Select Country

Don’t have your Nedbank ID yet?

Nedbank ID single sign-on gives you full digital access to Nedbank’s banking and lifestyle products and services on the Money app or Online Banking.

Log in

Log in to Online Banking or another one of our secured services.

Awards

Deals

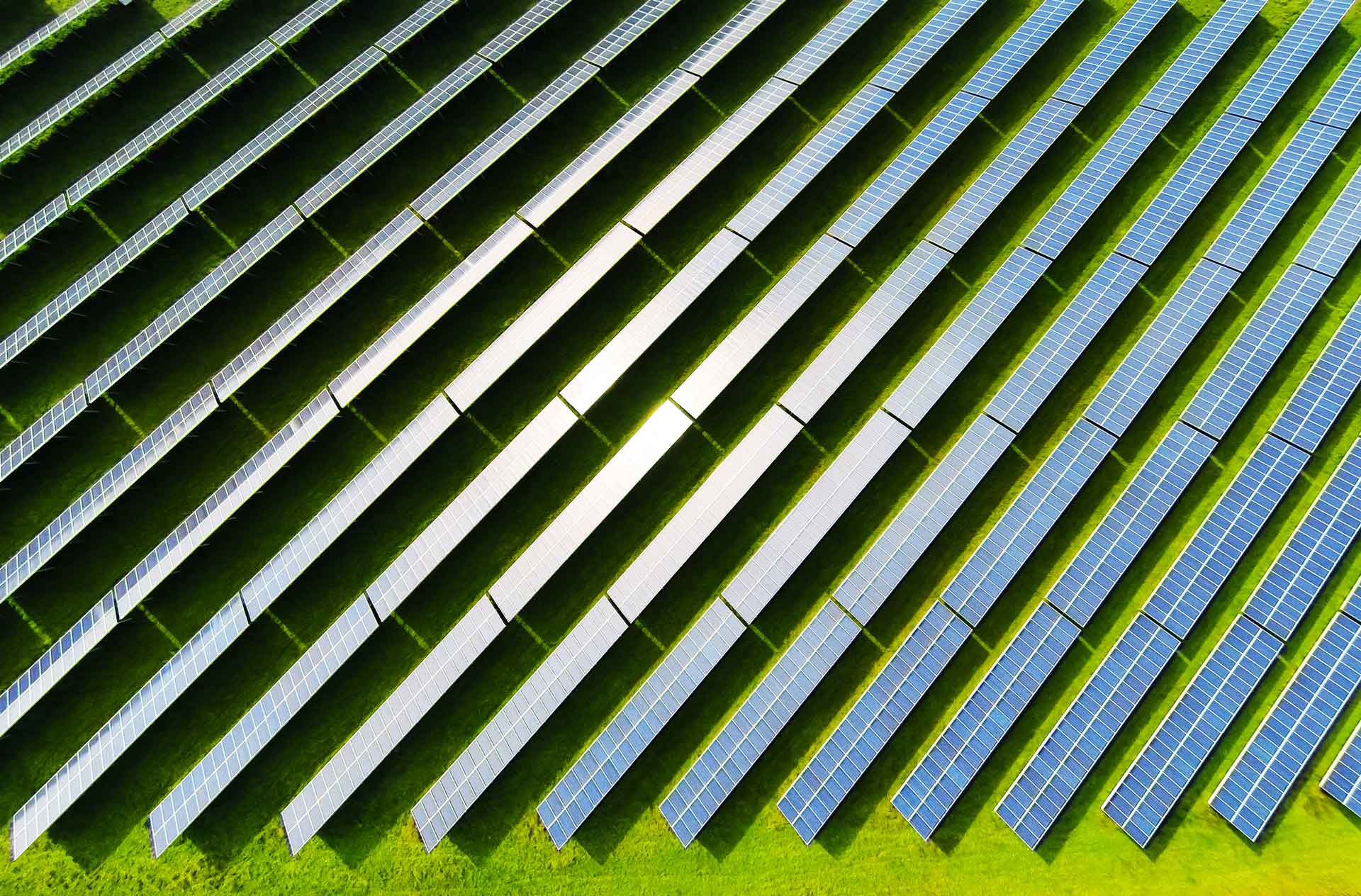

- R4bn Tronox deal funds two 100MW solar plants

- Billions to help Redefine build green properties

- Harmony pursues green goals with R10 billion loan

- Cold solutions finance for cold storage facilities

- International Finance Corporation green bond fund

- Envusa energy deal: The way for renewable energy

- Paladin Energy senior debt funding partnership

- Renewable energy wind farm financing

- Stor-Age’s successful inaugural bond auction

- PlusNet, Peninsula Packaging and Barrier Film Convertors co-investment opportunity | Nedbank CIB

