Select Country

Don’t have your Nedbank ID yet?

Nedbank ID single sign-on gives you full digital access to Nedbank’s banking and lifestyle products and services on the Money app or Online Banking.

Log in

Log in to Online Banking or another one of our secured services.

Awards

Deals

- R4bn Tronox deal funds two 100MW solar plants

- Billions to help Redefine build green properties

- Harmony pursues green goals with R10 billion loan

- Cold solutions finance for cold storage facilities

- International Finance Corporation green bond fund

- Envusa energy deal: The way for renewable energy

- Paladin Energy senior debt funding partnership

- Renewable energy wind farm financing

- Stor-Age’s successful inaugural bond auction

- PlusNet, Peninsula Packaging and Barrier Film Convertors co-investment opportunity | Nedbank CIB

- IFC Green Loan | Nedbank CIB

- AngloGold appoints Nedbank CIB as sole underwriter | Nedbank CIB

- Nedbank CIB Property Finance Team achievement | Nedbank CIB

- PwC Tower, Westlands — Where Kenya's corporate vision meets world-class execution

Women of Corporate Investment Banking

Young Analyst Programme

Articles

- Africa's pathway to a climate-resilient economy

- Commercial property trends 2022

- Green energy in the developing world | Nedbank CIB

- How sustainable finance creates value

- How the property sector recovered in 2023

- FURTHER IMPACT empowerment for entrepreneurs

- There's a new buoyancy around water and sanitation

- What happens when finance meets sustainability?

- Africa’s renewable-energy projects

- Breaking barriers for energy transition in mining

- Nedbank CIB wins big at 2025 IFC Awards

- South Africa leads clean energy transformation

Conferences

Benchmark Reform

Corporate Finance

Financing

Investing

Markets

Transacting

- Login & Register

- Online Banking

- Online Share Trading

- NedFleet

- Register for Nedbank ID

- About us

- Awards

- Deals

- Explore About us

- Awards

- Deals

- R4bn Tronox deal funds two 100MW solar plants

- Billions to help Redefine build green properties

- Harmony pursues green goals with R10 billion loan

- Cold solutions finance for cold storage facilities

- International Finance Corporation green bond fund

- Envusa energy deal: The way for renewable energy

- Paladin Energy senior debt funding partnership

- Renewable energy wind farm financing

- Stor-Age’s successful inaugural bond auction

- PlusNet, Peninsula Packaging and Barrier Film Convertors co-investment opportunity | Nedbank CIB

- IFC Green Loan | Nedbank CIB

- AngloGold appoints Nedbank CIB as sole underwriter | Nedbank CIB

- Nedbank CIB Property Finance Team achievement | Nedbank CIB

- PwC Tower, Westlands — Where Kenya's corporate vision meets world-class execution

- R4bn Tronox deal funds two 100MW solar plants

- Billions to help Redefine build green properties

- Harmony pursues green goals with R10 billion loan

- Cold solutions finance for cold storage facilities

- International Finance Corporation green bond fund

- Envusa energy deal: The way for renewable energy

- Paladin Energy senior debt funding partnership

- Renewable energy wind farm financing

- Stor-Age’s successful inaugural bond auction

- PlusNet, Peninsula Packaging and Barrier Film Convertors co-investment opportunity | Nedbank CIB

- IFC Green Loan | Nedbank CIB

- AngloGold appoints Nedbank CIB as sole underwriter | Nedbank CIB

- Nedbank CIB Property Finance Team achievement | Nedbank CIB

- PwC Tower, Westlands — Where Kenya's corporate vision meets world-class execution

- Women of Corporate Investment Banking

- Young Analyst Programme

- Articles

- Africa's pathway to a climate-resilient economy

- Commercial property trends 2022

- Green energy in the developing world | Nedbank CIB

- How sustainable finance creates value

- How the property sector recovered in 2023

- FURTHER IMPACT empowerment for entrepreneurs

- There's a new buoyancy around water and sanitation

- What happens when finance meets sustainability?

- Africa’s renewable-energy projects

- Breaking barriers for energy transition in mining

- Nedbank CIB wins big at 2025 IFC Awards

- South Africa leads clean energy transformation

- Africa's pathway to a climate-resilient economy

- Commercial property trends 2022

- Green energy in the developing world | Nedbank CIB

- How sustainable finance creates value

- How the property sector recovered in 2023

- FURTHER IMPACT empowerment for entrepreneurs

- There's a new buoyancy around water and sanitation

- What happens when finance meets sustainability?

- Africa’s renewable-energy projects

- Breaking barriers for energy transition in mining

- Nedbank CIB wins big at 2025 IFC Awards

- South Africa leads clean energy transformation

- Conferences

- Benchmark Reform

- Solutions

- Corporate Finance

- Financing

- Investing

- Markets

- Nedbank Business Hub

- Transacting

- Explore Solutions

- Corporate Finance

- Financing

- Investing

- Markets

- Nedbank Business Hub

- Business hub lead form

- Business hub lead form

- Transacting

- Sustainability

- Explore Sustainability

- Contact us

- Explore Contact us

Cote d'Ivoire’s €18.5m sustainability-linked loan

Cote d'Ivoire’s €18.5m sustainability-linked loan

Staff writer

2 mins

Nedbank CIB makes inroads into Côte d’Ivoire market with an innovative €18.5m sustainability-linked loan for the Cosmos Yopougon shopping mall.

