Select Country

Don’t have your Nedbank ID yet?

Nedbank ID single sign-on gives you full digital access to Nedbank’s banking and lifestyle products and services on the Money app or Online Banking.

Log in

Log in to Online Banking or another one of our secured services.

Awards

Deals

- R4bn Tronox deal funds two 100MW solar plants

- Billions to help Redefine build green properties

- Harmony pursues green goals with R10 billion loan

- Cold solutions finance for cold storage facilities

- International Finance Corporation green bond fund

- Envusa energy deal: The way for renewable energy

- Paladin Energy senior debt funding partnership

- Renewable energy wind farm financing

- Stor-Age’s successful inaugural bond auction

- PlusNet, Peninsula Packaging and Barrier Film Convertors co-investment opportunity | Nedbank CIB

- IFC Green Loan | Nedbank CIB

- AngloGold appoints Nedbank CIB as sole underwriter | Nedbank CIB

- Nedbank CIB Property Finance Team achievement | Nedbank CIB

- PwC Tower, Westlands — Where Kenya's corporate vision meets world-class execution

Women of Corporate Investment Banking

Young Analyst Programme

Articles

- Africa's pathway to a climate-resilient economy

- Commercial property trends 2022

- Green energy in the developing world | Nedbank CIB

- How sustainable finance creates value

- How the property sector recovered in 2023

- FURTHER IMPACT empowerment for entrepreneurs

- There's a new buoyancy around water and sanitation

- What happens when finance meets sustainability?

- Africa’s renewable-energy projects

- Breaking barriers for energy transition in mining

- Nedbank CIB wins big at 2025 IFC Awards

- South Africa leads clean energy transformation

Conferences

Benchmark Reform

Corporate Finance

Financing

Investing

Markets

Transacting

- Login & Register

- Online Banking

- Online Share Trading

- NedFleet

- Register for Nedbank ID

- About us

- Awards

- Deals

- Explore About us

- Awards

- Deals

- R4bn Tronox deal funds two 100MW solar plants

- Billions to help Redefine build green properties

- Harmony pursues green goals with R10 billion loan

- Cold solutions finance for cold storage facilities

- International Finance Corporation green bond fund

- Envusa energy deal: The way for renewable energy

- Paladin Energy senior debt funding partnership

- Renewable energy wind farm financing

- Stor-Age’s successful inaugural bond auction

- PlusNet, Peninsula Packaging and Barrier Film Convertors co-investment opportunity | Nedbank CIB

- IFC Green Loan | Nedbank CIB

- AngloGold appoints Nedbank CIB as sole underwriter | Nedbank CIB

- Nedbank CIB Property Finance Team achievement | Nedbank CIB

- PwC Tower, Westlands — Where Kenya's corporate vision meets world-class execution

- R4bn Tronox deal funds two 100MW solar plants

- Billions to help Redefine build green properties

- Harmony pursues green goals with R10 billion loan

- Cold solutions finance for cold storage facilities

- International Finance Corporation green bond fund

- Envusa energy deal: The way for renewable energy

- Paladin Energy senior debt funding partnership

- Renewable energy wind farm financing

- Stor-Age’s successful inaugural bond auction

- PlusNet, Peninsula Packaging and Barrier Film Convertors co-investment opportunity | Nedbank CIB

- IFC Green Loan | Nedbank CIB

- AngloGold appoints Nedbank CIB as sole underwriter | Nedbank CIB

- Nedbank CIB Property Finance Team achievement | Nedbank CIB

- PwC Tower, Westlands — Where Kenya's corporate vision meets world-class execution

- Women of Corporate Investment Banking

- Young Analyst Programme

- Articles

- Africa's pathway to a climate-resilient economy

- Commercial property trends 2022

- Green energy in the developing world | Nedbank CIB

- How sustainable finance creates value

- How the property sector recovered in 2023

- FURTHER IMPACT empowerment for entrepreneurs

- There's a new buoyancy around water and sanitation

- What happens when finance meets sustainability?

- Africa’s renewable-energy projects

- Breaking barriers for energy transition in mining

- Nedbank CIB wins big at 2025 IFC Awards

- South Africa leads clean energy transformation

- Africa's pathway to a climate-resilient economy

- Commercial property trends 2022

- Green energy in the developing world | Nedbank CIB

- How sustainable finance creates value

- How the property sector recovered in 2023

- FURTHER IMPACT empowerment for entrepreneurs

- There's a new buoyancy around water and sanitation

- What happens when finance meets sustainability?

