Select Country

Don’t have your Nedbank ID yet?

Nedbank ID single sign-on gives you full digital access to Nedbank’s banking and lifestyle products and services on the Money app or Online Banking.

Log in

Log in to Online Banking or another one of our secured services.

Awards

Deals

- R4bn Tronox deal funds two 100MW solar plants

- Billions to help Redefine build green properties

- Harmony pursues green goals with R10 billion loan

- Cold solutions finance for cold storage facilities

- International Finance Corporation green bond fund

- Envusa energy deal: The way for renewable energy

- Paladin Energy senior debt funding partnership

- Renewable energy wind farm financing

- Stor-Age’s successful inaugural bond auction

- PlusNet, Peninsula Packaging and Barrier Film Convertors co-investment opportunity | Nedbank CIB

- IFC Green Loan | Nedbank CIB

- AngloGold appoints Nedbank CIB as sole underwriter | Nedbank CIB

- Nedbank CIB Property Finance Team achievement | Nedbank CIB

- PwC Tower, Westlands — Where Kenya's corporate vision meets world-class execution

Women of Corporate Investment Banking

Young Analyst Programme

Articles

- Africa's pathway to a climate-resilient economy

- Commercial property trends 2022

- Green energy in the developing world | Nedbank CIB

- How sustainable finance creates value

- How the property sector recovered in 2023

- FURTHER IMPACT empowerment for entrepreneurs

- There's a new buoyancy around water and sanitation

- What happens when finance meets sustainability?

- Africa’s renewable-energy projects

- Breaking barriers for energy transition in mining

- Nedbank CIB wins big at 2025 IFC Awards

- South Africa leads clean energy transformation

Conferences

Benchmark Reform

Corporate Finance

Financing

Investing

Markets

Transacting

- Login & Register

- Online Banking

- Online Share Trading

- NedFleet

- Register for Nedbank ID

- About us

- Awards

- Deals

- Explore About us

- Awards

- Deals

- R4bn Tronox deal funds two 100MW solar plants

- Billions to help Redefine build green properties

- Harmony pursues green goals with R10 billion loan

- Cold solutions finance for cold storage facilities

- International Finance Corporation green bond fund

- Envusa energy deal: The way for renewable energy

- Paladin Energy senior debt funding partnership

- Renewable energy wind farm financing

- Stor-Age’s successful inaugural bond auction

- PlusNet, Peninsula Packaging and Barrier Film Convertors co-investment opportunity | Nedbank CIB

- IFC Green Loan | Nedbank CIB

- AngloGold appoints Nedbank CIB as sole underwriter | Nedbank CIB

- Nedbank CIB Property Finance Team achievement | Nedbank CIB

- PwC Tower, Westlands — Where Kenya's corporate vision meets world-class execution

- R4bn Tronox deal funds two 100MW solar plants

- Billions to help Redefine build green properties

- Harmony pursues green goals with R10 billion loan

- Cold solutions finance for cold storage facilities

- International Finance Corporation green bond fund

- Envusa energy deal: The way for renewable energy

- Paladin Energy senior debt funding partnership

- Renewable energy wind farm financing

- Stor-Age’s successful inaugural bond auction

- PlusNet, Peninsula Packaging and Barrier Film Convertors co-investment opportunity | Nedbank CIB

- IFC Green Loan | Nedbank CIB

- AngloGold appoints Nedbank CIB as sole underwriter | Nedbank CIB

- Nedbank CIB Property Finance Team achievement | Nedbank CIB

- PwC Tower, Westlands — Where Kenya's corporate vision meets world-class execution

- Women of Corporate Investment Banking

- Young Analyst Programme

- Articles

- Africa's pathway to a climate-resilient economy

- Commercial property trends 2022

- Green energy in the developing world | Nedbank CIB

- How sustainable finance creates value

- How the property sector recovered in 2023

- FURTHER IMPACT empowerment for entrepreneurs

- There's a new buoyancy around water and sanitation

- What happens when finance meets sustainability?

- Africa’s renewable-energy projects

- Breaking barriers for energy transition in mining

- Nedbank CIB wins big at 2025 IFC Awards

- South Africa leads clean energy transformation

- Africa's pathway to a climate-resilient economy

- Commercial property trends 2022

- Green energy in the developing world | Nedbank CIB

- How sustainable finance creates value

- How the property sector recovered in 2023

- FURTHER IMPACT empowerment for entrepreneurs

- There's a new buoyancy around water and sanitation

- What happens when finance meets sustainability?

