Select Country

Don’t have your Nedbank ID yet?

Nedbank ID single sign-on gives you full digital access to Nedbank’s banking and lifestyle products and services on the Money app or Online Banking.

Log in

Log in to Online Banking or another one of our secured services.

Awards

Deals

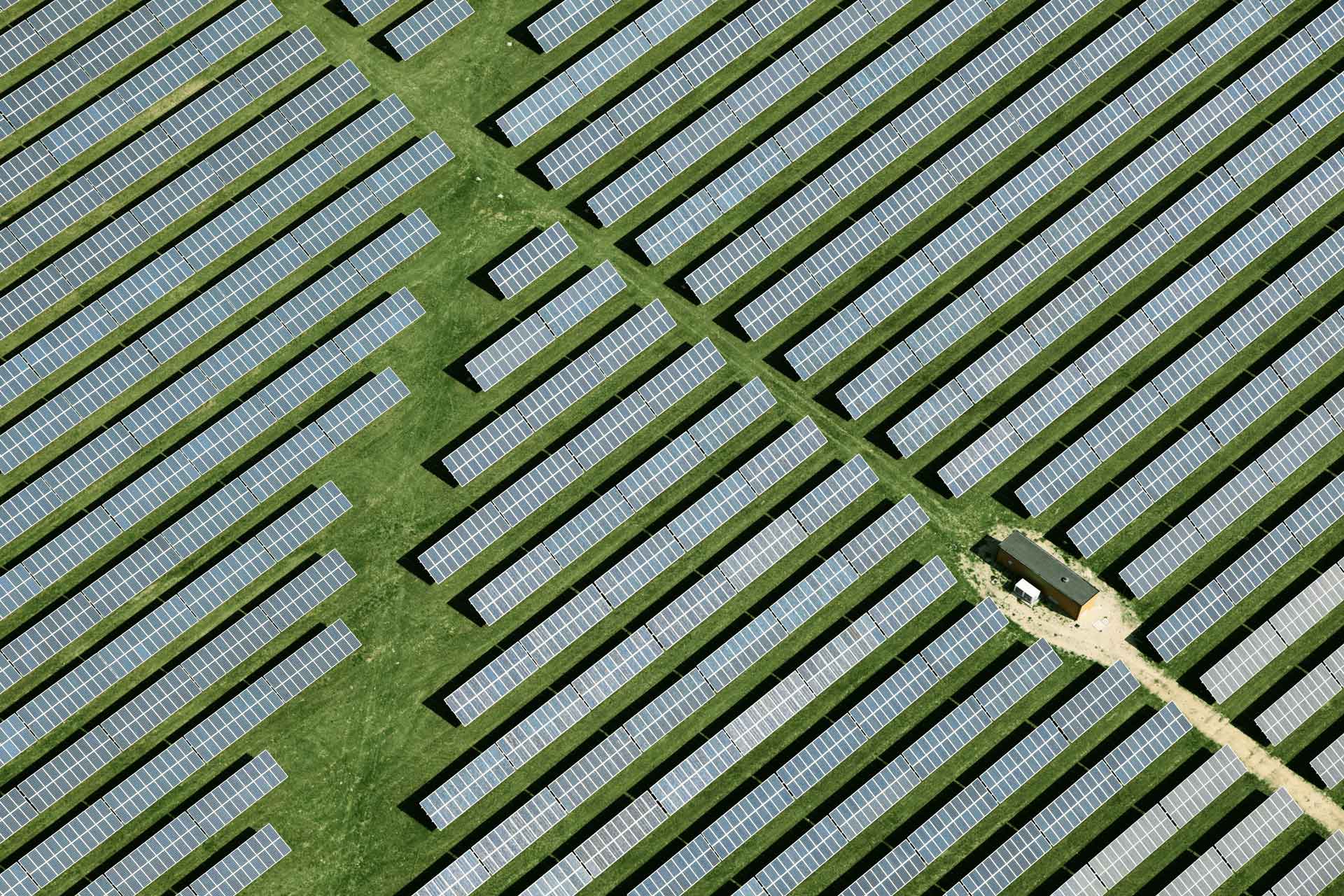

- R4bn Tronox deal funds two 100MW solar plants

- Billions to help Redefine build green properties

- Harmony pursues green goals with R10 billion loan

- Cold solutions finance for cold storage facilities

- International Finance Corporation green bond fund

- Envusa energy deal: The way for renewable energy

- Paladin Energy senior debt funding partnership

- Renewable energy wind farm financing

- Stor-Age’s successful inaugural bond auction

- PlusNet, Peninsula Packaging and Barrier Film Convertors co-investment opportunity | Nedbank CIB

