Select Country

Don’t have your Nedbank ID yet?

Nedbank ID single sign-on gives you full digital access to Nedbank’s banking and lifestyle products and services on the Money app or Online Banking.

Log in

Log in to Online Banking or another one of our secured services.

Awards

Deals

- R4bn Tronox deal funds two 100MW solar plants

- Billions to help Redefine build green properties

- Harmony pursues green goals with R10 billion loan

- Cold solutions finance for cold storage facilities

- International Finance Corporation green bond fund

- Envusa energy deal: The way for renewable energy

- Paladin Energy senior debt funding partnership

- Renewable energy wind farm financing

- Stor-Age’s successful inaugural bond auction

- PlusNet, Peninsula Packaging and Barrier Film Convertors co-investment opportunity | Nedbank CIB

- IFC Green Loan | Nedbank CIB

- AngloGold appoints Nedbank CIB as sole underwriter | Nedbank CIB

- Nedbank CIB Property Finance Team achievement | Nedbank CIB

- PwC Tower, Westlands — Where Kenya's corporate vision meets world-class execution

Women of Corporate Investment Banking

Young Analyst Programme

Articles

- Africa's pathway to a climate-resilient economy

- Commercial property trends 2022

- Green energy in the developing world | Nedbank CIB

- How sustainable finance creates value

- How the property sector recovered in 2023

- FURTHER IMPACT empowerment for entrepreneurs

- There's a new buoyancy around water and sanitation

- What happens when finance meets sustainability?

- Africa’s renewable-energy projects

- Breaking barriers for energy transition in mining

- Nedbank CIB wins big at 2025 IFC Awards

- South Africa leads clean energy transformation

Conferences

Benchmark Reform

Corporate Finance

Financing

Investing

Markets

Transacting

- Login & Register

- Online Banking

- Online Share Trading

- NedFleet

- Register for Nedbank ID

- About us

- Awards

- Deals

- Explore About us

- Awards

- Deals

- R4bn Tronox deal funds two 100MW solar plants

- Billions to help Redefine build green properties

- Harmony pursues green goals with R10 billion loan

- Cold solutions finance for cold storage facilities

- International Finance Corporation green bond fund

- Envusa energy deal: The way for renewable energy

- Paladin Energy senior debt funding partnership

- Renewable energy wind farm financing

- Stor-Age’s successful inaugural bond auction

- PlusNet, Peninsula Packaging and Barrier Film Convertors co-investment opportunity | Nedbank CIB

- IFC Green Loan | Nedbank CIB

- AngloGold appoints Nedbank CIB as sole underwriter | Nedbank CIB

- Nedbank CIB Property Finance Team achievement | Nedbank CIB

- PwC Tower, Westlands — Where Kenya's corporate vision meets world-class execution

- R4bn Tronox deal funds two 100MW solar plants

- Billions to help Redefine build green properties

- Harmony pursues green goals with R10 billion loan

- Cold solutions finance for cold storage facilities

- International Finance Corporation green bond fund

- Envusa energy deal: The way for renewable energy

- Paladin Energy senior debt funding partnership

- Renewable energy wind farm financing

- Stor-Age’s successful inaugural bond auction

- PlusNet, Peninsula Packaging and Barrier Film Convertors co-investment opportunity | Nedbank CIB

- IFC Green Loan | Nedbank CIB

- AngloGold appoints Nedbank CIB as sole underwriter | Nedbank CIB

- Nedbank CIB Property Finance Team achievement | Nedbank CIB

- PwC Tower, Westlands — Where Kenya's corporate vision meets world-class execution

- Women of Corporate Investment Banking

- Young Analyst Programme

- Articles

- Africa's pathway to a climate-resilient economy

- Commercial property trends 2022

- Green energy in the developing world | Nedbank CIB

- How sustainable finance creates value

- How the property sector recovered in 2023

- FURTHER IMPACT empowerment for entrepreneurs

- There's a new buoyancy around water and sanitation

- What happens when finance meets sustainability?

- Africa’s renewable-energy projects

- Breaking barriers for energy transition in mining

- Nedbank CIB wins big at 2025 IFC Awards

- South Africa leads clean energy transformation

- Africa's pathway to a climate-resilient economy

- Commercial property trends 2022

- Green energy in the developing world | Nedbank CIB

- How sustainable finance creates value

- How the property sector recovered in 2023

- FURTHER IMPACT empowerment for entrepreneurs

- There's a new buoyancy around water and sanitation

- What happens when finance meets sustainability?

