Select Country

Don’t have your Nedbank ID yet?

Nedbank ID single sign-on gives you full digital access to Nedbank’s banking and lifestyle products and services on the Money app or Online Banking.

Log in

Log in to Online Banking or another one of our secured services.

Awards

Deals

- R4bn Tronox deal funds two 100MW solar plants

- Billions to help Redefine build green properties

- Harmony pursues green goals with R10 billion loan

- Cold solutions finance for cold storage facilities

- International Finance Corporation green bond fund

- Envusa energy deal: The way for renewable energy

- Paladin Energy senior debt funding partnership

- Renewable energy wind farm financing

- Stor-Age’s successful inaugural bond auction

- PlusNet, Peninsula Packaging and Barrier Film Convertors co-investment opportunity | Nedbank CIB

- IFC Green Loan | Nedbank CIB

- AngloGold appoints Nedbank CIB as sole underwriter | Nedbank CIB

- Nedbank CIB Property Finance Team achievement | Nedbank CIB

- PwC Tower, Westlands — Where Kenya's corporate vision meets world-class execution

Women of Corporate Investment Banking

Young Analyst Programme

Articles

- Africa's pathway to a climate-resilient economy

- Commercial property trends 2022

- Green energy in the developing world | Nedbank CIB

- How sustainable finance creates value

- How the property sector recovered in 2023

- FURTHER IMPACT empowerment for entrepreneurs

- There's a new buoyancy around water and sanitation

- What happens when finance meets sustainability?

- Africa’s renewable-energy projects

- Breaking barriers for energy transition in mining

- Nedbank CIB wins big at 2025 IFC Awards

- South Africa leads clean energy transformation

Conferences

Benchmark Reform

Corporate Finance

Financing

Investing

Markets

Transacting

- Login & Register

- Online Banking

- Online Share Trading

- NedFleet

- Register for Nedbank ID

- About us

- Awards

- Deals

- Explore About us

- Awards

- Deals

- R4bn Tronox deal funds two 100MW solar plants

- Billions to help Redefine build green properties

- Harmony pursues green goals with R10 billion loan

- Cold solutions finance for cold storage facilities

- International Finance Corporation green bond fund

- Envusa energy deal: The way for renewable energy

- Paladin Energy senior debt funding partnership

- Renewable energy wind farm financing

- Stor-Age’s successful inaugural bond auction

- PlusNet, Peninsula Packaging and Barrier Film Convertors co-investment opportunity | Nedbank CIB

- IFC Green Loan | Nedbank CIB

- AngloGold appoints Nedbank CIB as sole underwriter | Nedbank CIB

- Nedbank CIB Property Finance Team achievement | Nedbank CIB

- PwC Tower, Westlands — Where Kenya's corporate vision meets world-class execution

- R4bn Tronox deal funds two 100MW solar plants

- Billions to help Redefine build green properties

- Harmony pursues green goals with R10 billion loan

- Cold solutions finance for cold storage facilities

- International Finance Corporation green bond fund

- Envusa energy deal: The way for renewable energy

- Paladin Energy senior debt funding partnership

- Renewable energy wind farm financing

- Stor-Age’s successful inaugural bond auction

- PlusNet, Peninsula Packaging and Barrier Film Convertors co-investment opportunity | Nedbank CIB

- IFC Green Loan | Nedbank CIB

- AngloGold appoints Nedbank CIB as sole underwriter | Nedbank CIB

- Nedbank CIB Property Finance Team achievement | Nedbank CIB

- PwC Tower, Westlands — Where Kenya's corporate vision meets world-class execution

- Women of Corporate Investment Banking

- Young Analyst Programme

- Articles

- Africa's pathway to a climate-resilient economy

- Commercial property trends 2022

- Green energy in the developing world | Nedbank CIB

- How sustainable finance creates value

- How the property sector recovered in 2023

- FURTHER IMPACT empowerment for entrepreneurs

- There's a new buoyancy around water and sanitation

- What happens when finance meets sustainability?