- IFC Green Loan | Nedbank CIB

- AngloGold appoints Nedbank CIB as sole underwriter | Nedbank CIB

- Nedbank CIB Property Finance Team achievement | Nedbank CIB

- PwC Tower, Westlands — Where Kenya's corporate vision meets world-class execution

Women of Corporate Investment Banking

Young Analyst Programme

Articles

- Africa's pathway to a climate-resilient economy

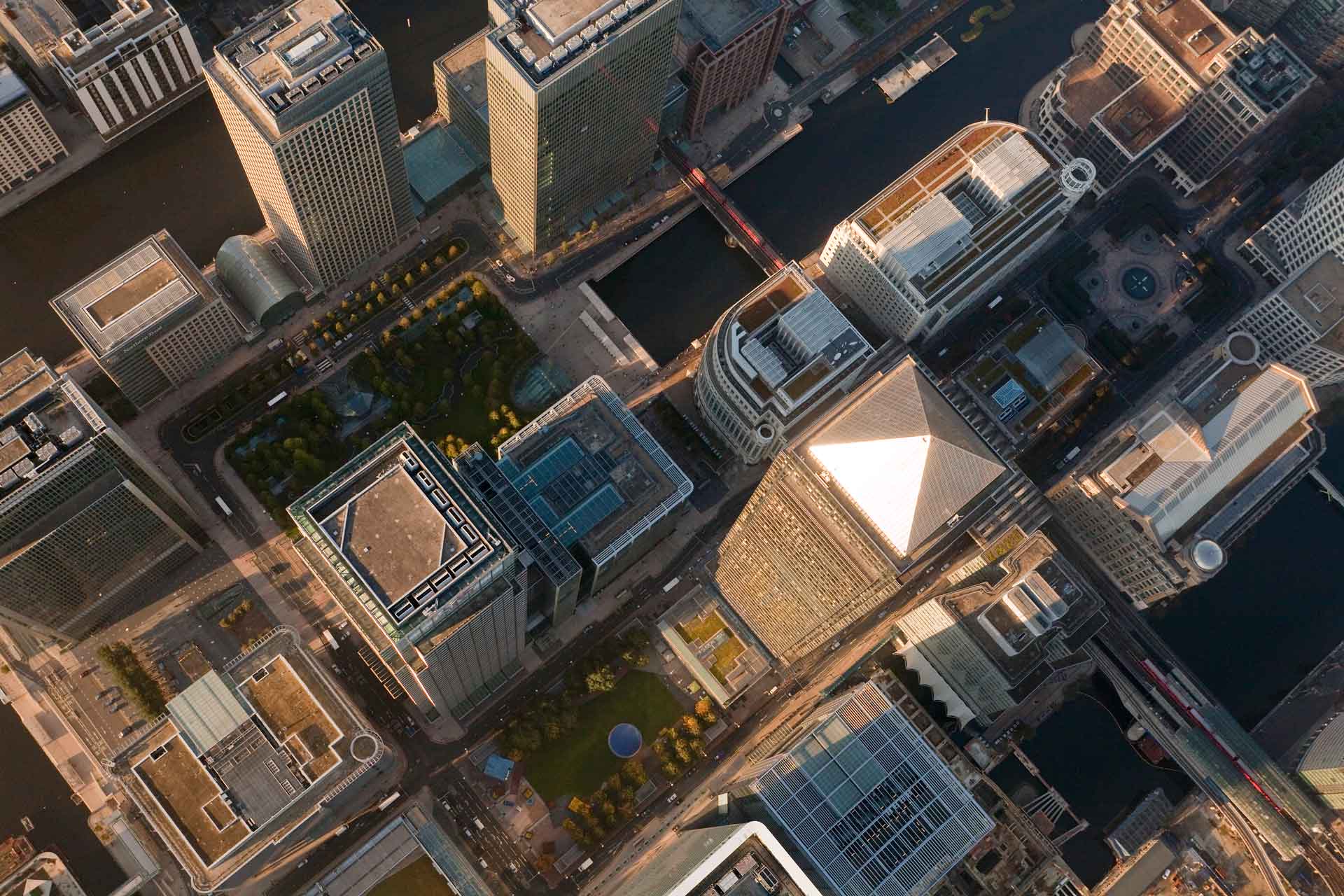

- Commercial property trends 2022

- Green energy in the developing world | Nedbank CIB

- How sustainable finance creates value

- How the property sector recovered in 2023

- FURTHER IMPACT empowerment for entrepreneurs

- There's a new buoyancy around water and sanitation

- What happens when finance meets sustainability?

