintenance.

We offer and ensure seamless installation of the selected solution.

Step 6: Ongoing maintenance

We offer continuous maintenance and support after installation and commissioning.

Contact our Avo Solar C&I Acquisition Lead to find out more or to request a quote.

Related posts

See allNedbank CIB honoured for leadership in sustainable finance

Our ESG-backed approach to lending and financing was recognised at the 2022 Global Finance Sustainable Finance Awards, where we ranked in the top 6% of banks globally and received awards for Outstanding Leadership in Green Bonds and Outstanding Leadership in Transition/Sustainability-linked Bonds.

By Staff writer

Published 11 Jul 2025 in nedbank:cib/deals/esg

Nedbank CIB honoured for leadership in sustainable finance

Our ESG-backed approach to lending and financing was recognised at the 2022 Global Finance Sustainable Finance Awards, where we ranked in the top 6% of banks globally and received awards for Outstanding Leadership in Green Bonds and Outstanding Leadership in Transition/Sustainability-linked Bonds.

Staff writer

Published 11 Jul 2025

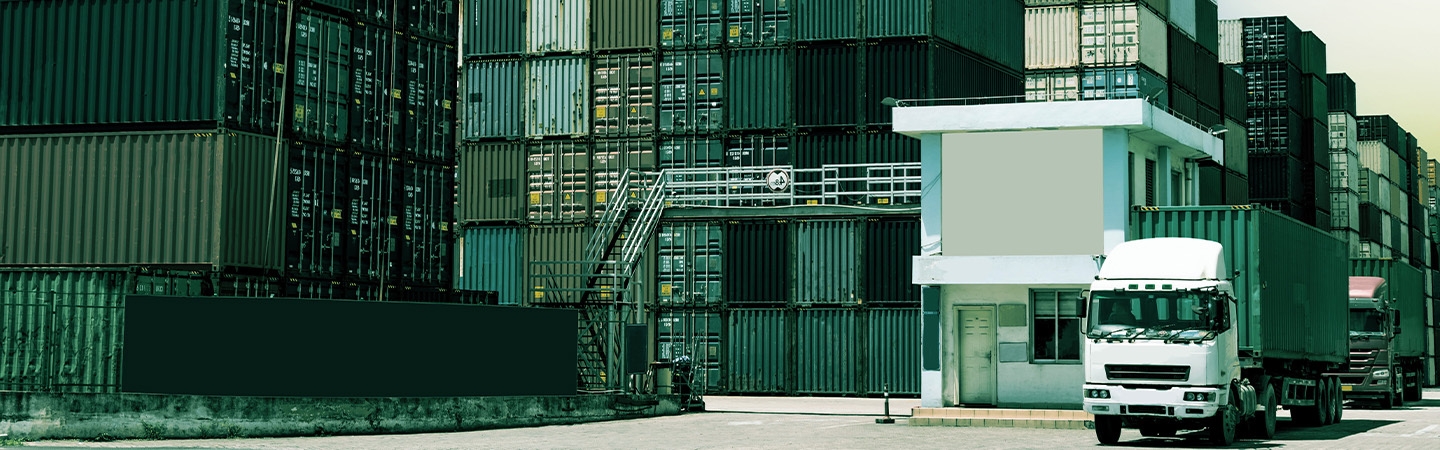

NCIB and DP World: Boosting Trade Finance in Africa

Nedbank Corporate and Investment Banking (CIB) is proud to announce a significant strategic partnership with DP World Trade Finance to address the significant working capital challenges of businesses in sub-Saharan Africa (SSA).

By Staff writer

Published 11 Oct 2024 in nedbank:cib/articles/finance

NCIB and DP World: Boosting Trade Finance in Africa

Nedbank Corporate and Investment Banking (CIB) is proud to announce a significant strategic partnership with DP World Trade Finance to address the significant working capital challenges of businesses in sub-Saharan Africa (SSA).

Staff writer

Published 11 Oct 2024

Transforming trade finance in West Africa

Discover how collaboration between banks, development finance institutions, and insurers is transforming trade finance in West Africa.

By Craig Weitz, Principal of Africa Infrastructure Finance, and Alicia Ellman, Senior Sales Associate for Nedbank Corporate and Investment Banking (CIB)

Published 23 Jul 2024 in nedbank:cib/articles/finance

Transforming trade finance in West Africa

Discover how collaboration between banks, development finance institutions, and insurers is transforming trade finance in West Africa.

Craig Weitz, Principal of Africa Infrastructure Finance, and Alicia Ellman, Senior Sales Associate for Nedbank Corporate and Investment Banking (CIB)

Published 23 Jul 2024

Embedded generation: The next vital developments to an energy-secure South Africa

Improved legislation, aggressive financing terms from funders and assistance from developed countries to aid South Africa in alleviating energy crisis.

By Amith Singh; Head of Energy Finance: NCIB

Published 30 May 2024 in nedbank:cib/articles/investment

Embedded generation: The next vital developments to an energy-secure South Africa

Improved legislation, aggressive financing terms from funders and assistance from developed countries to aid South Africa in alleviating energy crisis.

Amith Singh; Head of Energy Finance: NCIB

Published 30 May 2024