- IFC Green Loan | Nedbank CIB

- AngloGold appoints Nedbank CIB as sole underwriter | Nedbank CIB

- Nedbank CIB Property Finance Team achievement | Nedbank CIB

- PwC Tower, Westlands — Where Kenya's corporate vision meets world-class execution

Women of Corporate Investment Banking

Young Analyst Programme

Articles

- Africa's pathway to a climate-resilient economy

- Commercial property trends 2022

- Green energy in the developing world | Nedbank CIB

- How sustainable finance creates value

- How the property sector recovered in 2023

- FURTHER IMPACT empowerment for entrepreneurs

- There's a new buoyancy around water and sanitation

- What happens when finance meets sustainability?

- Africa’s renewable-energy projects

- Breaking barriers for energy transition in mining

- Nedbank CIB wins big at 2025 IFC Awards

- South Africa leads clean energy transformation

Conferences

Benchmark Reform

Corporate Finance

Financing

Investing

Markets

Transacting

- Login & Register

- Online Banking

- Online Share Trading

- NedFleet

- Register for Nedbank ID

- About us

- Awards

- Deals

- Explore About us

- Awards

- Deals

- R4bn Tronox deal funds two 100MW solar plants

- Billions to help Redefine build green properties

- Harmony pursues green goals with R10 billion loan

- Cold solutions finance for cold storage facilities

- International Finance Corporation green bond fund

- Envusa energy deal: The way for renewable energy

- Paladin Energy senior debt funding partnership

- Renewable energy wind farm financing

- Stor-Age’s successful inaugural bond auction

- PlusNet, Peninsula Packaging and Barrier Film Convertors co-investment opportunity | Nedbank CIB

- IFC Green Loan | Nedbank CIB

- AngloGold appoints Nedbank CIB as sole underwriter | Nedbank CIB

- Nedbank CIB Property Finance Team achievement | Nedbank CIB

- PwC Tower, Westlands — Where Kenya's corporate vision meets world-class execution

- R4bn Tronox deal funds two 100MW solar plants

- Billions to help Redefine build green properties

- Harmony pursues green goals with R10 billion loan

- Cold solutions finance for cold storage facilities

- International Finance Corporation green bond fund

- Envusa energy deal: The way for renewable energy

- Paladin Energy senior debt funding partnership

- Renewable energy wind farm financing

- Stor-Age’s successful inaugural bond auction

- PlusNet, Peninsula Packaging and Barrier Film Convertors co-investment opportunity | Nedbank CIB

- IFC Green Loan | Nedbank CIB

- AngloGold appoints Nedbank CIB as sole underwriter | Nedbank CIB

- Nedbank CIB Property Finance Team achievement | Nedbank CIB

- PwC Tower, Westlands — Where Kenya's corporate vision meets world-class execution

- Women of Corporate Investment Banking

- Young Analyst Programme

- Articles

- Africa's pathway to a climate-resilient economy

- Commercial property trends 2022

- Green energy in the developing world | Nedbank CIB

- How sustainable finance creates value

- How the property sector recovered in 2023

- FURTHER IMPACT empowerment for entrepreneurs

- There's a new buoyancy around water and sanitation

- What happens when finance meets sustainability?

- Africa’s renewable-energy projects

- Breaking barriers for energy transition in mining

- Nedbank CIB wins big at 2025 IFC Awards

- South Africa leads clean energy transformation

- Africa's pathway to a climate-resilient economy

- Commercial property trends 2022

- Green energy in the developing world | Nedbank CIB

- How sustainable finance creates value

- How the property sector recovered in 2023

- FURTHER IMPACT empowerment for entrepreneurs

- There's a new buoyancy around water and sanitation

- What happens when finance meets sustainability?