- Africa’s renewable-energy projects

- Breaking barriers for energy transition in mining

- Nedbank CIB wins big at 2025 IFC Awards

- South Africa leads clean energy transformation

- Conferences

- Benchmark Reform

- Solutions

- Corporate Finance

- Financing

- Investing

- Markets

- Nedbank Business Hub

- Transacting

- Explore Solutions

- Corporate Finance

- Financing

- Investing

- Markets

- Nedbank Business Hub

- Business hub lead form

- Business hub lead form

- Transacting

- Sustainability

- Explore Sustainability

- Contact us

- Explore Contact us

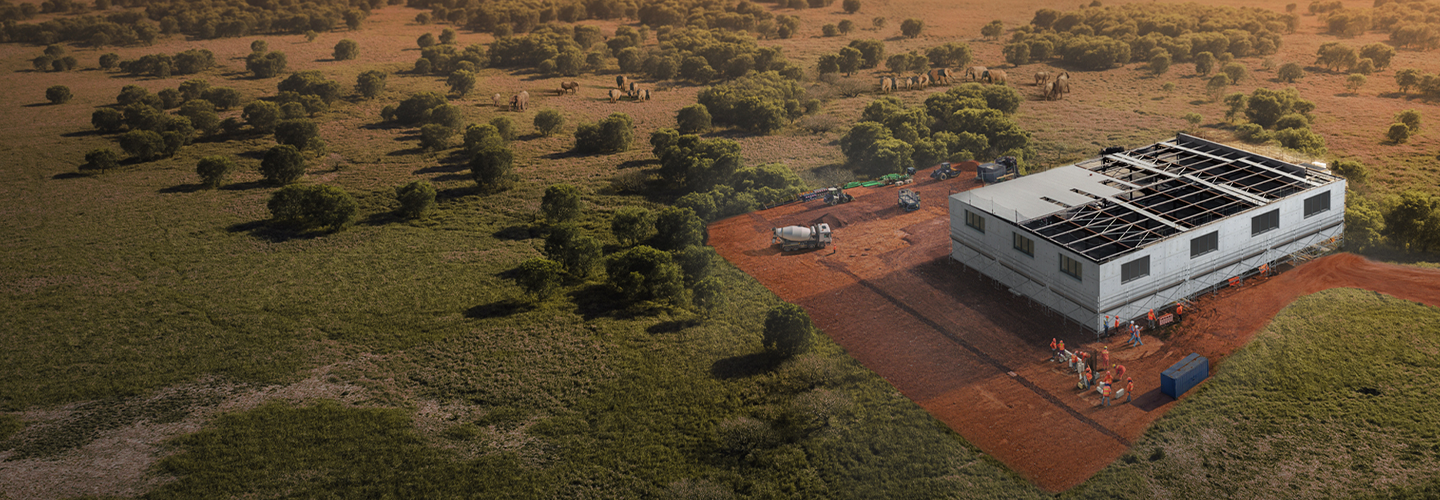

Learn about Nedbank’s partnership with Sterling and Wilson

Learn about Nedbank’s partnership with Sterling and Wilson

Staff writer

3 mins

Partnering for sustainable development

Nedbank Corporate and Investment Banking (NCIB) is proud to have successfully provided R70 million and US$28.55 million in financial facilities to support Sterling and Wilson’s role as the EPC contractor for the Northam Platinum solar PV project.

Nedbank’s commitment to sustainable energy solutions

The financial guarantees and construction-related facilities are part of NCIB's efforts to drive sustainability in the energy sector. The guarantees were issued under the international Financial Institutions framework. Financial instruments ensure payment and performance in construction projects, providing the client with security, flexibility, and support for large-scale projects.

Sterling and Wilson: Leaders in EPC solutions

Sterling and Wilson is a global player specialising in end-to-end engineering, procurement, and construction (EPS) solutions, specifically solar energy projects. With an impressive EPC portfolio of 19.4 GWp, Sterling and Wilson is at the forefront of renewable energy sources, expanding into hybrid energy, energy storage, and floating solar solutions to enhance global sustainability. The company’s focus is India, where its EPC portfolio has reached over 14 GWp. It is one of the top players in the Indian market, targeting an order book of 34 GWp.