- Africa’s renewable-energy projects

- Breaking barriers for energy transition in mining

- Nedbank CIB wins big at 2025 IFC Awards

- South Africa leads clean energy transformation

- Conferences

- Benchmark Reform

- Solutions

- Corporate Finance

- Financing

- Investing

- Markets

- Nedbank Business Hub

- Transacting

- Explore Solutions

- Corporate Finance

- Financing

- Investing

- Markets

- Nedbank Business Hub

- Business hub lead form

- Business hub lead form

- Transacting

- Sustainability

- Explore Sustainability

- Contact us

- Explore Contact us

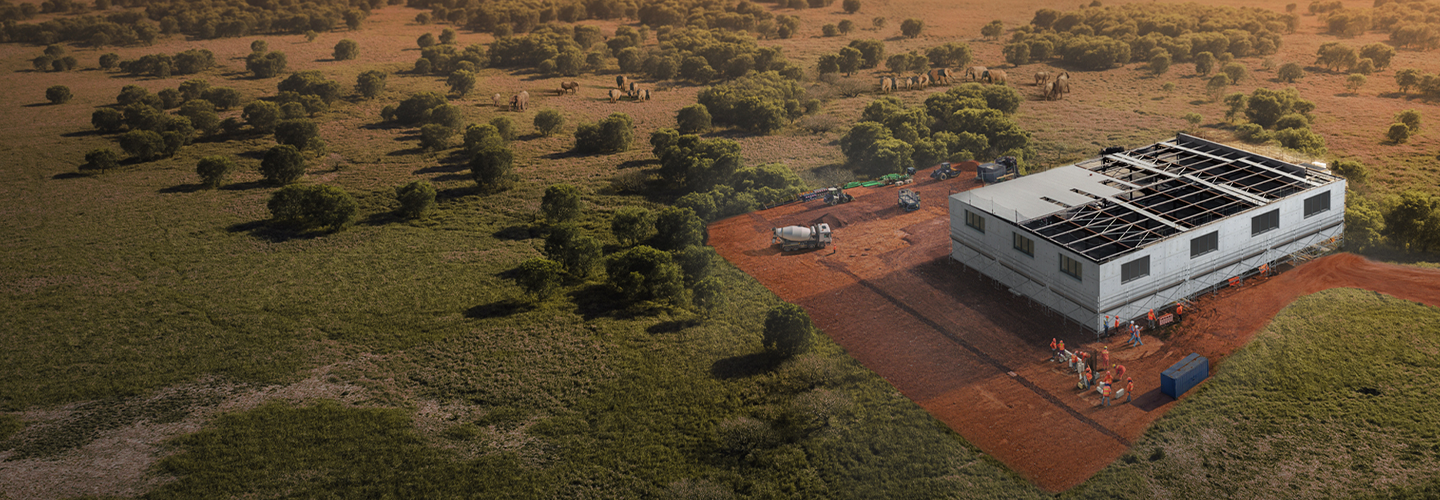

Nedbank CIB backs DRDGOLD with R2-billion for mining expansion

Nedbank CIB backs DRDGOLD with R2-billion for mining expansion

Staff writer

3 mins

Unlocking new value in innovative mining.

Nedbank CIB’s financial support for DRDGOLD’s growth

Nedbank Corporate and Investment Banking (CIB) recently concluded a financing package of up to R2 billion for DRDGOLD. DRDGOLD is a historic name in South African mining and the oldest company listed on the Johannesburg Stock Exchange (JSE), having been formed in 1895. Over the course of its history, the company has transitioned from deep-level underground gold mining to focus entirely on large-scale, mechanised, on-surface mining by retreating historical mine waste dams to produce gold and reverse the negative environmental legacy associated with these dumps.

Addressing environmental and social challenges of mine dumps

Although new deposition occurs on lined and safe facilities constructed to world-class standards, which removes historical waste dumps often located on or near aquifers and dolomitic areas, old gold mining waste dumps (or tailings) surrounding Johannesburg pose both an environmental and social challenge in communities. Given the time when much of this mining occurred, tailings have not been depositioned safely or in a way that allows environmental rehabilitation.

By creating jobs through procurement and socioeconomic development programmes, including self-enabling poverty alleviation and educational programmes, DRDGOLD aims to improve the quality of life for their employees and their communities.

The importance of tailings retreatment in modern mining

Tailings retreatment, undertaken by companies like DRDGOLD, is a positive story for South Africa. By profitably ‘remining' these old tailings and turning them into modern, environmentally safe tailings storage facilities, these sites can be revegetated to minimise dust and be fully rehabilitated for productive purposes.