- Africa’s renewable-energy projects

- Breaking barriers for energy transition in mining

- Nedbank CIB wins big at 2025 IFC Awards

- South Africa leads clean energy transformation

- Africa's pathway to a climate-resilient economy

- Commercial property trends 2022

- Green energy in the developing world | Nedbank CIB

- How sustainable finance creates value

- How the property sector recovered in 2023

- FURTHER IMPACT empowerment for entrepreneurs

- There's a new buoyancy around water and sanitation

- What happens when finance meets sustainability?

- Africa’s renewable-energy projects

- Breaking barriers for energy transition in mining

- Nedbank CIB wins big at 2025 IFC Awards

- South Africa leads clean energy transformation

- Conferences

- Benchmark Reform

- Solutions

- Corporate Finance

- Financing

- Investing

- Markets

- Nedbank Business Hub

- Transacting

- Explore Solutions

- Corporate Finance

- Financing

- Investing

- Markets

- Nedbank Business Hub

- Business hub lead form

- Business hub lead form

- Transacting

- Sustainability

- Explore Sustainability

- Contact us

- Explore Contact us

Overberg Agri Bedrywe secures annual refinance deal

Overberg Agri Bedrywe secures annual refinance deal

Staff writer

3 mins

Overberg Agri Bedrywe (Pty) Ltd is a key financier of the SA wheat farming industry

Nedbank Corporate and Investment Banking (CIB) has completed the annual refinancing of a R3 billon deal for our client, Overberg Agri Bedrywe (Pty) Ltd (OAB). The transaction was lead arranged by Nedbank Debt Structured Products in collaboration with the Agricultural Commodities Team.

Partnering with OAB for food security

AOB is a wholly-owned subsidiary of Acorn Agri and Food Ltd (AAF). AAF is an investment holding company focused on improving food security in Southern Africa through investments linked to the agricultural services sector.

AAF is an investment holding company focused on improving food security in Southern Africa through investments linked to the agricultural services sector.