- Africa’s renewable-energy projects

- Breaking barriers for energy transition in mining

- Nedbank CIB wins big at 2025 IFC Awards

- South Africa leads clean energy transformation

Conferences

Benchmark Reform

Corporate Finance

Financing

Investing

Markets

Transacting

- Login & Register

- Online Banking

- Online Share Trading

- NedFleet

- Register for Nedbank ID

- About us

- Awards

- Deals

- Explore About us

- Awards

- Deals

- R4bn Tronox deal funds two 100MW solar plants

- Billions to help Redefine build green properties

- Harmony pursues green goals with R10 billion loan

- Cold solutions finance for cold storage facilities

- International Finance Corporation green bond fund

- Envusa energy deal: The way for renewable energy

- Paladin Energy senior debt funding partnership

- Renewable energy wind farm financing

- Stor-Age’s successful inaugural bond auction

- PlusNet, Peninsula Packaging and Barrier Film Convertors co-investment opportunity | Nedbank CIB

- IFC Green Loan | Nedbank CIB

- AngloGold appoints Nedbank CIB as sole underwriter | Nedbank CIB

- Nedbank CIB Property Finance Team achievement | Nedbank CIB

- PwC Tower, Westlands — Where Kenya's corporate vision meets world-class execution

- R4bn Tronox deal funds two 100MW solar plants

- Billions to help Redefine build green properties

- Harmony pursues green goals with R10 billion loan

- Cold solutions finance for cold storage facilities

- International Finance Corporation green bond fund

- Envusa energy deal: The way for renewable energy

- Paladin Energy senior debt funding partnership

- Renewable energy wind farm financing

- Stor-Age’s successful inaugural bond auction

- PlusNet, Peninsula Packaging and Barrier Film Convertors co-investment opportunity | Nedbank CIB

- IFC Green Loan | Nedbank CIB

- AngloGold appoints Nedbank CIB as sole underwriter | Nedbank CIB

- Nedbank CIB Property Finance Team achievement | Nedbank CIB

- PwC Tower, Westlands — Where Kenya's corporate vision meets world-class execution

- Women of Corporate Investment Banking

- Young Analyst Programme

- Articles

- Africa's pathway to a climate-resilient economy

- Commercial property trends 2022

- Green energy in the developing world | Nedbank CIB

- How sustainable finance creates value

- How the property sector recovered in 2023

- FURTHER IMPACT empowerment for entrepreneurs

- There's a new buoyancy around water and sanitation

- What happens when finance meets sustainability?

- Africa’s renewable-energy projects

- Breaking barriers for energy transition in mining

- Nedbank CIB wins big at 2025 IFC Awards

- South Africa leads clean energy transformation

- Africa's pathway to a climate-resilient economy

- Commercial property trends 2022

- Green energy in the developing world | Nedbank CIB

- How sustainable finance creates value

- How the property sector recovered in 2023

- FURTHER IMPACT empowerment for entrepreneurs

- There's a new buoyancy around water and sanitation

- What happens when finance meets sustainability?

- Africa’s renewable-energy projects

- Breaking barriers for energy transition in mining

- Nedbank CIB wins big at 2025 IFC Awards

- South Africa leads clean energy transformation

- Conferences

- Benchmark Reform

- Solutions

- Corporate Finance

- Financing

- Investing

- Markets

- Nedbank Business Hub

- Transacting

- Explore Solutions

- Corporate Finance

- Financing

- Investing

- Markets

- Nedbank Business Hub

- Business hub lead form

- Business hub lead form

- Transacting

- Sustainability

- Explore Sustainability

- Contact us

- Explore Contact us

The Interconnectedness Imperative: Balancing ESG for South Africa’s Just Transition

The Interconnectedness Imperative: Balancing ESG for South Africa’s Just Transition

By Mike Davis, Chief Financial Officer of Nedbank Group

2 mins

The upcoming Conference of the Parties (COP) 28 in Dubai is stacking up to be a pivotal moment in the world’s climate journey. Not only will it mark the conclusion of the first global stocktake of the progress that has (or has not) been made towards realising the commitments of the Paris Agreement, but also the host country has made it clear that it intends placing a bright spotlight on critical aspects of adaptation, like food system and agriculture decarbonisation as well as the growing need for significant finance delivery to enable the achievement of meaningful climate outcomes, particularly in developing countries.