- Africa’s renewable-energy projects

- Breaking barriers for energy transition in mining

- Nedbank CIB wins big at 2025 IFC Awards

- South Africa leads clean energy transformation

- Conferences

- Benchmark Reform

- Solutions

- Corporate Finance

- Financing

- Investing

- Markets

- Nedbank Business Hub

- Transacting

- Explore Solutions

- Corporate Finance

- Financing

- Investing

- Markets

- Nedbank Business Hub

- Business hub lead form

- Business hub lead form

- Transacting

- Sustainability

- Explore Sustainability

- Contact us

- Explore Contact us

R370 million to fund self-storage facilities across South Africa

R370 million to fund self-storage facilities across South Africa

Staff writer

2 mins

Nedbank Property Partners and Stor-Age Property REIT joint venture to install self-storage facilities around the country.

Nedbank Property Partners (“NPP”) and Stor-Age Property REIT (“Stor-Age”), the only publicly traded self-storage REIT in South Africa, have concluded a joint venture arrangement where the companies formed will develop four self-storage facilities at a total cost of approximately R370 million and NPP will be providing both equity and mezzanine loan funding.

The properties in Morningside (7,400m² GLA) and Bryanston (4,700m² GLA), Gauteng, as well as the properties in Paarden Eiland (4,700m² GLA) and Pinelands (7,300m² GLA) in Cape Town, are all due for completion in 2023 and will be branded and managed by Stor-Age.

Related posts

See allR1 billion debt capital market issuance by OMLACSA

Nedbank Corporate and Investment Banking (CIB) is proud to announce that its Specialised Distribution Team has once again been mandated as sole lead arranger by Old Mutual Life Assurance Company South Africa Limited (OMLACSA), a subsidiary of Old Mutual Limited (OML), in its return to the South African debt capital markets for a R1 billion bond issuance.

By Staff writer

Published 23 Jul 2024 in nedbank:cib/deals

R1 billion debt capital market issuance by OMLACSA

Nedbank Corporate and Investment Banking (CIB) is proud to announce that its Specialised Distribution Team has once again been mandated as sole lead arranger by Old Mutual Life Assurance Company South Africa Limited (OMLACSA), a subsidiary of Old Mutual Limited (OML), in its return to the South African debt capital markets for a R1 billion bond issuance.

Staff writer

Published 23 Jul 2024

Strategic partnership secures R4.5 billion for Limpopo's water infrastructure

In a landmark move to address South Africa’s escalating water crisis, Nedbank Corporate and Investment Banking (CIB) has successfully closed a R4.5 billion term loan facility to the Trans-Caledon Tunnel Authority (TCTA) for the Mokolo-Crocodile River Water Augmentation Project Phase 2A (MCWAP-2A). This financial collaboration underscores Nedbank’s unwavering commitment to sustainable development and critical infrastructure projects.

By Staff writer

Published 23 Jul 2024 in nedbank:cib/deals

Strategic partnership secures R4.5 billion for Limpopo's water infrastructure

In a landmark move to address South Africa’s escalating water crisis, Nedbank Corporate and Investment Banking (CIB) has successfully closed a R4.5 billion term loan facility to the Trans-Caledon Tunnel Authority (TCTA) for the Mokolo-Crocodile River Water Augmentation Project Phase 2A (MCWAP-2A). This financial collaboration underscores Nedbank’s unwavering commitment to sustainable development and critical infrastructure projects.

Staff writer

Published 23 Jul 2024

NCIB plays key role in SA Corporate’s acquisition and subsequent delisting of Indluplace

Nedbank Corporate and Investment Banking (CIB), recently played a pivotal role in the successful acquisition and subsequent delisting by SA Corporate Real Estate Limited (“SA Corporate”) of Indluplace Properties Limited (“Indluplace”). Acting through our Corporate Finance team, CIB served as the exclusive corporate advisor and transaction sponsor in the transaction, which involved the integration of Indluplace Properties Limited ("Indluplace") into SA Corporate's portfolio.

By Staff writer

Published 23 Jul 2024 in nedbank:cib/deals/property

NCIB plays key role in SA Corporate’s acquisition and subsequent delisting of Indluplace

Nedbank Corporate and Investment Banking (CIB), recently played a pivotal role in the successful acquisition and subsequent delisting by SA Corporate Real Estate Limited (“SA Corporate”) of Indluplace Properties Limited (“Indluplace”). Acting through our Corporate Finance team, CIB served as the exclusive corporate advisor and transaction sponsor in the transaction, which involved the integration of Indluplace Properties Limited ("Indluplace") into SA Corporate's portfolio.