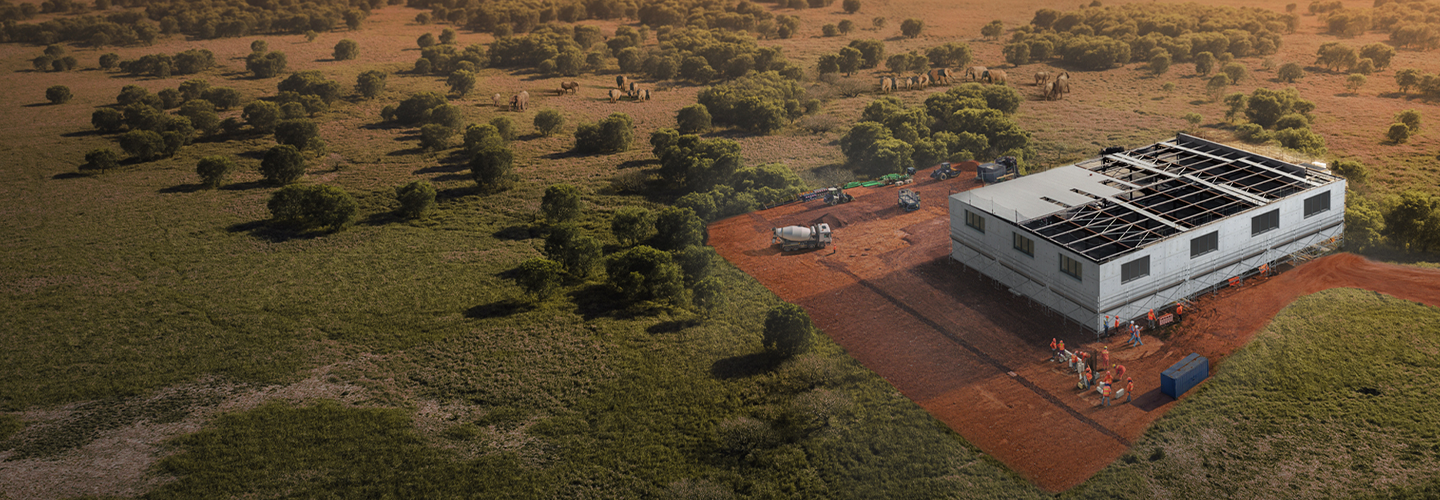

Nedbank Corporate and Investment Banking (CIB) is pleased to announce its first property and sustainable finance transaction in Côte d’Ivoire, marking a milestone in its expansion into the West African market. This landmark deal involves an €18.5m sustainability-linked term loan and revolving credit facility in collaboration with HC Capital Properties Ltd, sponsor of the Cosmos Yopougon shopping mall. This consolidates Cosmos Yopougon’s position as the leading sustainable retail destination in the region and underscoring both companies’ commitment to environmental sustainability and responsible finance.

Reducing waste and the carbon footprint of the Cosmos Yopougon shopping centre

Cosmos Yopougon, a flagship development of HC Capital Properties, has consistently demonstrated its leadership in green practices. As the first operational building in Francophone West and Central Africa to achieve the International Finance Corporation EDGE green building certification, the shopping centre has set a new benchmark for sustainable construction and operations. The shopping centre is a unique example of how commercial real estate can contribute to sustainable development.

The newly secured sustainability-linked debt solution, structured by Nedbank’s Property Finance Africa and Sustainable Finance Solutions teams, represents a further step forward in green finance innovation. This loan is structured to incentivise the mall’s continued improvement in environmental performance, with a focus on waste management to reduce waste generated at Cosmos Yopougon. This initiative aligns with the mall’s commitment to integrating environmental, social, and governance principles into its operations, financing strategy, and reducing its carbon footprint through improved energy, water, and waste management practices.

‘Cosmos Yopougon is dedicated to advancing its sustainability strategy by implementing recycling programmes for cardboard, plastic, and construction waste. This sustainability-linked facility is a testament to our commitment to reducing our environmental impact and promoting sustainable practices within the retail property sector,’ said Sanankoua Cheick Abou, Managing Partner of HC Capital Properties.

The debt facility will aid in refinancing bonds from previous lenders and further contribute to the mall’s sustainability strategy. From construction to operation, and redevelopment, the mall has followed international retail industry standards, incorporating optimal green features for an environmentally friendly and energy-efficient operation. This includes the use of sustainable and economical building materials – reducing their electricity consumption and carbon emissions.