All this points to the need for South Africa to take real action to speed up its Just Transition and increase momentum towards its green economy aspirations. The event offers a valuable platform on which our country can demonstrate its commitment to accelerating decarbonisation, addressing financial gaps in climate adaptation, and fully leveraging the international backing we have received, such as through the US$8,5 billion Just Energy Transition Partnership, to drive our energy transition.

Importantly, this narrative needs to show that South Africa’s Just Transition is not merely a decarbonisation plan but a pledge endorsed by all South Africans – businesses, government, and individuals alike – to transform and diversify our economy within the parameters of environmental sustainability. We need to show the world that our Just Transition journey focuses on fostering an economy that alleviates poverty, reduces inequality, and combats unemployment.

While the energy transition is a key element, it is one of several pillars facilitating broader transformative change. South Africa has the highest Gini coefficient (a measure of inequality) in the world, so it is clear that a transition to a green economy cannot be discussed without addressing these significant social issues. The urgency is amplified by the looming threat of climate change, which poses severe risks not only to our natural ecosystems but also our social and economic fabric. As a result of our location in the southern hemisphere, the Southern African Development Community (SADC) region is experiencing warming at twice the global average rate. The Intergovernmental Panel on Climate Change (IPCC)'s latest findings show that the potential repercussions of this include a dramatic reduction in agricultural output and a decline in gross domestic product (GDP). If we fail to act now, the future could be even bleaker, with up to a 50% drop in South Africa’s GDP by 2100 and millions of people displaced due to adverse climate conditions.

A Just Transition is rooted in four pillars: equitable distribution of risks, inclusive decision-making, active support for affected workers and communities, as well as opportunities for structural economic changes. Overlaying these pillars is the principle of distributive, restorative, and procedural justice (the ‘just’ in ‘Just Transition’), ensuring fairness and empowerment for all. Achieving this requires that we break out of traditional silo thinking and recognise that the 'E' and 'S' in ‘ESG’ (environmental, social and governance) are interconnected components of a larger puzzle.

Financial institutions, particularly banks, play a pivotal role in this Just Transition journey. It is imperative to intentionally channel capital into sectors that diversify the economy and effect significant environmental change.

Nedbank recognises the delicate balance required for achieving a net-zero economy by 2050. By aligning our investment and lending practices, we are fulfilling a key strategic business commitment that acknowledges the role of concentrated capital in social inequality. We are committed to directing our sustainable development finance (SDF) towards supporting businesses, projects, and transactions that equitably distribute capital for the broader benefit of society. At the end of June 2023, we had a purpose-led business baseline of R134 billion in SDF, and it is our ambition to increase this to over 20% of total gross loans and advances by 2025.

Ultimately, the success and potential for the positive impact of South Africa’s Just Transition will depend on our understanding that the components of ESG are not meant to be trade-offs; the still-prevalent notion that pursuing one of them inevitably comes at the expense of the others is misguided. A Just Transition encompassing all 3 dimensions is a strategic necessity for the sustainable future of South Africa and presents a unique opportunity to materially address our nation’s triple challenges of poverty, inequality, and unemployment. Nedbank remains committed to playing a leading role in the Just Transition.

Related posts

See allThe growth of sustainable finance in South Africa

As part of an expert panel at the 2022 South African Real Estate Investment Trust Conference, Arvana Singh, Nedbank Head of Sustainable Finance Solutions, shared some thoughts on how sustainable finance in South Africa can help mitigate ESG-related risks.

By Staff writer

Published 30 May 2024 in nedbank:cib/articles/property

The growth of sustainable finance in South Africa

As part of an expert panel at the 2022 South African Real Estate Investment Trust Conference, Arvana Singh, Nedbank Head of Sustainable Finance Solutions, shared some thoughts on how sustainable finance in South Africa can help mitigate ESG-related risks.

Staff writer

Published 30 May 2024

Nedbank CIB honoured for leadership in sustainable finance

Our ESG-backed approach to lending and financing was recognised at the 2022 Global Finance Sustainable Finance Awards, where we ranked in the top 6% of banks globally and received awards for Outstanding Leadership in Green Bonds and Outstanding Leadership in Transition/Sustainability-linked Bonds.

By Staff writer

Published 11 Jul 2025 in nedbank:cib/deals/esg

Nedbank CIB honoured for leadership in sustainable finance

Our ESG-backed approach to lending and financing was recognised at the 2022 Global Finance Sustainable Finance Awards, where we ranked in the top 6% of banks globally and received awards for Outstanding Leadership in Green Bonds and Outstanding Leadership in Transition/Sustainability-linked Bonds.

Staff writer

Published 11 Jul 2025