DRDGOLD’s purpose is to reverse the environmental legacy of mining and improve quality of life, with sustainable development at the heart its business. By creating value from tailings, they transform what was once considered waste. Through land rehabilitation, they make areas available for people and economic activity, ensuring these lands are reintegrated into natural ecosystems. The company is indeed rolling back the environmental legacy of mining in South Africa.

Investing in renewable energy: DRDGOLD’s solar and battery projects

Riaan Davel, Group Chief Financial Officer of DRDGOLD, highlights the company’s ambitious plans: 'DRDGOLD is currently in a period of large-scale growth and investment. Between FY24 and FY27, we are due to spend significant capital amounts on the development of a large-scale solar power and battery storage facility and the expansion of our operations on the East and West Rand.'

Nedbank CIB: A strategic partner for mining companies

Nedbank CIB is the sole financier to DRDGOLD and is proud to be associated with a company that is using the sun’s rays to improve the legacy of mining in South Africa. 'This partnership shows how Nedbank CIB’s sector specialisation helps clients achieve their growth objectives while contributing to South Africa’s economic and environmental well-being.' – Greg Webber, Co-head of Mining and Resources at Nedbank CIB.

'This collaboration with Nedbank CIB is a significant milestone for DRDGOLD. It not only provides us with the financial backing to expand our operations, but also aligns with our commitment to innovative and responsible mining.' – Niël Pretorius, Chief Executive of DRDGOLD.

Related posts

See allSuccessful conclusion of a sustainability R2-billion Tier II bond

Nedbank Corporate and Investment Banking (NCIB) is pleased to announce the successful conclusion of a R2 billion sustainability tier II bond listed on the sustainability segment of the JSE on 7 November 2024.

By Staff writer

Published 10 Dec 2024 in nedbank:cib/deals

Successful conclusion of a sustainability R2-billion Tier II bond

Nedbank Corporate and Investment Banking (NCIB) is pleased to announce the successful conclusion of a R2 billion sustainability tier II bond listed on the sustainability segment of the JSE on 7 November 2024.

Staff writer

Published 10 Dec 2024

Strategic partnership secures R4.5 billion for Limpopo's water infrastructure

In a landmark move to address South Africa’s escalating water crisis, Nedbank Corporate and Investment Banking (CIB) has successfully closed a R4.5 billion term loan facility to the Trans-Caledon Tunnel Authority (TCTA) for the Mokolo-Crocodile River Water Augmentation Project Phase 2A (MCWAP-2A). This financial collaboration underscores Nedbank’s unwavering commitment to sustainable development and critical infrastructure projects.

By Staff writer

Published 23 Jul 2024 in nedbank:cib/deals

Strategic partnership secures R4.5 billion for Limpopo's water infrastructure

In a landmark move to address South Africa’s escalating water crisis, Nedbank Corporate and Investment Banking (CIB) has successfully closed a R4.5 billion term loan facility to the Trans-Caledon Tunnel Authority (TCTA) for the Mokolo-Crocodile River Water Augmentation Project Phase 2A (MCWAP-2A). This financial collaboration underscores Nedbank’s unwavering commitment to sustainable development and critical infrastructure projects.

Staff writer

Published 23 Jul 2024

Nedbank CIB arranges landmark auction for Stor-Age

As a leading debt capital market arranger in the property sector, Nedbank CIB is proud to announce its role in assisting Stor-Age with the establishment of its Domestic Medium-Term Note (DMTN) Programme and executing its inaugural public bond auction as the sole lead arranger. Stor-Age raised R500 million across two notes of offer, which listed on the JSE on the 18th of April 2024. Nedbank was also appointed in various agency roles on the programme, including the debt sponsor and paying, settlement, transfer, calculation and issuer agent.

By Staff writer

Published 04 Aug 2024 in nedbank:cib/deals

Nedbank CIB arranges landmark auction for Stor-Age

As a leading debt capital market arranger in the property sector, Nedbank CIB is proud to announce its role in assisting Stor-Age with the establishment of its Domestic Medium-Term Note (DMTN) Programme and executing its inaugural public bond auction as the sole lead arranger. Stor-Age raised R500 million across two notes of offer, which listed on the JSE on the 18th of April 2024. Nedbank was also appointed in various agency roles on the programme, including the debt sponsor and paying, settlement, transfer, calculation and issuer agent.

Staff writer

Published 04 Aug 2024