In terms of their tenants, Cosmos Yopougon has streamlined waste disposal through single-stream recycling. They also encourage participation in the initiative through a comprehensive awareness programme that highlights the significance of recycling store waste. These initiatives, coupled with annual reviews of the waste and recycling data from all properties, allow the mall to detect gaps in the process, explore opportunities to optimise waste management, and increase recycling rates.

Waste management is one of the key sustainability concerns in the retail property sector. Through the collaboration between Nedbank CIB and the mall’s owner, Emergence Plaza Ltd, Cosmos Yopougon has the resources needed to achieve their objectives.

By prioritising waste reduction and integrating ESG principles into our financing strategy and management processes, we aim to unlock greater value for our clients and the communities we serve.

Emergence Plaza

Nedbank CIB is committed to providing innovative funding solutions across Africa

The transaction not only underscores Nedbank CIB’s expertise in creating bespoke sustainable finance solutions, but also demonstrates its capability to support clients' sustainability journeys across Africa. This deal is a clear example of how Nedbank CIB leverages its deep understanding of client needs and market dynamics to deliver impactful financial solutions.

‘We are proud to partner with HC Capital Properties in this pioneering transaction in Côte d’Ivoire. This deal demonstrates our commitment to using our financial expertise to do good and create long-term value for our clients and the communities they serve. By focusing on key sustainability issues such as waste management, we are helping our clients achieve their immediate and long-term sustainability goals.’ – Gerhard Zeelie, Divisional Executive of Property Finance Africa at Nedbank CIB

The transaction aligns with Nedbank CIB’s broader purpose-led value creation strategy, highlighting the bank’s readiness to partner with local real estate players in West Africa to deliver innovative and impactful solutions.

The ongoing collaboration between Nedbank CIB and HC Capital Properties reflects a shared vision for a sustainable future. Nedbank CIB’s support through this sustainability-linked loan not only reaffirms Cosmos Yopougon’s position as a high-quality asset with the highest green credentials in the subregion, but also serves as a model for future real estate green finance initiatives in West Africa.

Nedbank CIB’s recent accolades, including being named the Best Bank for Sustainable Finance in South Africa and Best Bank for Green Bonds in Africa by Global Finance in 2024, further cement its leadership in the sustainable finance sector.

Related posts

See allSuccessful conclusion of a sustainability R2-billion Tier II bond

Nedbank Corporate and Investment Banking (NCIB) is pleased to announce the successful conclusion of a R2 billion sustainability tier II bond listed on the sustainability segment of the JSE on 7 November 2024.

By Staff writer

Published 10 Dec 2024 in nedbank:cib/deals

Successful conclusion of a sustainability R2-billion Tier II bond

Nedbank Corporate and Investment Banking (NCIB) is pleased to announce the successful conclusion of a R2 billion sustainability tier II bond listed on the sustainability segment of the JSE on 7 November 2024.

Staff writer

Published 10 Dec 2024

Strategic partnership secures R4.5 billion for Limpopo's water infrastructure

In a landmark move to address South Africa’s escalating water crisis, Nedbank Corporate and Investment Banking (CIB) has successfully closed a R4.5 billion term loan facility to the Trans-Caledon Tunnel Authority (TCTA) for the Mokolo-Crocodile River Water Augmentation Project Phase 2A (MCWAP-2A). This financial collaboration underscores Nedbank’s unwavering commitment to sustainable development and critical infrastructure projects.

By Staff writer

Published 23 Jul 2024 in nedbank:cib/deals

Strategic partnership secures R4.5 billion for Limpopo's water infrastructure

In a landmark move to address South Africa’s escalating water crisis, Nedbank Corporate and Investment Banking (CIB) has successfully closed a R4.5 billion term loan facility to the Trans-Caledon Tunnel Authority (TCTA) for the Mokolo-Crocodile River Water Augmentation Project Phase 2A (MCWAP-2A). This financial collaboration underscores Nedbank’s unwavering commitment to sustainable development and critical infrastructure projects.

Staff writer

Published 23 Jul 2024

Nedbank CIB arranges landmark auction for Stor-Age

As a leading debt capital market arranger in the property sector, Nedbank CIB is proud to announce its role in assisting Stor-Age with the establishment of its Domestic Medium-Term Note (DMTN) Programme and executing its inaugural public bond auction as the sole lead arranger. Stor-Age raised R500 million across two notes of offer, which listed on the JSE on the 18th of April 2024. Nedbank was also appointed in various agency roles on the programme, including the debt sponsor and paying, settlement, transfer, calculation and issuer agent.

By Staff writer

Published 04 Aug 2024 in nedbank:cib/deals

Nedbank CIB arranges landmark auction for Stor-Age

As a leading debt capital market arranger in the property sector, Nedbank CIB is proud to announce its role in assisting Stor-Age with the establishment of its Domestic Medium-Term Note (DMTN) Programme and executing its inaugural public bond auction as the sole lead arranger. Stor-Age raised R500 million across two notes of offer, which listed on the JSE on the 18th of April 2024. Nedbank was also appointed in various agency roles on the programme, including the debt sponsor and paying, settlement, transfer, calculation and issuer agent.

Staff writer

Published 04 Aug 2024