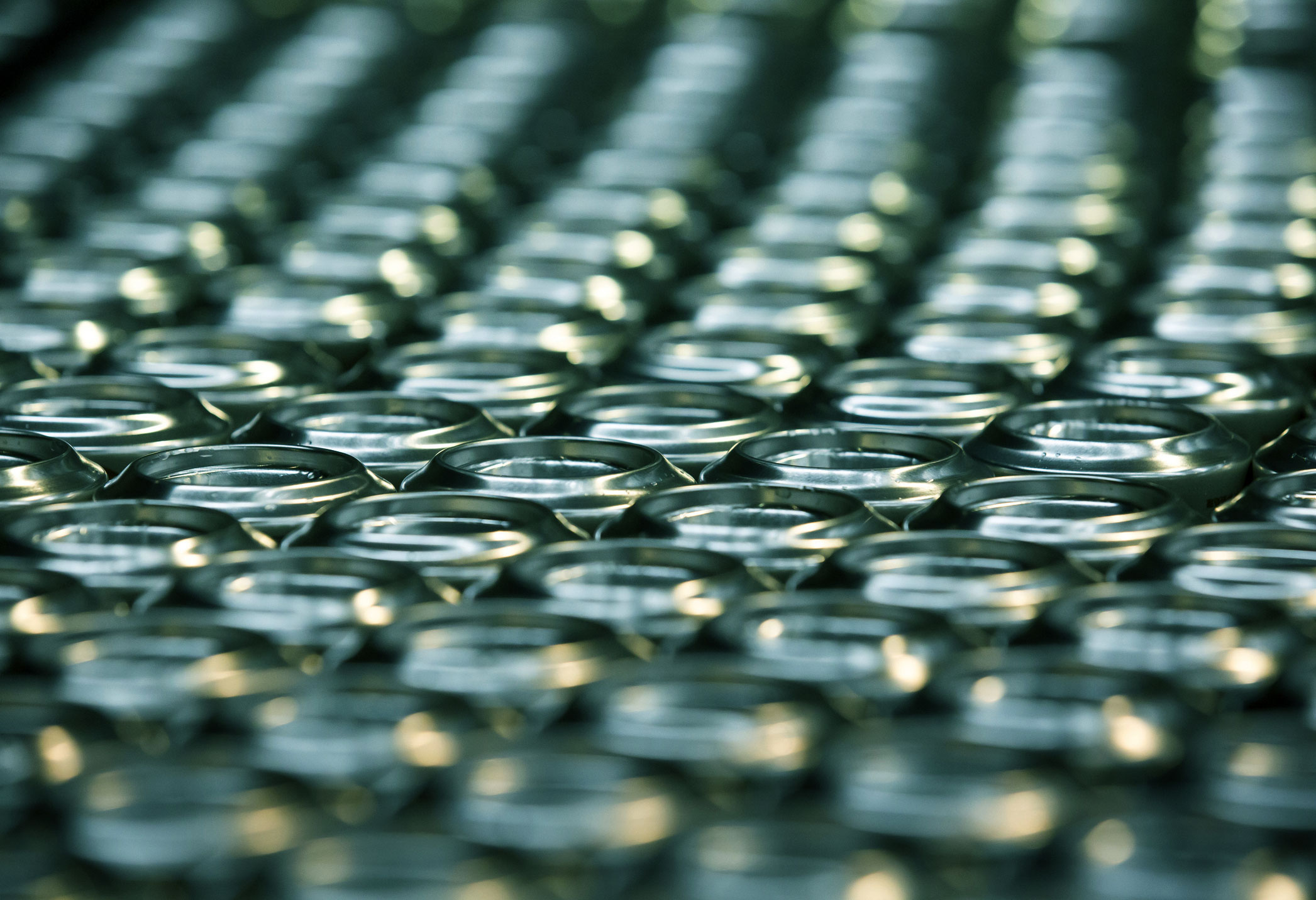

OAB is a key financier, farming input and equipment supplier, and a valuable grain storage and crop production service provider to the wheat, barley, and canola farming sectors in the Swartland and Southern Cape regions.

OAB supplies packaging materials to fruit farmers and supports the funding of conservation agriculture through its advisory support services.

Refinance deal strengthens agricultural services

The refinance deal of a R3 billion syndicated facility led by Nedbank's CIB Team is a significant milestone.

‘The refinancing transaction, closed on 31 March 2025, has fortified our relationship with a key agricultural client in South Africa with Nedbank contributing an anchor portion of the total facility,’ says Zhann Meyer, Head of Agricultural Commodities at Nedbank CIB.

Diversification of funding through a syndicated asset-backed funding facility

Nedbank established the asset-backed funding facility for OAB in 2016 to transition the company from its dependency on a single funder to a diversified panel of lenders.

Nedbank, the mandated lead arranger of the facility, has increased the debt package from R1.3 billion to R3 billion and has expanded the lender syndicate to 5 lenders.

We are the preferred advisor and structuring bank and we help clients to optimise their structure to align with their business needs on an ongoing basis.

Innovative facility tailored for sustainable food security

This is the first of its kind for an agricultural receivables-backed facility tailored to align with the client's growing and changing business and funding needs.

Impact on crop production and grain storage

OAB is a major player in the country’s largest wheat, barley, and canola-producing region. OAB is dominant in the Overberg and Swartland regions of the Western Cape and offers silo services to producers that contribute approximately 25% of total domestic wheat production.

OAB funds more than 2 000 farmers, yielding approximately 550 000 tonnes of grain, 5.5 million boxes of grapes, and 1.5 million boxes of citrus annually.

Ensuring sustainable vegetable production

According to Philip Slabber, Chief Financial Officer of Overberg Agri Bedrywe, the business’s turnover is 85% based on credit sales and, therefore, the funding provided via the asset-backed facility is an integral part of its business model, which plays a vital role in sustainable vegetable production.

‘Partnering with Nedbank with its capital markets expertise and experience, taking the lead as an advisor and structuring bank for the syndicate, is comforting and a key asset to Overberg Agri Bedrywe. We treasure the longstanding relationship with the Nedbank CIB Team and are grateful for their role in our business's success,’ says Slabber.