Staff writer

Published 23 Jul 2024

Conclusion of a R1,billion term funding facility for the IDC

Nedbank CIB Public Sector Debt Finance is proud to announce a R1 billion term-funding facility to the Industrial Development Corporation (IDC) to support the IDC's investment mandate.

By Staff writer

Published 23 Jul 2024 in nedbank:cib/deals

Nedbank CIB arranges landmark auction for Stor-Age

As a leading debt capital market arranger in the property sector, Nedbank CIB is proud to announce its role in assisting Stor-Age with the establishment of its Domestic Medium-Term Note (DMTN) Programme and executing its inaugural public bond auction as the sole lead arranger. Stor-Age raised R500 million across two notes of offer, which listed on the JSE on the 18th of April 2024. Nedbank was also appointed in various agency roles on the programme, including the debt sponsor and paying, settlement, transfer, calculation and issuer agent.

By Staff writer

Published 04 Aug 2024 in nedbank:cib/deals

Nedbank CIB arranges landmark auction for Stor-Age

As a leading debt capital market arranger in the property sector, Nedbank CIB is proud to announce its role in assisting Stor-Age with the establishment of its Domestic Medium-Term Note (DMTN) Programme and executing its inaugural public bond auction as the sole lead arranger. Stor-Age raised R500 million across two notes of offer, which listed on the JSE on the 18th of April 2024. Nedbank was also appointed in various agency roles on the programme, including the debt sponsor and paying, settlement, transfer, calculation and issuer agent.

Staff writer

Published 04 Aug 2024

Nedbank CIB closes R1,3 billion finance deal for Intertoll’s 50% acquisition of Bombela

Nedbank CIB has successfully closed R1,3 billion of acquisition finance facilities to support Intertoll International Holdings B.V. (Intertoll) in purchasing a 50% equity stake in Bombela Concession Company (RF) (Pty) Ltd (BCC).

By Staff writer

Published 22 Aug 2024 in nedbank:cib/deals/finance

Nedbank CIB closes R1,3 billion finance deal for Intertoll’s 50% acquisition of Bombela

Nedbank CIB has successfully closed R1,3 billion of acquisition finance facilities to support Intertoll International Holdings B.V. (Intertoll) in purchasing a 50% equity stake in Bombela Concession Company (RF) (Pty) Ltd (BCC).

Staff writer

Published 22 Aug 2024

Nedbank Private Equity’s successful divestiture of its equity stake in The Beverage Company

Nedbank Private Equity (NPE), a division of Nedbank Corporate and Investment Banking (CIB), has successfully and fully exited its equity investment in The Beverage Company (BevCo) to Varun Beverages Limited (Varun), which is listed on both the Bombay Stock Exchange and National Stock Exchange in India.

By Staff writer

Published 10 Sep 2024 in nedbank:cib/deals

Nedbank Private Equity’s successful divestiture of its equity stake in The Beverage Company

Nedbank Private Equity (NPE), a division of Nedbank Corporate and Investment Banking (CIB), has successfully and fully exited its equity investment in The Beverage Company (BevCo) to Varun Beverages Limited (Varun), which is listed on both the Bombay Stock Exchange and National Stock Exchange in India.

Staff writer

Published 10 Sep 2024

US$102m syndication for ETG Agri Inputs FZE

Our Agricultural Commodities, Syndication, and Distribution (S&D) Teams are pleased to announce the conclusion of a US$102 million agricultural commodity syndication for ETG Agri Inputs FZE, a company within ETG’s Agri Inputs and Fertilizer Vertical.

By Staff writer

Published 18 Oct 2024 in nedbank:cib/deals

US$102m syndication for ETG Agri Inputs FZE

Our Agricultural Commodities, Syndication, and Distribution (S&D) Teams are pleased to announce the conclusion of a US$102 million agricultural commodity syndication for ETG Agri Inputs FZE, a company within ETG’s Agri Inputs and Fertilizer Vertical.