- Africa’s renewable-energy projects

- Breaking barriers for energy transition in mining

- Nedbank CIB wins big at 2025 IFC Awards

- South Africa leads clean energy transformation

- Conferences

- Benchmark Reform

- Solutions

- Corporate Finance

- Financing

- Investing

- Markets

- Nedbank Business Hub

- Transacting

- Explore Solutions

- Corporate Finance

- Financing

- Investing

- Markets

- Nedbank Business Hub

- Business hub lead form

- Business hub lead form

- Transacting

- Sustainability

- Explore Sustainability

- Contact us

- Explore Contact us

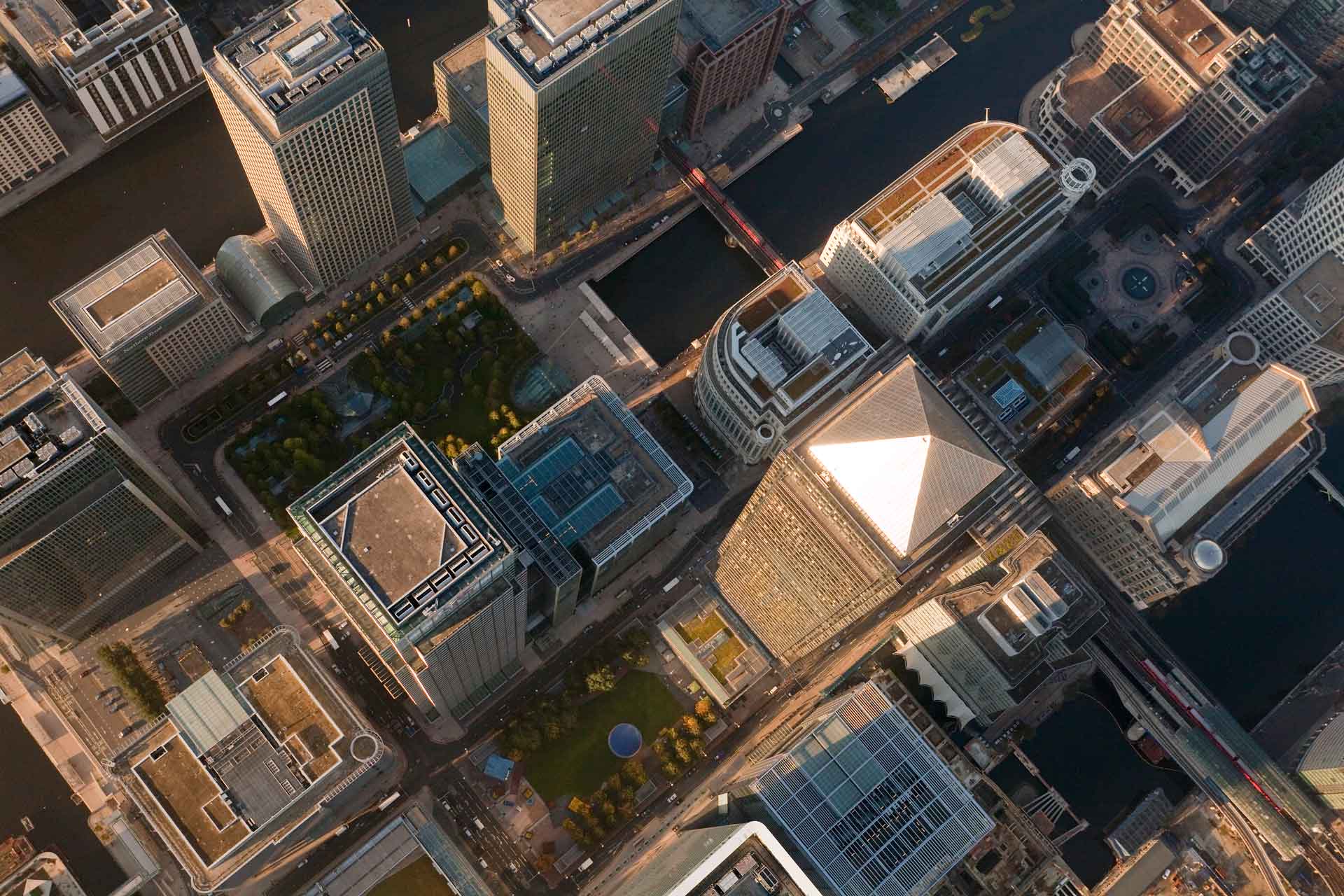

High returns amid emerging market growth in South Africa

High returns amid emerging market growth in South Africa

Staff writer

2 mins

Discover why South Africa is a top investment destination with high returns and strategic opportunities.

With its strategic positioning and abundant natural resources, South Africa is emerging as a prime destination for global investors. Amid political stability and a commitment to national unity, the country offers unique investment opportunities within the BRICS nations (Brazil, Russia, India, China, and South Africa), creating a fertile ground for foreign direct investment (FDI).