By integrating advanced energy storage technologies and solar electricity into its projects, Sterling and Wilson is leading the way in creating sustainable energy infrastructures that support global decarbonisation efforts.

Global reach: Key projects and achievements

South Africa is another key strategic area for the client, showing a material increase in the order book and pipeline. Sterling and Wilson Renewable Energy Limited (SWREL), the ultimate parent company with headquarters in India and listed on the Indian Stock Exchange, has completed several landmark projects, including The Sweihan 1 177 MW PV independent power project in Abu Dhabi.

Other key utility-scale projects have been executed in several countries, including Australia, India, Vietnam, Morocco, Oman, United States, Chile and South Africa (De Aar, Northern Cape).

Strategic importance for NCIB

The proposed transaction provides the business team with the opportunity to further embed its sector penetration with a leading global EPC contractor on a project where the off-taker, Northam, is a key client of the bank, and the project is funded by a consortium of lenders comprising NCIB Energy Finance.

Regarding the current transaction structure and discussions with the client, Nedbank will be awarded 100% of the transactional banking on this project, allowing us to earn revenue from multiple product streams. Furthermore, this transaction will open the door for Nedbank’s future participation in the SWSA pipeline in South Africa and the rest of the continent.

As a preferred contractor to Asia, the Middle East, and Africa, SWSA has a potential EPC pipeline in excess of 1 GW. As SWSA is a new bank client, this pipeline will be targeted cautiously, with each project being assessed on its individual merits.

Related posts

See allSuccessful conclusion of a sustainability R2-billion Tier II bond

Nedbank Corporate and Investment Banking (NCIB) is pleased to announce the successful conclusion of a R2 billion sustainability tier II bond listed on the sustainability segment of the JSE on 7 November 2024.

By Staff writer

Published 10 Dec 2024 in nedbank:cib/deals

Successful conclusion of a sustainability R2-billion Tier II bond

Nedbank Corporate and Investment Banking (NCIB) is pleased to announce the successful conclusion of a R2 billion sustainability tier II bond listed on the sustainability segment of the JSE on 7 November 2024.

Staff writer

Published 10 Dec 2024

Strategic partnership secures R4.5 billion for Limpopo's water infrastructure

In a landmark move to address South Africa’s escalating water crisis, Nedbank Corporate and Investment Banking (CIB) has successfully closed a R4.5 billion term loan facility to the Trans-Caledon Tunnel Authority (TCTA) for the Mokolo-Crocodile River Water Augmentation Project Phase 2A (MCWAP-2A). This financial collaboration underscores Nedbank’s unwavering commitment to sustainable development and critical infrastructure projects.

By Staff writer

Published 23 Jul 2024 in nedbank:cib/deals

Strategic partnership secures R4.5 billion for Limpopo's water infrastructure

In a landmark move to address South Africa’s escalating water crisis, Nedbank Corporate and Investment Banking (CIB) has successfully closed a R4.5 billion term loan facility to the Trans-Caledon Tunnel Authority (TCTA) for the Mokolo-Crocodile River Water Augmentation Project Phase 2A (MCWAP-2A). This financial collaboration underscores Nedbank’s unwavering commitment to sustainable development and critical infrastructure projects.

Staff writer

Published 23 Jul 2024

Nedbank CIB arranges landmark auction for Stor-Age

As a leading debt capital market arranger in the property sector, Nedbank CIB is proud to announce its role in assisting Stor-Age with the establishment of its Domestic Medium-Term Note (DMTN) Programme and executing its inaugural public bond auction as the sole lead arranger. Stor-Age raised R500 million across two notes of offer, which listed on the JSE on the 18th of April 2024. Nedbank was also appointed in various agency roles on the programme, including the debt sponsor and paying, settlement, transfer, calculation and issuer agent.

By Staff writer

Published 04 Aug 2024 in nedbank:cib/deals

Nedbank CIB arranges landmark auction for Stor-Age

As a leading debt capital market arranger in the property sector, Nedbank CIB is proud to announce its role in assisting Stor-Age with the establishment of its Domestic Medium-Term Note (DMTN) Programme and executing its inaugural public bond auction as the sole lead arranger. Stor-Age raised R500 million across two notes of offer, which listed on the JSE on the 18th of April 2024. Nedbank was also appointed in various agency roles on the programme, including the debt sponsor and paying, settlement, transfer, calculation and issuer agent.

Staff writer

Published 04 Aug 2024