Staff writer

Published 18 Oct 2024

Successful conclusion of a sustainability R2-billion Tier II bond

Nedbank Corporate and Investment Banking (NCIB) is pleased to announce the successful conclusion of a R2 billion sustainability tier II bond listed on the sustainability segment of the JSE on 7 November 2024.

By Staff writer

Published 10 Dec 2024 in nedbank:cib/deals

Successful conclusion of a sustainability R2-billion Tier II bond

Nedbank Corporate and Investment Banking (NCIB) is pleased to announce the successful conclusion of a R2 billion sustainability tier II bond listed on the sustainability segment of the JSE on 7 November 2024.

Staff writer

Published 10 Dec 2024

Assura’s secondary JSE listing: Building for a Healthier Future

Discover how Nedbank CIB’s expertise facilitated Assura plc’s successful secondary inward listing on the JSE, navigating the JSE’s fast-track listing process with ease and pioneering market liquidity solutions.

By Staff writer

Published 11 Mar 2025 in nedbank:cib/corporate-finance

Assura’s secondary JSE listing: Building for a Healthier Future

Discover how Nedbank CIB’s expertise facilitated Assura plc’s successful secondary inward listing on the JSE, navigating the JSE’s fast-track listing process with ease and pioneering market liquidity solutions.

Staff writer

Published 11 Mar 2025

Nedbank CIB’s expertise fuels SATH’s strategic shareholding in IHS Towers South Africa

Insights into Nedbank CIB’s pivotal role in advancing BEE and telecommunications value creation through SATH’s subscription in IHS Towers South Africa

By Staff writer

Published 04 Apr 2025 in nedbank:cib/deals/corporate-finance

Nedbank CIB achieved an international milestone

Nedbank Corporate and Investment Banking (CIB) played a key role in assisting Attacq Limited to reach a remarkable milestone in sustainability by supporting Mall of Africa's achievement of the Excellence in Design for Greater Efficiencies (EDGE) Advanced certification. This certification, presented by the International Finance Corporation (IFC), marks the first time a shopping centre in Africa has received this recognition, and it also makes Mall of Africa the largest retail building globally to earn this certification.

By Staff writer

Published 23 Jul 2025 in nedbank:cib/deals/finance

Nedbank CIB achieved an international milestone

Nedbank Corporate and Investment Banking (CIB) played a key role in assisting Attacq Limited to reach a remarkable milestone in sustainability by supporting Mall of Africa's achievement of the Excellence in Design for Greater Efficiencies (EDGE) Advanced certification. This certification, presented by the International Finance Corporation (IFC), marks the first time a shopping centre in Africa has received this recognition, and it also makes Mall of Africa the largest retail building globally to earn this certification.

Staff writer

Published 23 Jul 2025

Reinforcing environmental stewardship with the IFC green loan

Nedbank Corporate and Investment Banking (CIB) has strengthened its leadership in green finance with a $200 million green loan from the International Finance Corporation (IFC). The CIB Property Finance Team continues to pioneer innovative green finance solutions for sustainable development. With the latest milestone of a $200 million green loan from IFC, we can further expand our green building finance portfolio across residential, commercial, retail and industrial sectors.

By Staff writer

Published 23 Jul 2025 in nedbank:cib/deals/finance

Reinforcing environmental stewardship with the IFC green loan

Nedbank Corporate and Investment Banking (CIB) has strengthened its leadership in green finance with a $200 million green loan from the International Finance Corporation (IFC). The CIB Property Finance Team continues to pioneer innovative green finance solutions for sustainable development. With the latest milestone of a $200 million green loan from IFC, we can further expand our green building finance portfolio across residential, commercial, retail and industrial sectors.

Staff writer

Published 23 Jul 2025

Investing in connectivity: Nedbank CIB backs Actis in Swiftnet deal

Discover how Nedbank Corporate and Investment Banking's (CIB's) strategic equity investment empowers digital inclusion by supporting Actis' majority acquisition of Swiftnet – South Africa's fourth-largest independent tower company.

By Staff writer

Published 27 Nov 2025 in nedbank:cib/deals/investment

Investing in connectivity: Nedbank CIB backs Actis in Swiftnet deal

Discover how Nedbank Corporate and Investment Banking's (CIB's) strategic equity investment empowers digital inclusion by supporting Actis' majority acquisition of Swiftnet – South Africa's fourth-largest independent tower company.

Staff writer

Published 27 Nov 2025