Understanding market valuations and PE discounts

South Africa trades at a significant price-to-earnings (PE) discount relative to developed and emerging markets. This is a prime opportunity for foreign investors to deploy capital to stocks listed on the Johannesburg Stock Exchange (JSE) at appealing levels, with potential upside from a predicted market rally.

JSE All Share Index performance

In the past year, the JSE All Share Index (ALSI) has surpassed the performance of indices like the FTSE All Share and EuroStoxx 50, fuelled by investor confidence in the newly established Government of National Unity (GNU).

Though contingent on effective policy implementation, the market's positive response signals strong potential.

In a comparative analysis of PE multiples, the JSE All Share Index demonstrates significant value relative to developed and emerging markets. The JSE All Share Index trades at a PE multiple of 12.6 times, representing a 21.3% discount to the average PE multiple of 16.0x observed in developed markets. This disparity highlights the investment opportunities available within South Africa, underscoring its lower market valuations as a potential advantage for existing and prospective investors. Similarly, compared to emerging markets, where the average PE multiple stands at 14.5x, the PE multiple of the JSE All Share Index is lower by 13.5%, offering compelling entry points for investors looking for returns in emerging markets.

South Africa's role as the gateway to Africa, its sophisticated financial system, and its robust resources boost its investment appeal. The market is characterised by higher equity returns, fuelled by competitive dividend yields and attractive valuation metrics, making it an excellent choice for yield-seeking investors in the current move to a lower interest-rate environment.

The mining sector remains a cornerstone of the economy.

Investment opportunities in the mining sector

The mining sector remains a cornerstone of the economy, driven by sustained global demand for commodities such as gold, platinum and coal. This continuous demand and South Africa’s rich mineral reserves make the mining industry especially appealing for investors seeking stable and potentially high returns. Additionally, the retail sector shows vital signs of recovery, buoyed by economic stabilisation and anticipated interest rate cuts. As consumer confidence improves and spending increases, the retail industry is poised to benefit significantly, offering promising opportunities for investment in both established retail giants and emerging market players.

Economic reforms boosting GDP growth

Aligning with growth in other emerging markets, South Africa is seeing gradual improvements in GDP, supported by significant reforms in critical state-owned enterprises such as Transnet. These efforts aim to boost rail performance and overall economic growth. Eskom also reported that South Africa enjoyed over 200 consecutive days of uninterrupted power supply. Nonetheless, the investment landscape faces challenges, such as regulatory complexities around Black Economic Empowerment (BEE), slow bureaucratic processes, and stringent offshore investment regulations.

Navigating regulatory complexities

Investors must navigate several complexities, including BBBEE compliance, fluctuating tax regimes, and rigorous licensing requirements. External issues like load-shedding, corruption and crime also pose risks that could compromise investor confidence and operational stability.

Investors are advised to leverage South Africa’s developed financial markets, facilitate strategic investments and offer timely exit options. Understanding and adapting to the regulatory environment is crucial for successful market engagement.

Long-term investment prospects and high returns

The long-term investment prospects in South Africa look promising, dependent on sustained economic reforms and political stability. Comprehensive policy reforms to enhance transparency and expedite processes are crucial for smoothing investment flows and bolstering market confidence.

While rich with opportunities, South Africa’s investment environment demands careful navigation of its complexities. However, with strategic foresight and a commitment to understanding the local landscape, investors can unlock significant value and contribute to the country’s economic growth. The long-term prospects remain promising, contingent on sustained economic reforms and political stability, making South Africa a compelling destination for global investors seeking growth and diversification.

Related posts

See allThe growth of sustainable finance in South Africa

As part of an expert panel at the 2022 South African Real Estate Investment Trust Conference, Arvana Singh, Nedbank Head of Sustainable Finance Solutions, shared some thoughts on how sustainable finance in South Africa can help mitigate ESG-related risks.

By Staff writer

Published 30 May 2024 in nedbank:cib/articles/property

The growth of sustainable finance in South Africa

As part of an expert panel at the 2022 South African Real Estate Investment Trust Conference, Arvana Singh, Nedbank Head of Sustainable Finance Solutions, shared some thoughts on how sustainable finance in South Africa can help mitigate ESG-related risks.

Staff writer

Published 30 May 2024

South Africa’s healthcare sector requires more investment for equity

There is a need for additional investment in South Africa’s fast-growing healthcare sector to cater for the increasing needs of the country, including addressing the national hospital bed shortfall, says Anél Bosman, Group Managing Executive of Nedbank Corporate and Investment Banking.

By Staff writer

Published 08 Jul 2025 in nedbank:cib/articles/investment

South Africa’s healthcare sector requires more investment for equity

There is a need for additional investment in South Africa’s fast-growing healthcare sector to cater for the increasing needs of the country, including addressing the national hospital bed shortfall, says Anél Bosman, Group Managing Executive of Nedbank Corporate and Investment Banking.

Staff writer

Published 08 Jul 2025